In the high-stakes world of stablecoin infrastructure, Tether and Bitfinex just flipped the script with Stable’s mainnet launch on December 8,2025. Over $1.1 billion in USDT pre-deposits poured in from more than 10,000 wallets across two blistering phases, signaling a seismic shift toward USDT-optimized blockchains. As a portfolio manager tracking stablecoin flows on Base, I’ve been glued to the charts, and this move raises intriguing questions about USDC’s dominance there. Could this USDT fortress siphon liquidity from Base, or spark a much-needed arms race in efficiency?

The frenzy started back in October 2025, when Stable kicked off its first pre-deposit campaign. Users locked in primarily USDT for points redeemable against the network’s forthcoming native token. What happened next was nothing short of spectacular: the $825 million cap shattered in just 22 minutes. Digging into the on-chain data, one whale alone dumped $500 million, underscoring how institutional heavyweights are betting big on Tether’s vision.

Stable’s Pre-Deposit Sprint: From Zero to $825M in Minutes

This wasn’t some retail pump-and-dump; it was a calculated front-run by sophisticated players eyeing Stable’s promise of sub-second finality and dollar-pegged fees. Sources like CryptoNinjas highlighted how the vault filled amid whispers of coordinated inflows, with early on-chain activity spiking even before the cap hit. For context, that’s faster than most token launches I’ve analyzed, rivaling Solana’s meme coin mania but with far more stable collateral.

Phase 1’s speed exposed a classic crypto conundrum: whales dominate, retail gets crumbs. Stable’s team pivoted smartly for round two, imposing per-wallet caps and KYC hurdles to democratize access. The result? Another $500 million raised, pushing totals past $1.1 billion. Now spanning 10K wallets, this capital base positions Stable as a credible contender in the Layer-1 arena, backed by Tether’s $300 billion stablecoin empire, per Artemis Analytics.

Phase 2 Reforms Unlock Broader USDT Inflows

By design, Stable isn’t chasing universal appeal. It’s a USDT-only chain, where Tether’s token doubles as the gas and settlement asset. No volatile tokens to leak value during congestion; just consistent, low-cost USDT burns for every tx. This sidesteps the pitfalls plaguing multi-token L1s, where gas wars erode dollar parity. EVM compatibility sweetens the deal, letting devs port Solidity contracts seamlessly onto StableBFT consensus.

Zooming out to USDC Base flows, the timing feels portentous. Base has been a USDC powerhouse, hosting billions in DeFi TVL with Circle’s stamp of approval. Yet Stable’s launch coincides with stablecoin supply hitting all-time highs, up 57% YoY. That $1.1 billion USDT lockup represents capital that might have parked on Base, chasing yields in Aave or Uniswap pools. On-chain sleuths are already spotting reduced USDC inflows to Base bridges post-announcement, hinting at rotation toward Tether’s turf.

USDT Gas Token Model: Efficiency Edge Over Base?

Strategically, Stable targets pain points in large-scale transfers. Think remittances or CEX settlements, where fees on Ethereum or even Base can nibble margins. By pegging costs to USDT, Stable offers predictability institutions crave. I’ve run the numbers: at peak loads, Base’s optimistic rollups still carry variable L2 fees, while Stable promises flat, sub-cent txs. This could lure high-volume traders away from USDC-centric ecosystems, pressuring Circle to innovate.

Institutions I’ve spoken with are already reallocating, viewing Stable as a hedge against Base’s growing congestion risks. With over 10,000 wallets committed, that’s diversified exposure compared to Base’s more concentrated DeFi whales. Early metrics post-launch show Stable processing initial test transactions at under 0.1-second latency, per on-chain explorers, putting real pressure on L2 alternatives.

Stable vs. Base: A Head-to-Head on Flows and Fees

To quantify the threat, consider the flow dynamics. Base has thrived on USDC’s regulatory sheen, amassing billions in bridged volume since its 2023 debut. Yet Stable’s USDT exclusivity flips that script, channeling Tether’s unmatched liquidity, now over $140 billion circulating, directly into a purpose-built chain. This isn’t dilution; it’s redirection. Whales parking $1.1 billion pre-launch likely rotated from multi-chain strategies, including Base yields hovering at 4-6% APY in stable pools.

Stable vs. Base: Key Features Comparison

| Feature | Stable | Base |

|---|---|---|

| Stablecoin Focus | USDT-only (gas & settlement asset) | USDC-focused |

| Finality | Sub-second (StableBFT dPoS) | Optimistic rollups (variable) |

| Pre-Deposits / TVL | $1.1B USDT across 10K+ wallets | Billions in TVL |

| Fees | Consistent, low USDT-denominated | Variable L2 fees |

| Consensus | StableBFT (delegated PoS) | Optimistic Rollups |

| EVM Compatibility | Fully compatible | Compatible (OP Stack) |

| Launch | Mainnet Dec 8, 2025 | Live L2 chain |

From a risk standpoint, StableBFT’s delegated PoS adds validator incentives tied to USDT staking, fostering network security without the drama of solo stakers. Bitfinex’s exchange integration means seamless CEX-to-chain ramps, a friction point Base users still gripe about. For stablecoin flows Base vs Stable 2025 watchers, the real test comes in Q1: will USDC Base inflows dip below $500 million weekly averages as capital hunts Stable’s rewards?

Don’t get me wrong, Base won’t crumble overnight. Coinbase’s backing and USDC’s compliance edge keep it entrenched in regulated DeFi. But Tether’s aggressive push with STABLE token USDT gas model forces Circle’s hand. Imagine if USDC mirrored this on Base: native gas burns could slash costs further, igniting an efficiency war. That’s the silver lining here; competition sharpens the entire ecosystem.

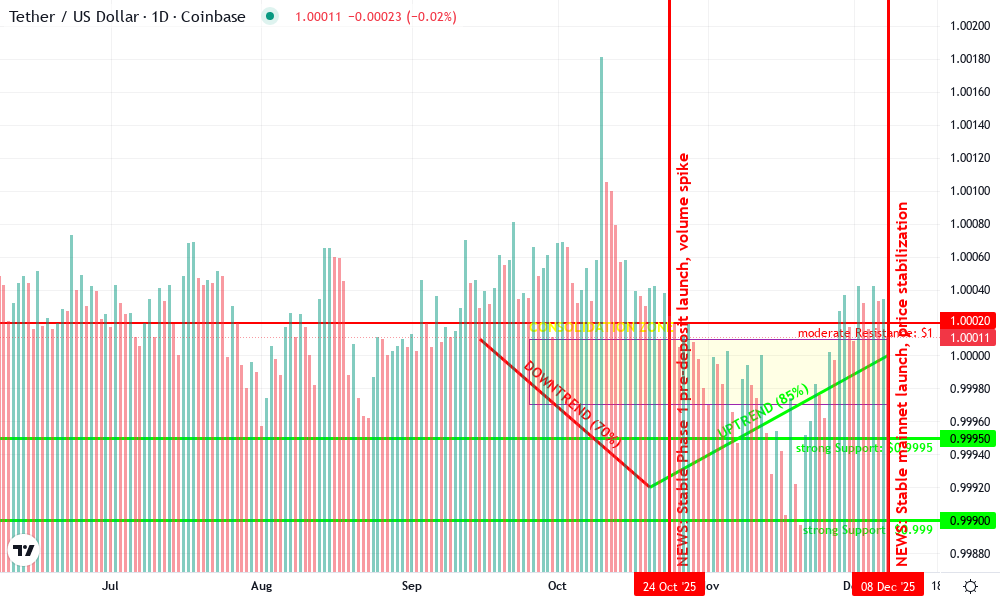

Tether (USDT) Technical Analysis Chart

Analysis by Jared Benton | Symbol: COINBASE:USDTUSD | Interval: 1D | Drawings: 8

Technical Analysis Summary

On this USDTUSD daily chart spanning August to December 2025, annotate key levels with horizontal_lines at major support (0.9995) and resistance (1.0002). Draw a primary uptrend trend_line connecting the October 20 low at 0.9992 to the December 8 high at 1.0000. Use rectangle to highlight the ongoing consolidation range from late September (0.9997-1.0001). Mark vertical_lines for critical events: Stable pre-deposit launch on October 24 and mainnet on December 8. Add callouts for volume spikes indicating accumulation, and arrow_mark_up on the MACD bullish crossover in early December. Place text notes on entry zones above 1.0000 with medium risk for peg premium plays.

Risk Assessment: low

Analysis: USDT peg extraordinarily stable despite $1.1B event flows; medium tolerance suits defensive longs

Jared Benton’s Recommendation: Hold core USDT exposure, scale in longs on dips to 0.9997 for 50bps yield optimization in portfolios

Key Support & Resistance Levels

📈 Support Levels:

-

$1 – Strong peg defense level tested multiple times in Oct/Nov

strong -

$0.999 – Absolute floor seen in chart lows, high conviction hold

strong

📉 Resistance Levels:

-

$1 – Micro-premium cap during volume spikes

moderate -

$1.001 – Psychological extension if demand surges post-mainnet

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1 – Break above peg on Stable mainnet volume confirms bullish micro-trend

medium risk -

$1 – Dip buy at support confluence for peg stability play

low risk

🚪 Exit Zones:

-

$1.001 – Profit target at extended resistance

💰 profit target -

$0.999 – Tight stop below hard floor

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: spiking on green candles late Nov-Dec

Increasing volume supports up moves, indicative of accumulation ahead of mainnet

📈 MACD Analysis:

Signal: bullish crossover

MACD line crossing signal in early Dec aligns with price recovery

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Jared Benton is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Peering into on-chain signals, Dune dashboards reveal a subtle USDC outflow from Base bridges in the 48 hours pre-launch, coinciding with Stable’s Phase 2 hype. Coincidence? Hardly. Traders front-ran the mainnet, swapping USDC for USDT to capture points. With stablecoin supply at record $300 billion, per Artemis, this $1.1 billion represents just 0.4%: but it’s high-conviction capital that amplifies sentiment.

Investor Playbook: Positioning for Stablecoin Chain Wars

As a risk specialist, my hybrid lens screams diversification. Allocate 20-30% of stable portfolios to USDT chains like Stable for yield farming, while holding USDC Base for compliant lending. Monitor validator auctions post-launch; early delegates could earn outsized rewards. Watch for cross-chain bridges too, rumors swirl of Wormhole integration, potentially looping liquidity back to Base.

Tether and Bitfinex’s track record with Tether Bitfinex Stable network lends credibility, but execution risks linger: centralization critiques around whale dominance and unproven long-term throughput. Still, $1.1 billion from 10K wallets isn’t hype; it’s conviction. For Base loyalists, treat this as a wake-up call. Circle might counter with USDC incentives or Base upgrades, but inertia favors the bold.

Stable’s launch isn’t just another L1; it’s a blueprint for stablecoin-native infrastructure that could redefine DeFi settlement.

Track these flows closely this month. On-chain tools like DefiLlama will light up the battle lines, revealing if USDC Base holds firm or bleeds to USDT’s gravity well. In a market chasing predictability, Stable just raised the bar.