In the ever-evolving landscape of decentralized finance, the Base chain has emerged as a powerhouse for stablecoin activity, with USDC inflows surging to new heights. Recent data from DefiLlama reveals USDC circulating on Base at $4.41 billion, marking a and 1.87% increase that underscores the network’s accelerating adoption. This growth, intertwined with $250 million in fresh mints, signals a pivotal shift toward deeper DeFi integration and liquidity provision on Base, drawing both retail users and institutional players into its low-cost, high-throughput ecosystem.

Reflecting on these developments, it’s clear that Base’s appeal lies not just in its technical merits-optimized for scalability by Coinbase-but in how it amplifies stablecoin utility. USDC on Base mints have become a barometer for broader market sentiment, as issuers like Circle respond to demand with precision strikes of liquidity. This isn’t mere speculation; it’s a deliberate build-out of infrastructure that positions Base as a contender against Ethereum and Solana in the stablecoin arena.

Dissecting the $250M Mint Event and Its Immediate Ripple Effects

The $250 million USDC mints on Base represent a calculated infusion, pushing total supply past key thresholds and enhancing on-chain liquidity pools. According to Artemis Terminal, USDC’s overall supply stands at $77.3 billion with a and 1.33% uptick, while stablecoin addresses have climbed to 14.1 million ( and 2.76%). On Base specifically, this minting spree has catalyzed a and 1.05% daily gain in USDC circulation, outpacing rivals like Sky Dollar (USDS) at $138.8 million.

USDC Base Inflows: A Lens on DeFi Yield Opportunities

Diving deeper into USDC Base inflows, we see a network where stablecoin flows Base are reshaping yield farming and lending dynamics. Adjusted transaction volume for USDC hits 1.7 trillion ( and 0.88%), with 667.4 million transactions reflecting robust usage. On Base, this translates to fortified liquidity in DEXs and automated market makers, where USDC DeFi yields 2025 are projected to attract yield hunters seeking 5-10% APYs amid volatile markets.

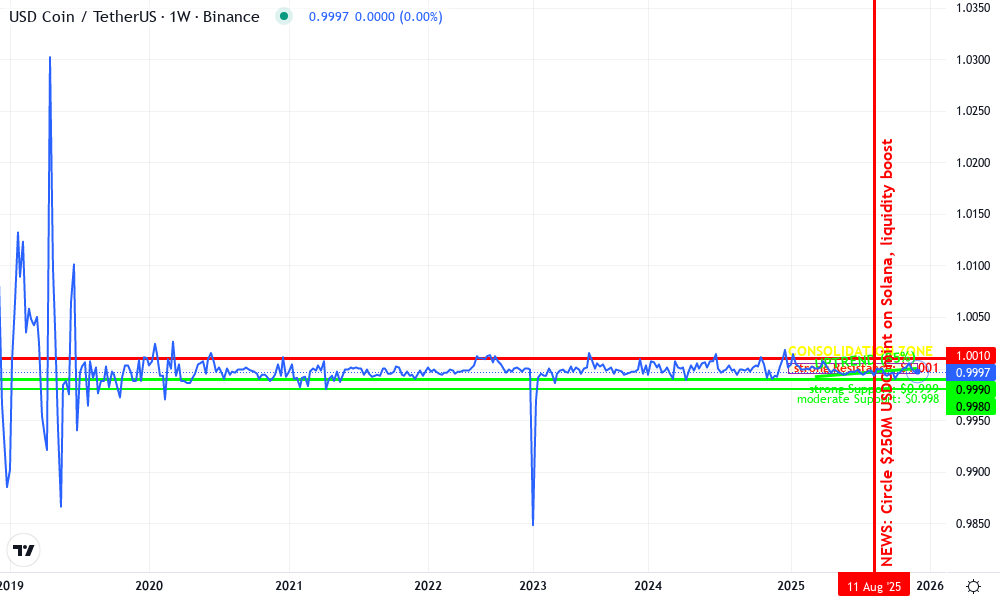

USD Coin Technical Analysis Chart

Analysis by Elena McAllister | Symbol: BINANCE:USDCUSDT | Interval: 1W | Drawings: 6

Technical Analysis Summary

As Elena McAllister, apply conservative horizontal lines at key peg levels: strong support at 0.999 (historical bounce point), moderate resistance at 1.001. Draw a flat trendline along the 1.000 peg from early 2025 consolidation. Use callouts for volume stability and MACD neutrality. Rectangle for ongoing accumulation zone mid-2025. Vertical line for August USDC mint event. Text annotations emphasizing fundamental peg strength over technical volatility.

Risk Assessment: low

Analysis: USDC’s perfect peg maintenance in 2025, backed by growing supply ($77.3B) and DeFi integrations, minimizes downside; conservative approach favors holding over trading

Elena McAllister’s Recommendation: Hold USDC as stable portfolio anchor; monitor fundamentals like Solana inflows for long-term confidence

Key Support & Resistance Levels

📈 Support Levels:

-

$0.999 – Primary peg support, repeatedly held in 2025 volatility

strong -

$0.998 – Secondary support from mid-year consolidation

moderate

📉 Resistance Levels:

-

$1.001 – Upper peg boundary, rarely breached in stable conditions

strong -

$1.002 – Minor resistance from brief 2025 spikes

weak

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$0.999 – Dip to strong support for low-risk accumulation, aligned with fundamental growth

low risk -

$1 – Peg reaffirmation entry for conservative holders

low risk

🚪 Exit Zones:

-

$1.001 – Profit target at resistance for minimal gains

💰 profit target -

$0.998 – Tight stop below secondary support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: stable with upticks on mint events

Volume steady at peg levels, spikes align with Solana USDC inflows indicating adoption

📈 MACD Analysis:

Signal: neutral/bullish crossover potential

MACD histogram flat near zero, signaling low volatility and peg integrity

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Elena McAllister is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

From my vantage as a long-term analyst, these trends evoke the early Ethereum stablecoin boom, but with Base’s edge in fees and speed. Protocols leveraging native USDC are seeing TVL swells, as fresh capital from mints funnels directly into high-efficiency pools. Yet, this surge prompts reflection: are we witnessing organic growth or orchestrated liquidity provision? Data from DefiLlama suggests the former, with USDC dominating Base’s stablecoin rankings and steady climbs in holder activity.

Tracing Broader Stablecoin Flows and Base’s Competitive Edge

Zooming out, stablecoin flows Base must be contextualized against the ecosystem’s maturation. While USDT leads overall per Artemis charts, USDC’s portion trends higher in 2025, bolstered by Base’s $4.41 billion foothold. This positions the chain third behind Ethereum and now rivaling Solana’s recent mints, where Circle deployed similar tactics. On Base, however, the impact feels more endemic-developers are embedding USDC natively, fostering seamless multichain bridges via protocols like CCTP.

Opinionated take: Base’s USDC on Base mints aren’t just numbers; they’re a strategic pivot toward sustainable DeFi infrastructure. As addresses proliferate and volumes stabilize, expect cascading effects on token launches and perpetuals trading. For investors eyeing USDC Base adoption trends, this inflow surge is a green light for positioning in Base-native yields and liquidity provision strategies.

Yet this momentum demands scrutiny. While Base’s USDC Base inflows paint an optimistic picture, parallels with Solana’s recent $250 million USDC mint in August offer a comparative lens. There, Circle’s move swelled supply to over $1.4 billion, mirroring Base’s trajectory but highlighting network-specific dynamics. Solana’s developer surge-35% year-over-year-fuels native integrations, much like Base’s low-fee environment draws liquidity providers. The difference? Base’s $4.41 billion USDC dominance crushes Solana’s inflows in absolute terms, cementing its lead in everyday DeFi utility.

Navigating Risks Amid USDC on Base Mints and Volatility

Reflecting on these cross-chain parallels, investors must weigh risks. USDC’s adjusted volume at $1.7 trillion signals maturity, but Base chain stablecoin trends expose vulnerabilities: centralization concerns around Coinbase’s influence and potential regulatory headwinds for Circle. A dip in stablecoin transactions to 667.4 million (-0.11%) whispers caution; over-reliance on mint events could falter if macro tightening curtails DeFi speculation. Still, Base’s edge persists-fees under $0.01 per swap enable micro-yield strategies inaccessible elsewhere.

USDC Price Prediction 2026-2031

Risk-adjusted forecasts amid Base Chain inflows surge to $6B by Q4 2025, $250M mints, and DeFi yields of 6-12% APY

| Year | Minimum Price | Average Price | Maximum Price | YoY Change (Avg) |

|---|---|---|---|---|

| 2026 | $0.97 | $1.00 | $1.02 | 0.00% |

| 2027 | $0.98 | $1.00 | $1.015 | 0.00% |

| 2028 | $0.985 | $1.00 | $1.01 | 0.00% |

| 2029 | $0.99 | $1.00 | $1.008 | 0.00% |

| 2030 | $0.995 | $1.00 | $1.005 | 0.00% |

| 2031 | $0.997 | $1.00 | $1.003 | 0.00% |

Price Prediction Summary

USDC is projected to maintain its $1.00 USD peg with high reliability through 2031, supported by surging Base Chain adoption ($6B supply target), robust DeFi liquidity, and yields of 6-12% APY. Deviation ranges narrow progressively as regulatory clarity improves and tech like CCTP enhances stability, though bearish market cycles pose minor depeg risks (min scenarios).

Key Factors Affecting USD Coin Price

- Explosive USDC inflows on Base Chain, with $250M mints boosting DeFi liquidity and $6B supply projection by Q4 2025

- High DeFi yields (6-12% APY) in top pools driving sustained demand and utility

- Regulatory tailwinds favoring compliant stablecoins like USDC over competitors

- Technological advancements including CCTP for seamless cross-chain transfers

- Market cycles: potential short-term depegs in bear markets (e.g., to $0.97 min in 2026), recoveries to avg $1.00

- Increasing institutional adoption and developer activity reducing peg volatility over time

- Competition from USDT and emerging stables pressuring but reinforcing USDC’s market position

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Protocols like Aerodrome and Uniswap V3 on Base exemplify this, channeling mint-fueled liquidity into stable pairs yielding 7-9% APYs. My analysis favors diversified positions: allocate to USDC lending on Base for steady returns, hedging against ETH volatility while capturing USDC DeFi yields 2025. Data from DefiLlama underscores this; USDC’s 1.05% daily gain laps competitors like Anzen USDz (-2.70%), proving resilience.

Stablecoin Flows Base: Pathways to Institutional Adoption

Looking ahead, USDC adoption on Base chain hints at institutional gateways. With stablecoin float at $270 billion-plus, Base’s inflows signal a shift from retail frenzy to sophisticated plays-RWAs tokenized via USDC, remittances streamlined, and perp markets deepened. Artemis Terminal’s metrics-stablecoin addresses at 14.1 million ( and 2.76%)-reveal expanding user bases, ripe for enterprise entry.

I’ve long argued stablecoins bridge TradFi and DeFi; Base accelerates this. CCTP’s multichain prowess, soon live across ecosystems, will supercharge stablecoin flows Base, minimizing bridges and wrapped assets. Imagine treasuries parking billions in Base USDC pools, earning yields sans custody risks. This isn’t hype; it’s the logical endpoint of $77.3 billion supply growth ( and 1.33%).

Base isn’t chasing Solana’s speed or Ethereum’s security-it’s redefining accessibility, one USDC mint at a time.

For yield chasers, the playbook is clear: monitor mints via Artemis, stack in high-TVL pools, and rotate on volume spikes. As 2025 unfolds, these $250 million events will recur, each layering infrastructure for the next DeFi supercycle. Base’s ascent, rooted in unflashy execution, rewards the patient-those investing for the future, not just today.