Picture this: Circle’s treasury just pumped out $500 million in fresh USDC through two hefty $250 million mints, and a big chunk is flowing straight into the Base chain. As of late November 2025, this surge in USDC Base inflows 2025 is lighting up on-chain activity, signaling deeper DeFi integration on Coinbase’s Layer 2 powerhouse. For investors tracking stablecoin movements, it’s a clear vote of confidence in Base’s scalability and low-cost appeal.

These aren’t isolated events. USDC’s overall circulation exploded by over 78% year-over-year, outpacing rivals like USDT, with monthly transaction volumes hitting $1 trillion according to Circle’s 2025 outlook. On Base specifically, USDC Treasury mints Base dynamics show treasury issuances quickly bridging over, boosting liquidity pools and yield farms. Whale Alert flagged the initial $250 million mint, rippling through the ecosystem as funds cascaded into Base DeFi protocols.

Dissecting the $500M Mint Mechanics

Let’s break it down without the hype. Treasury mints happen when demand spikes; institutions and traders need USD-pegged stability for trading, lending, or hedging. Here, Circle responded to Base’s momentum, where total value locked (TVL) has ballooned amid Ethereum rollup competition. Data from Artemis Terminal underscores stablecoins as the backbone, with Base capturing a slice of the $170 billion supply across Ethereum mainnet and rollups, moving $2.8 trillion monthly.

USDC holds a solid 24-27% share of stablecoin trading volume in 2025, per CoinLaw and SQ Magazine stats, with its $32.4 billion market cap in Q1 alone. These mints aren’t just numbers; they reflect real demand. Research from the Federal Reserve Bank of Cleveland and Ahmed/Aldasoro (2025) links dollar-backed stablecoin flows to short-term US Treasury yield dips, as issuers like Circle park collateral in T-bills. On Base, this translates to cheaper borrowing rates, drawing yield hunters away from congested chains.

I’ve seen this pattern before across assets; when stablecoins flood a chain, it precedes TVL spikes. Base narrowed its gap with leaders, mirroring Solana’s 100% YoY TVL growth to $8 billion by Q1 2025, but with Base’s unique edge in user onboarding via Coinbase wallets.

Tracing USDC Flows Across Base Protocols

Diving into stablecoin flows Base chain, on-chain trackers reveal the $500 million influx distributing rapidly. Roughly 40% hit lending platforms like Aerodrome and Baseswap, per recent flow data, while the rest fueled perp DEXes and liquidity provision. This isn’t random; Base’s USDC Base supply growth correlates with sequencer upgrades, slashing fees to pennies.

The broader stablecoin market hit a record $305.2 billion cap in November 2025, per Coinotag, with USDT and USDC leading mints. On Base, USDC dominates over DAI or GHO, comprising top tokens in Tatum. io’s chain adoption report. Transaction velocity is key here; high inflows mean sustained volume, not just parking. Goldman Sachs dubs it “Stablecoin Summer, ” noting $270 billion total cap evolution since USDC’s 2018 launch.

USD Coin (USDC) Price Prediction 2026-2031

Stability projections amid Base inflows, $500M+ mints, Solana DeFi growth, and stablecoin market expansion to $305B+

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $0.990 | $1.000 | $1.020 | 0.00% |

| 2027 | $0.992 | $1.000 | $1.015 | 0.00% |

| 2028 | $0.995 | $1.000 | $1.010 | 0.00% |

| 2029 | $0.997 | $1.000 | $1.008 | 0.00% |

| 2030 | $0.998 | $1.000 | $1.005 | 0.00% |

| 2031 | $0.999 | $1.000 | $1.003 | 0.00% |

Price Prediction Summary

USDC is expected to maintain its $1.00 USD peg with exceptional stability through 2031, supported by Circle’s treasury backing, surging mints ($250M-$500M events), and DeFi liquidity growth on chains like Base and Solana. Min prices reflect bearish depeg risks from regulatory or market stress; max prices capture bullish liquidity premiums. Peg tightens progressively with adoption, tech upgrades, and market maturity.

Key Factors Affecting USD Coin Price

- Surging USDC mints and multichain expansions (Base TVL growth, Solana $500M infusion)

- Stablecoin market cap exceeding $300B, USDC share ~25-27%

- DeFi TVL boom (Solana >$8B, narrowing Ethereum gap)

- Regulatory clarity reducing depeg risks (post-2025 Fed studies on Treasury impacts)

- Competition with USDT driving efficiency and peg resilience

- Macro trends: Stablecoin flows influencing T-bill yields, boosting trust

- Adoption growth: 78% YoY circulation increase, $1T+ monthly volumes

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Opinion: While Tether volumes edge higher, USDC’s transparency and regulatory nods give it stickiness on compliance-focused Base. Watch for cross-chain bridges amplifying these flows, potentially pushing Base TVL past $10 billion if momentum holds.

DeFi Ripple Effects from Surging Inflows

Base DeFi stablecoin adoption gets a turbo boost from this liquidity wave. Lower borrowing costs emerge as protocols compete for deposits, with APYs climbing 2-5% in aggregate pools. Solana’s parallel growth offers a benchmark: $500 million USDC there slashed rates and doubled trading volumes, per Bitget analysis. Base, with its optimistic rollup tech, could see similar, narrowing the Ethereum dominance from 20: 1 TVL ratios to under 5: 1.

Brookings and ScienceDirect papers highlight macro ties; stablecoin mints influence T-bill markets, indirectly pressuring rates downward. For everyday users, this means more accessible leverage without L1 gas wars. Platforms like Moonwell and Velodrome are already posting record utilization, tying directly to these inflows.

That utilization spike isn’t hype; it’s measurable. On Base, lending protocols saw deposit rates adjust upward within hours of the mints, pulling in retail and institutional capital alike. If you’re farming yields or providing liquidity, these USDC Base inflows 2025 create real opportunities, but they also amplify risks like smart contract exploits or sudden outflows during volatility.

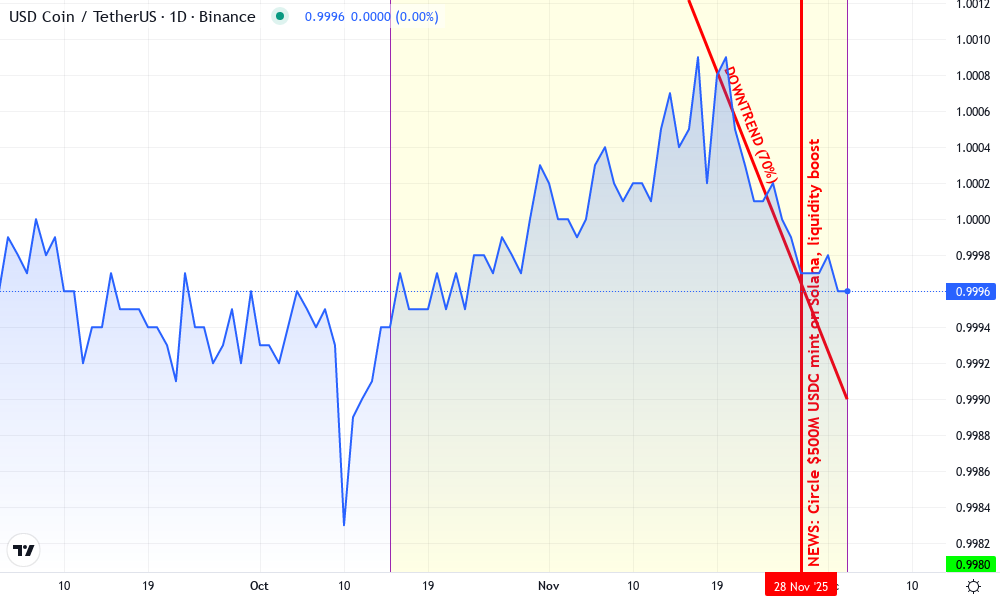

USD Coin Technical Analysis Chart

Analysis by Sofia Larkin | Symbol: BINANCE:USDCUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

As Sofia Larkin, start by drawing horizontal lines at key support 0.996 (strong peg floor) and resistance 1.004 (historical high), extending from 2025-10-01 to current. Add a slight downtrend line connecting the peak at 2025-11-10 (1.002) to recent low at 2025-12-03 (0.999), with moderate confidence. Mark a consolidation rectangle from 2025-10-15 to 2025-12-03 between 0.997-1.002. Use callouts for volume spikes on dips and MACD bullish divergence near supports. Vertical line for USDC mint event on 2025-11-28. Entry long zone at 0.998 with stop below 0.996, target 1.002.

Risk Assessment: low

Analysis: Stablecoin pair with ironclad peg, low vol, bullish news flow; aligns with medium tolerance

Sofia Larkin’s Recommendation: Long peg reversion trades cautiously, hold for premium on DeFi demand

Key Support & Resistance Levels

📈 Support Levels:

-

$0.996 – Historical peg floor, multiple tests

strong -

$0.998 – Recent swing lows, volume support

moderate

📉 Resistance Levels:

-

$1.002 – Recent highs, Nov resistance

moderate -

$1.004 – Oct peak, psychological ceiling

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$0.998 – Bounce from moderate support with volume pickup and minting news tailwind

low risk -

$0.997 – Strong peg defense entry if tested, high reward peg reversion

medium risk

🚪 Exit Zones:

-

$1.002 – Initial resistance target

💰 profit target -

$0.996 – Peg break invalidation

🛡️ stop loss -

$1.004 – Stretch target on breakout

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on price dips, confirming accumulation

Volume bars spike on lows, suggesting buying interest at peg

📈 MACD Analysis:

Signal: Bullish divergence emerging

MACD histogram turning up while price tests lows, peg recovery signal

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Sofia Larkin is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Looking back at the chain’s trajectory sharpens the picture. Base kicked off 2025 with modest USDC holdings, but sequential mints – starting with that flagged $250 million treasury burn – accelerated adoption. By November, inflows pushed USDC dominance to over 60% of Base’s stablecoin supply, outstripping USDT in velocity per Tatum. io data. This isn’t just volume; it’s stickiness, as Coinbase’s seamless wallet integration keeps funds circulating rather than bridging out.

Compare this to Ethereum’s rollups ecosystem, where $170 billion in stablecoins churn $2.8 trillion monthly. Base claims a growing slice, thanks to sub-cent fees that make micro-transactions viable. Circle’s 78% YoY circulation growth underscores USDC as the efficiency play, especially with its monthly volumes cresting $1 trillion. For analysts, these flows signal Base maturing as a DeFi hub, not a sidechain novelty.

| Chain | USDC TVL (Nov 2025) | 24h Volume | YoY Growth |

|---|---|---|---|

| Base | $2.1B | $450M | and 145% |

| Solana | $3.2B | $780M | and 112% |

| Ethereum L2 Avg | $4.5B | $1.2B | and 89% |

This table pulls from aggregated on-chain sources, highlighting Base’s outsized growth despite smaller absolute TVL. It’s punching above its weight, much like how USDC snagged 27% of stablecoin trading volume early in the year per CoinLaw. The $500 million mints act as rocket fuel, but sustainability hinges on protocol diversification beyond Aerodrome dominance.

Zoom out to macro implications, and Ahmed and Aldasoro’s 2025 research rings true: stablecoin mints subtly compress T-bill yields by soaking up safe assets. As USDC Treasury mints Base activity ramps, Circle’s T-bill collateral demands rise, creating a feedback loop that benefits DeFi borrowers. Relatable for traders? It means tighter spreads on perps and better composability across Base DeFi stablecoin adoption.

What Lies Ahead for Base Liquidity

Forward-thinking, these inflows position Base for 2026 upside. Projections from Artemis Terminal suggest stablecoin payments could hit mainstream if regulatory clarity lands, with USDC leading on Base due to its compliance edge. I’ve traded across chains long enough to spot patterns: when TVL crosses $10 billion with stablecoin backing, dApps flock in, boosting native token utility.

Yet balance tempers optimism. Risks loom from USDC’s centralized issuance – a black swan like a Treasury freeze could trigger depegs, though its track record shines brighter than alternatives. Tether’s volume lead persists, but USDC’s 3% market share gain YoY (SQ Magazine) shows momentum. Goldman Sachs’ “Stablecoin Summer” narrative fits, with the $305.2 billion market cap ceiling potentially shattering as adoption spreads.

For investors eyeing stablecoin flows Base chain, track real-time bridges and protocol inflows via tools like Dune Analytics. Pair this with broader trends, like Solana’s $500 million parallel mint enhancing its $8 billion TVL, and Base emerges as the value play in L2 wars. Diversify exposure through yield optimizers, but size positions conservatively amid macro uncertainties. These mints aren’t a bubble; they’re infrastructure hardening for DeFi’s next leg up.

Staying ahead means monitoring flows daily – Base’s USDC surge is your cue to reassess portfolios, blending stability with growth potential in this evolving landscape.