Stablecoin whales – large holders capable of moving hundreds of millions in a single transaction – have become critical market movers in 2025. Their activity is increasingly scrutinized by traders, funds, and protocols seeking an edge in the fast-evolving digital asset landscape. Recent on-chain data reveals a surge in large stablecoin transfers, with over $2.3 billion in Tether (USDT) flowing into exchanges and $1.5 billion in USD Coin (USDC) exiting exchange wallets. These flows are not just numbers; they are signals that often precede volatility, liquidity shifts, or strategic positioning.

How to Spot Stablecoin Whale Activity

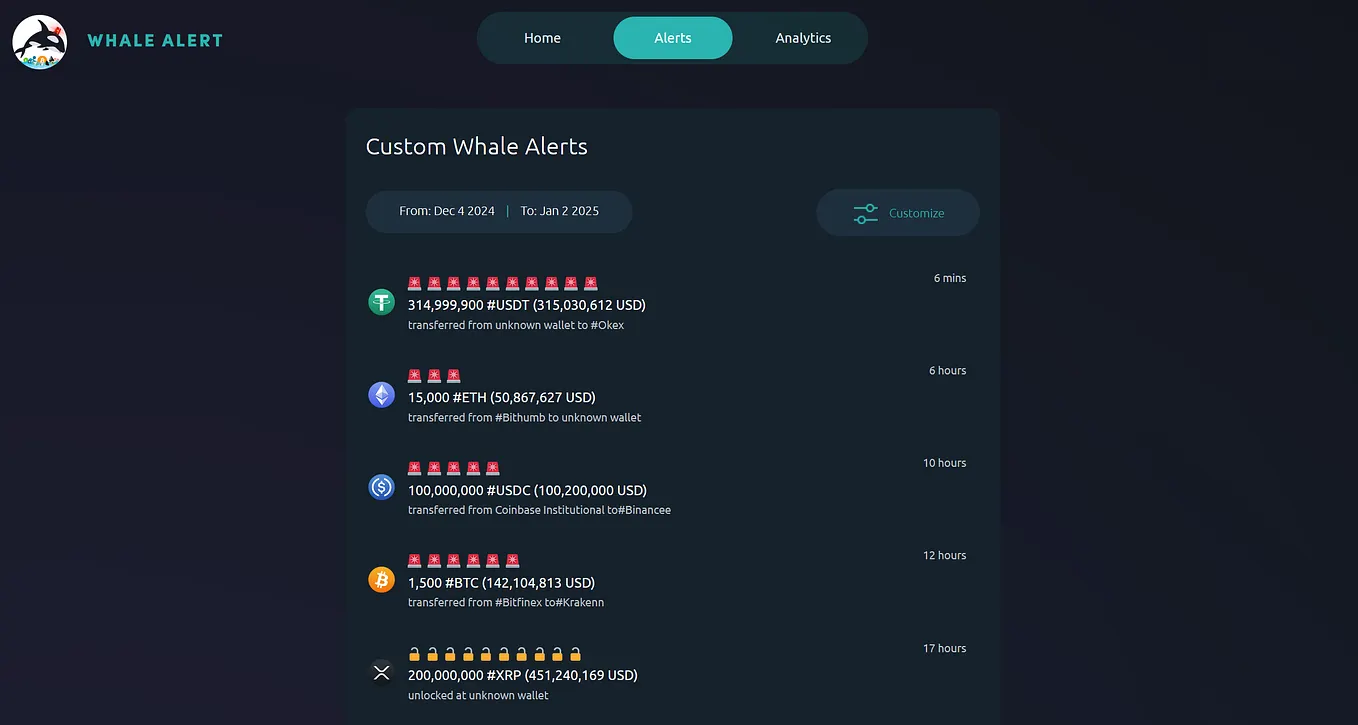

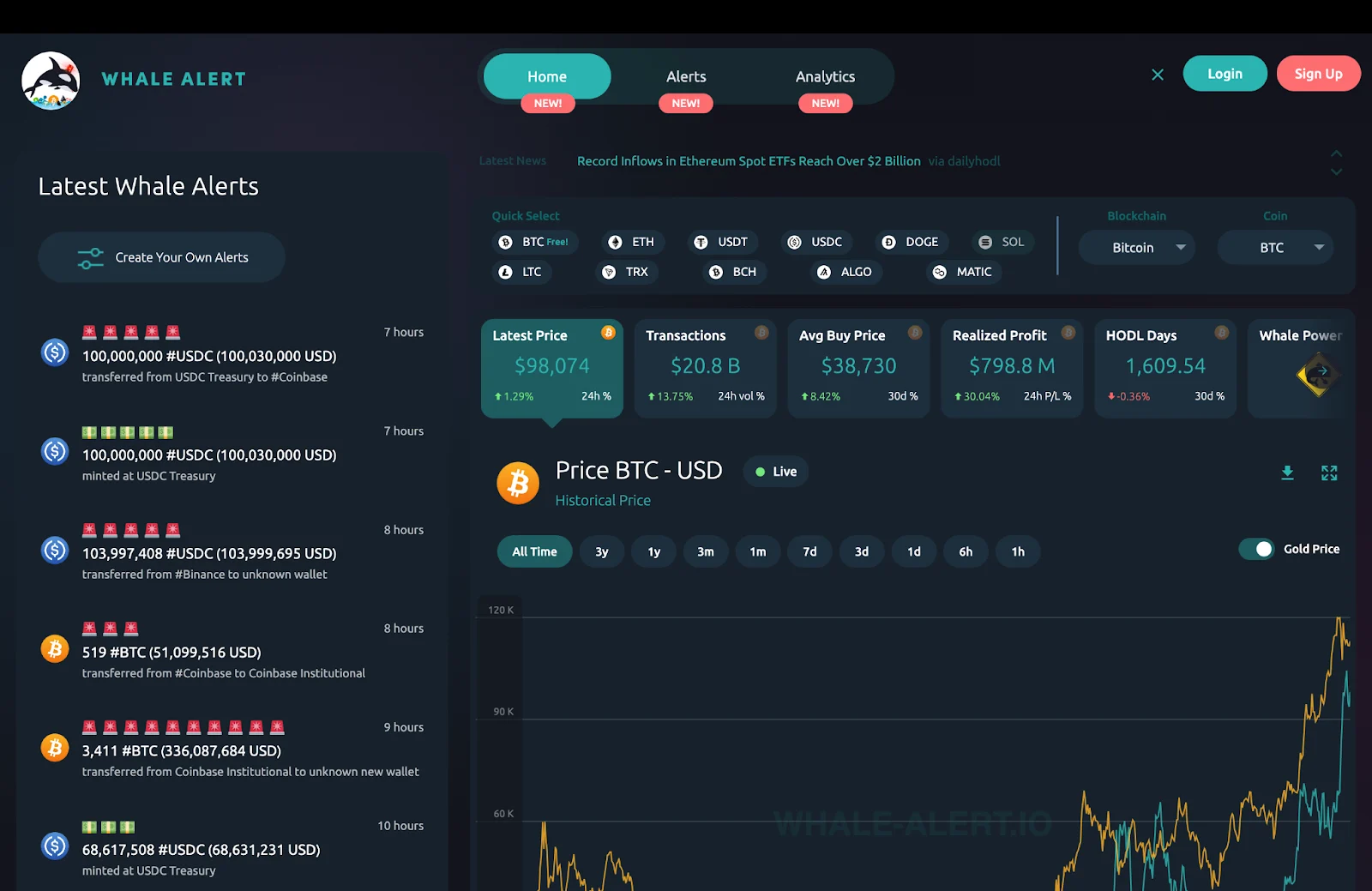

Identifying on-chain whale movements starts with tracking wallet addresses known for high-value transactions. Blockchain monitoring tools like Whale Alert and Lookonchain provide real-time alerts when significant sums move between wallets or exchanges. For example, Whale Alert flagged a $2.3 billion USDT deposit into exchanges – a move that typically suggests whales are preparing to deploy capital for major buys or arbitrage opportunities.

Conversely, the withdrawal of $1.5 billion USDC from exchanges often points to whales moving assets into cold storage or DeFi protocols, signaling caution or anticipation of market turbulence. Such patterns were evident when a single entity used 2.49 million USDC to acquire 11,824 Solana (SOL), then withdrew another 18,527 SOL from Binance and deposited both into Kamino for stablecoin borrowing – a sophisticated play on leverage and yield generation (source).

The Impact of Large Stablecoin Transfers on Market Sentiment

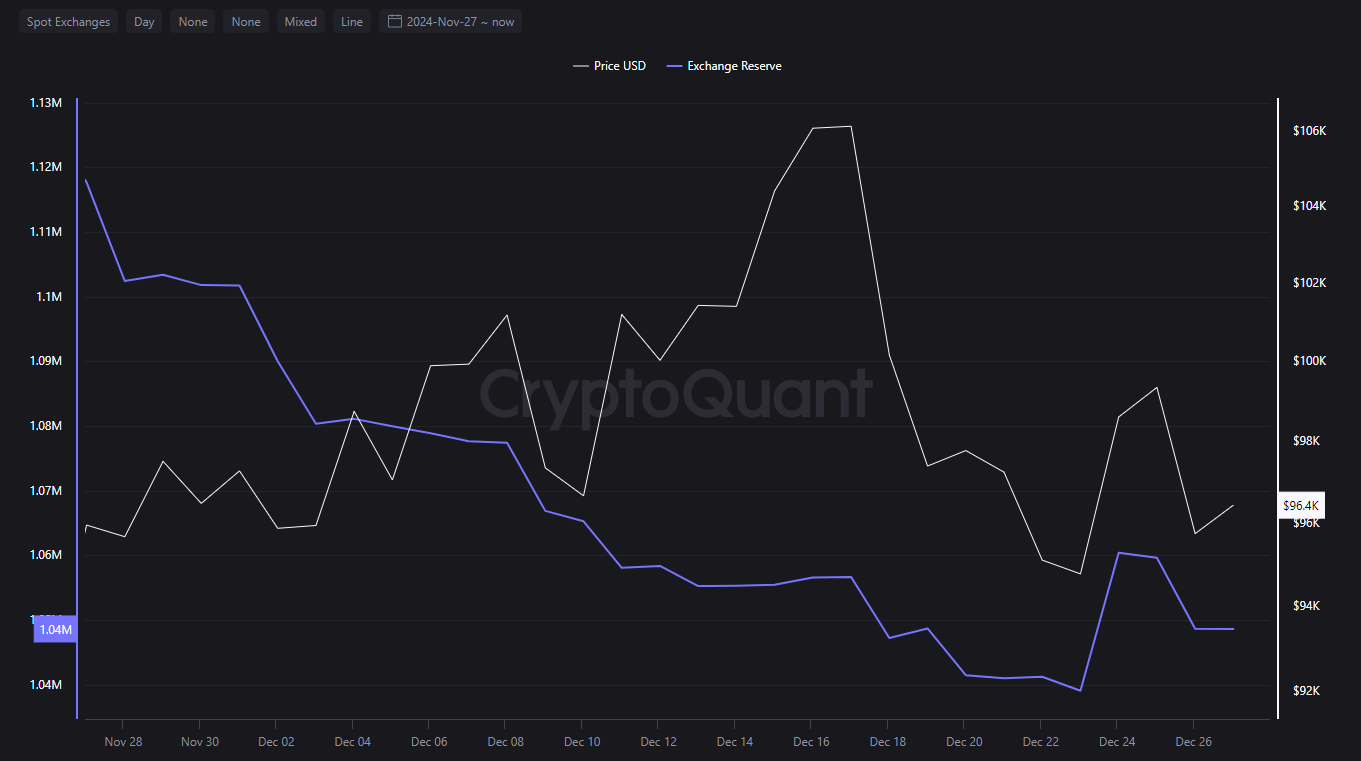

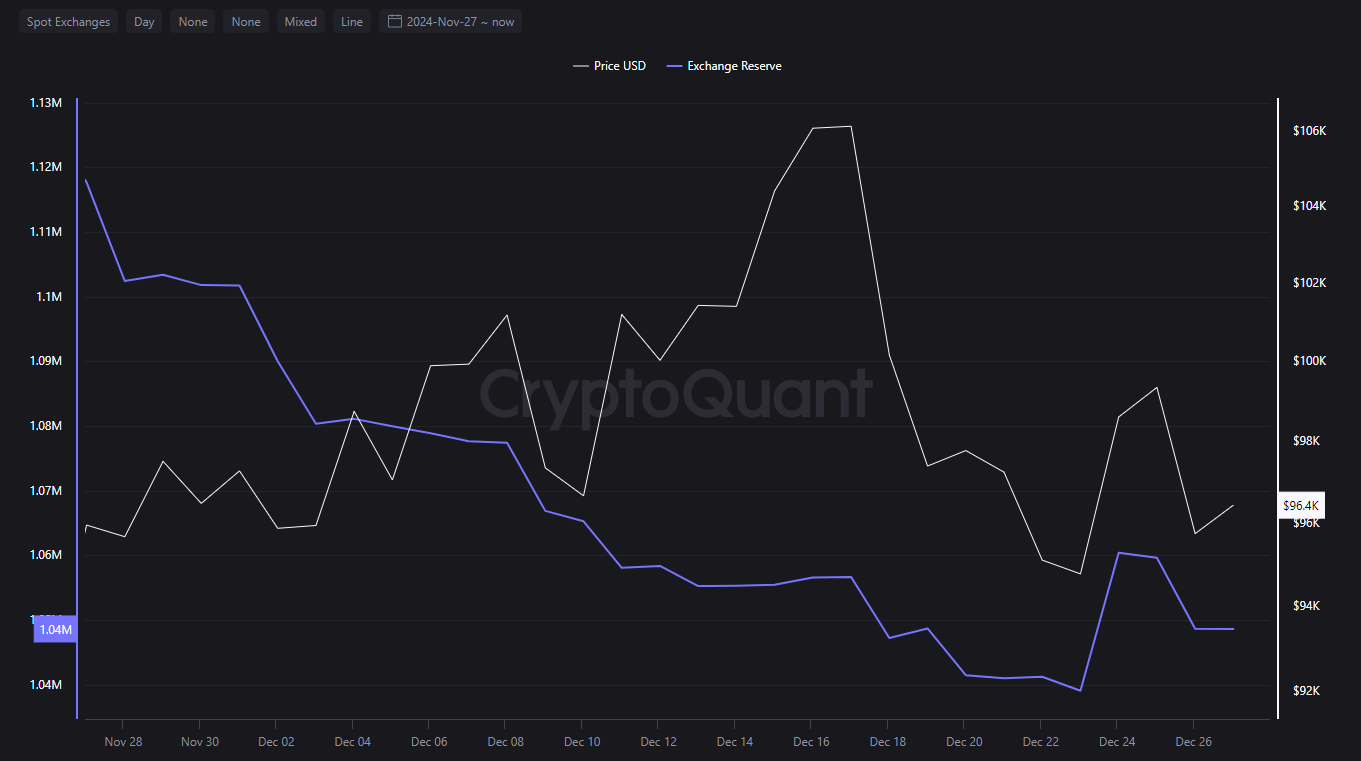

Stablecoin whale activity can shift sentiment rapidly across both CeFi and DeFi markets. When Binance received approximately $1.65 billion in stablecoins alongside the sale of 24,000 BTC by a single whale, it triggered sharp price swings and liquidations across derivatives platforms (source). These sudden inflows often act as precursors to increased trading volume or directional bets by institutional players.

The interplay between stablecoins like USDT and USDC is especially telling: while inflows typically suggest risk-on appetite (potential buying pressure), outflows may reflect hedging strategies or off-exchange accumulation ahead of anticipated volatility.

Key Indicators of Large Stablecoin Whale Movements

-

Massive Stablecoin Transfers to Exchanges: Sudden inflows, such as the recent $2.3 billion USDT deposit into exchanges, often signal whales preparing for large-scale purchases or market moves.

-

Significant Stablecoin Withdrawals from Exchanges: Large outflows, like the $1.5 billion USDC withdrawn from exchanges, may indicate whales moving assets to private wallets or DeFi platforms, often ahead of anticipated volatility.

-

High-Value Stablecoin Deposits on Major Platforms: Notable deposits, such as $1.65 billion in stablecoins on Binance, can precede major market events, including large asset sales or increased volatility.

-

Unusual Activity in Smaller Stablecoins: Exceptional movements, like the $50 million FDUSD deposit (2.33% of total supply) on Binance, highlight whale positioning and potential sentiment shifts.

-

Real-Time Alerts from Blockchain Monitoring Tools: Platforms such as Whale Alert and Lookonchain provide instant notifications on large stablecoin transactions, enabling timely market analysis.

Best Tools for Tracking On-Chain Whale Movements

The sophistication of modern blockchain analytics has democratized access to whale data:

- Whale Alert: Monitors multi-chain stablecoin transactions above custom thresholds; ideal for real-time surveillance.

- Lookonchain: Focuses on wallet clustering and behavioral analysis to spot coordinated accumulation or distribution events.

- BONKbot and Glassnode: Offer dashboards visualizing wallet flows, exchange deposits/withdrawals, and historical context for large transfers.

Setting up personalized alerts via these platforms allows investors to react quickly when whales make decisive moves – whether that’s deploying billions onto exchanges or retreating into DeFi protocols as market conditions shift (source).

For those aiming to stay ahead, combining on-chain analytics with market context is essential. Not every large transfer signals the same intent, so interpreting whale activity requires nuance. For example, a whale rotating $2.49 million USDC into SOL and then leveraging DeFi platforms like Kamino may be seeking yield, hedging risk, or preparing for directional bets, each scenario carries different implications for liquidity and price action.

Patterns emerge when looking at clusters of transactions rather than isolated events. When multiple whales move stablecoins off exchanges simultaneously, it often precedes periods of reduced liquidity or increased volatility. Conversely, synchronized inflows can foreshadow coordinated buying pressure or institutional accumulation phases.

Key Takeaways for Navigating Stablecoin Whale Activity

Effective Strategies to Track Stablecoin Whale Activity

-

Leverage Whale Alert for Real-Time Transaction Monitoring: Use Whale Alert to receive instant notifications of large stablecoin transfers, such as the recent $2.3 billion USDT inflow to exchanges. This tool tracks multiple blockchains and highlights significant whale movements that may precede market shifts.

-

Analyze On-Chain Data with Lookonchain: Platforms like Lookonchain provide detailed breakdowns of whale accumulation, sales, and exchange flows. For example, tracking the $1.5 billion USDC withdrawn from exchanges can reveal changing whale risk appetites and market sentiment.

-

Monitor Exchange Inflows and Outflows on Binance: Significant stablecoin deposits on Binance—such as the $1.65 billion recently observed—often coincide with major trades or volatility events. Watching these flows helps anticipate potential price swings or liquidation cascades.

-

Track Wallet Movements and Token Supply Concentration: Observing large deposits, like the $50 million FDUSD (2.33% of total supply) sent to Binance, can indicate whale strategies and potential market direction. Tools such as Etherscan and DeBank are effective for monitoring wallet balances and token distribution.

-

Set Custom Alerts and Analytics with Glassnode: Use Glassnode to configure alerts for large stablecoin transactions, wallet activity, and exchange flows. This enables proactive responses to whale-driven trends and supports data-driven trading decisions.

Here are pragmatic steps to leverage this data:

- Monitor threshold alerts: Set automated notifications for transfers above $10 million to filter out noise and focus on significant flows.

- Cross-reference exchange activity: Compare on-chain deposits/withdrawals with order book depth to gauge whether whales are positioning for spot trades or derivatives action.

- Analyze timing: Watch for clusters of large movements around macro events (e. g. , FOMC meetings, ETF launches) as these often catalyze whale repositioning.

- Diversify sources: Use multiple analytics platforms (Whale Alert, Lookonchain, Glassnode) to validate signals and reduce false positives.

The recent wave of $2.3 billion USDT inflows and $1.5 billion USDC outflows highlights how closely tied stablecoin whale actions are to broader market sentiment shifts. These movements serve as early warning indicators, savvy traders and analysts watch them closely to anticipate liquidity crunches or surges in risk appetite.

The Bottom Line: Real-Time Data Is Non-Negotiable

In the current landscape, where a single large transfer can ripple across both centralized and decentralized markets within minutes, relying on delayed or incomplete data is a losing proposition. The best defense is a robust toolkit of real-time alerts paired with disciplined interpretation, letting the charts and flows tell the story before headlines catch up.