Stablecoin giants USDT and USDC Base are locked in a fascinating tug-of-war for dominance, each with its own strengths in liquidity, flow dynamics, and adoption. If you’ve ever wondered which stablecoin best fits your trading or DeFi strategy, you’re not alone. Let’s dive into the latest market data and dissect how these titans stack up in 2025.

Liquidity Showdown: Centralized vs Decentralized Strengths

USDT continues to reign supreme on centralized exchanges (CEXs). According to Messari data, Tether boasts 2.8x more trading pairs and an impressive 3.4x greater market depth than any competitor. This translates to lower slippage for high-volume traders and a smoother experience for anyone moving size on CEXs. It’s no surprise that from January 2024 to April 2025, USDT balances on centralized platforms exploded from 15.2 billion to 40.9 billion USDT, marking a jaw-dropping 169% increase. That’s deep liquidity you can feel.

See Messari’s full liquidity analysis here.

USDC Base, meanwhile, is making waves where it matters most for DeFi natives: decentralized exchanges (DEXs). By early 2025, USDC commanded around 60% of all stablecoin trading volumes on DEXs, easily outpacing USDT’s 33% share. This isn’t just a stat – it signals a shift in user preference as DeFi protocols increasingly rely on USDC for collateral, swaps, and yield strategies.

The Flow Factor: Where Is the Capital Moving?

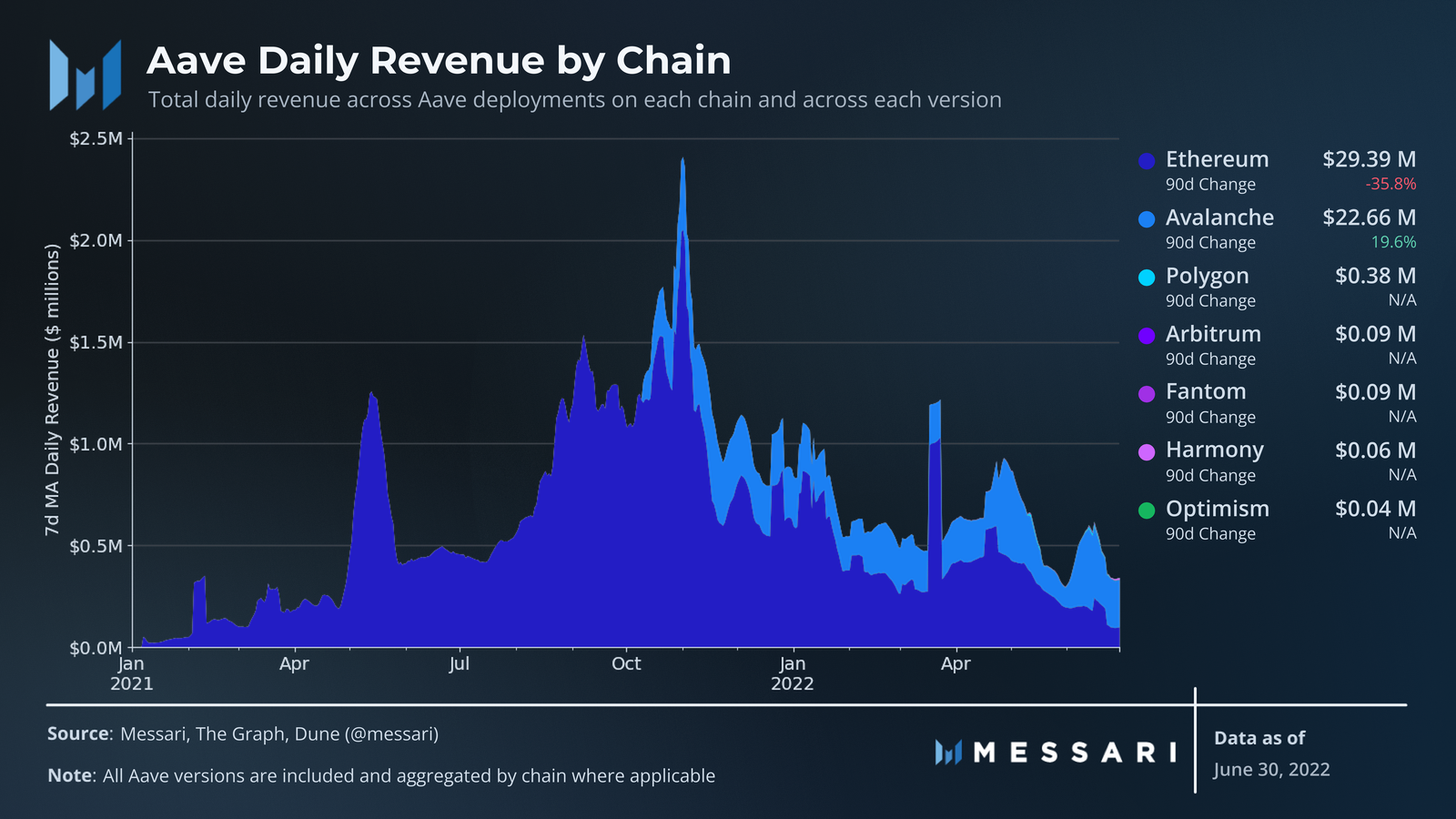

The capital flows tell their own story. On CEXs, traders clearly favor USDT for its unrivaled liquidity and sheer number of pairs. But zoom into DeFi lending protocols like Aave, and you’ll see a different picture: Aave’s USDC holdings leapt from 45 million in early 2024 to an eye-popping 1.32 billion by March 2025. That’s not just growth – it’s a migration of capital into the heart of decentralized finance.

This divergence highlights something crucial for investors: your choice between USDC Base vs USDT should depend on where you operate most frequently. If you’re trading on Binance or Coinbase Pro and need instant fills at scale, Tether is still king. But if you’re yield farming or borrowing against your stablecoins in DeFi ecosystems like Aave or Compound, USDC is quickly becoming indispensable.

Network Dominance: The Rise of USDC Base Across Chains

The network effect is real – especially when it comes to stablecoins integrating with new blockchains. In May 2024, USDC accounted for a staggering 99.5% of all stablecoin transaction volume on Solana, holding steady at 96% by December that year. The story repeats itself on Arbitrum where, by September 2024, USDC overtook Tether as the dominant stablecoin fueled by surging activity on platforms like Hyperliquid.

This growing network dominance isn’t just about branding – it’s about composability within DeFi protocols that increasingly default to using USDC as their base asset for lending pools, LP positions, and cross-chain transfers.

The Transparency Tradeoff: Market Trust vs Flexibility

A final note before we dig deeper into user behavior: transparency remains one of the sharpest dividing lines between these two coins. During high-stress events like the Silicon Valley Bank collapse, USDC’s detailed disclosures led to swift market reactions while Tether’s opacity acted as an unexpected buffer against immediate shocks. Some traders crave the comfort of full transparency (hello compliance-minded institutions), while others prize flexibility and speed even if it means less visibility under the hood.

For those navigating the stablecoin landscape in 2025, understanding the nuances of USDC Base vs USDT isn’t just academic – it’s mission critical. The liquidity split between CEXs and DEXs, the capital migration into DeFi, and the network-level adoption all point to a more specialized market than ever before. Let’s break down what this means for users and protocols alike.

Adoption Patterns: Which Stablecoin for Which User?

USDT’s unmatched liquidity on centralized exchanges makes it the default choice for high-frequency traders, arbitrageurs, and anyone needing to move large sums with minimal slippage. Its extensive trading pair coverage is a lifeline during periods of volatility or when executing cross-asset strategies. If you’re operating in fast-moving markets or need instant access to deep order books, USDT’s dominance is hard to ignore.

On the flip side, USDC Base has become the backbone of DeFi composability. Lending platforms like Aave and Compound increasingly use USDC as their base asset for pools. Protocols on Solana and Arbitrum have made USDC their primary stablecoin for swaps, LP incentives, and governance activities. This trend is reflected in how rapidly USDC volumes have expanded on DEXs – capturing 60% of all stablecoin volume by early 2025 – while also driving protocol innovation across chains.

Top Use Cases: USDC Base vs USDT

-

DeFi Lending on Aave with USDC: USDC is the preferred stablecoin for Aave, one of the largest DeFi lending platforms. In March 2025, Aave’s USDC holdings soared to 1.32 billion, reflecting its dominance in decentralized lending and borrowing protocols.

-

Cross-Chain Transfers with USDC on Solana & Arbitrum: USDC powers seamless cross-chain transfers, especially on Solana (where it held 96% of stablecoin volume by end of 2024) and Arbitrum. Its regulatory compliance and fast settlement make it ideal for bridging assets across networks.

-

Global Remittances with USDT: USDT is widely used for cross-border payments and remittances, especially in regions with limited banking access. Its high liquidity and broad acceptance on exchanges and OTC desks make it a practical choice for moving value internationally.

The upshot? Your ideal stablecoin depends on your crypto lifestyle. Are you an institutional trader chasing liquidity? Or a DeFi builder stacking yield and composability? There’s no one-size-fits-all answer – only context-driven choices.

User Sentiment and Community Pulse

The debate between transparency and flexibility continues to animate crypto Twitter and community forums. During times of market stress or regulatory uncertainty, users often flock to whichever stablecoin they perceive as safer or more resilient in that moment.

This ebb and flow is visible not just in trading volumes but also in social sentiment spikes whenever there’s news about audits, regulatory scrutiny, or network outages. The Silicon Valley Bank incident was a prime example: researchers noted that USDC’s transparency led to rapid repricing while Tether’s opacity delayed panic selling. This dynamic creates opportunities – and risks – depending on your appetite for disclosure versus speed.

What Should Investors Watch Next?

The next phase of stablecoin evolution will likely be defined by interoperability across chains, deeper integration with real-world assets (RWAs), and ongoing regulatory developments. As protocols race to capture new flows, expect even tighter competition between these two powerhouses.

- Watch for shifts in DEX volume: If USDT starts gaining share on decentralized platforms or if new entrants disrupt the status quo, it could shake up current adoption patterns.

- Monitor network upgrades: Chains like Solana or Arbitrum rolling out new features may further entrench USDC dominance – or open doors for challengers.

- Stay alert to regulatory signals: Compliance crackdowns could favor transparent models like USDC or force greater disclosure from Tether.

Which stablecoin do you trust most for DeFi activity in 2025?

USDT continues to dominate centralized exchanges with unmatched liquidity, while USDC has become the leading stablecoin on DeFi platforms and emerging networks. As DeFi evolves, your choice matters—tell us which stablecoin you trust most for your DeFi activities in 2025!

If you’re building strategies around stablecoins today, don’t just chase volume – follow the flows that align with your risk profile and preferred ecosystem. Both USDC Base and USDT have carved out distinct roles that reflect not just technical design but also evolving user values across CeFi and DeFi frontiers.