In the world of digital assets, transaction speed and cost have long been sticking points for both retail and institutional users. While the internet has transformed how we communicate and share information in milliseconds, money transfers have lagged behind, often plagued by high fees and slow settlement times. The rise of stablecoins like USDC promised a solution, but even these innovations were constrained by network congestion and fluctuating gas costs. That is, until the Base network’s real-time USDC payments entered the scene.

Base Network Slashes Stablecoin Latency: Real-Time USDC Transfers Explained

The integration of real-time USDC payments on Coinbase’s Base layer-2 network has been a watershed moment for crypto transactions. By re-architecting its payment flows and introducing real-time transaction streaming, Coinbase has reduced USDC receive latency on Base by 90% to roughly one second, with send times now halved to just two seconds (Source: Phemex). This leap isn’t just about convenience; it fundamentally changes what’s possible for stablecoin adoption in DeFi and beyond.

Consider this: legacy blockchains like Ethereum have historically struggled with congestion, causing delays that can stretch into minutes or even hours during peak periods. Now, with Base’s optimized infrastructure, users experience near-instant value transfer at virtually zero cost – a game-changer for both microtransactions and enterprise-scale payments.

This ultra-low latency is particularly significant given the current market data: as of today, Multichain Bridged USDC (Fantom) trades at $0.0583, up 0.0870% over the past 24 hours. These price dynamics underscore how stablecoins are increasingly being used not just as stores of value but as true mediums of exchange within fast-moving digital economies.

Zero-Fee Transfers and Mass Payments: The Coinbase Advantage

The December 2023 rollout of zero-fee USDC transfers on Base through Coinbase Wallet’s Simple Mode marked a pivotal shift in user experience (cryptonews.net). By stripping away complexity and focusing on essential actions like buying, selling, and transferring crypto assets, Coinbase has lowered barriers to entry – especially for users in frontier markets where every cent counts.

The innovation didn’t stop there. In September 2024, Coinbase launched Paymaker, a demo app designed to facilitate mass USDC payouts without gas fees (coinbase.com). Leveraging programmable MPC wallets for security and efficiency, Paymaker empowers businesses to send thousands of transactions simultaneously – an operational boon for payrolls, rewards programs, or any scenario demanding bulk transfers.

This approach is not only about speed but also about scale. In traditional finance or even first-generation blockchains, sending funds to thousands of recipients would be a logistical nightmare riddled with costs and manual reconciliation headaches. With real-time streaming on Base, those limitations are rapidly fading into history.

Major Partnerships Accelerate Instant Stablecoin Transfers

USD Coin (USDC) Price Prediction Table: 2026-2031

Professional Forecast for USDC on Base Network – Considering Real-Time Payments, Adoption, and Market Dynamics

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | +0.0% | USDC remains tightly pegged to $1 due to robust regulatory compliance and growing real-time payment adoption via Base. |

| 2027 | $0.97 | $1.00 | $1.03 | +0.0% | Increased utility from integrations (e.g., Stripe, Binance US) and mass payments support, with minor volatility during market corrections. |

| 2028 | $0.96 | $1.00 | $1.04 | +0.0% | Stablecoin competition intensifies (USDT, emerging CBDCs), but USDC retains peg from transparency and institutional trust. |

| 2029 | $0.96 | $1.00 | $1.05 | +0.0% | Potential regulatory changes in the US/EU could introduce brief volatility, but strong infrastructure keeps the peg stable. |

| 2030 | $0.95 | $1.00 | $1.06 | +0.0% | Wider adoption in mainstream finance and cross-border settlements strengthens USDC’s position as a leading stablecoin. |

| 2031 | $0.95 | $1.00 | $1.08 | +0.0% | Matured global payments ecosystem, with USDC used in diverse applications; maximum price reflects rare de-pegging events. |

Price Prediction Summary

USDC is designed to maintain a 1:1 peg with the US dollar, and major technological advancements (like real-time payments on Base), strong regulatory compliance, and institutional adoption are expected to preserve this stability through 2031. Occasional brief deviations may occur during extreme market events, but the average price is forecast to remain at $1.00 each year. Minimum and maximum ranges reflect possible short-lived volatility in exceptional circumstances.

Key Factors Affecting USD Coin Price

- Continued regulatory clarity and enforcement, particularly in the US and EU.

- Growth in real-time payment adoption and integration with major platforms (Coinbase, Stripe, Binance US).

- Competition from other stablecoins (e.g., USDT, DAI) and potential CBDC launches.

- Technological enhancements supporting zero-fee, instant transactions and mass payments.

- Market trust in USDC reserves and transparency from Circle/partners.

- Systemic risks (black swan events, regulatory shocks) causing brief deviations from the $1 peg.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

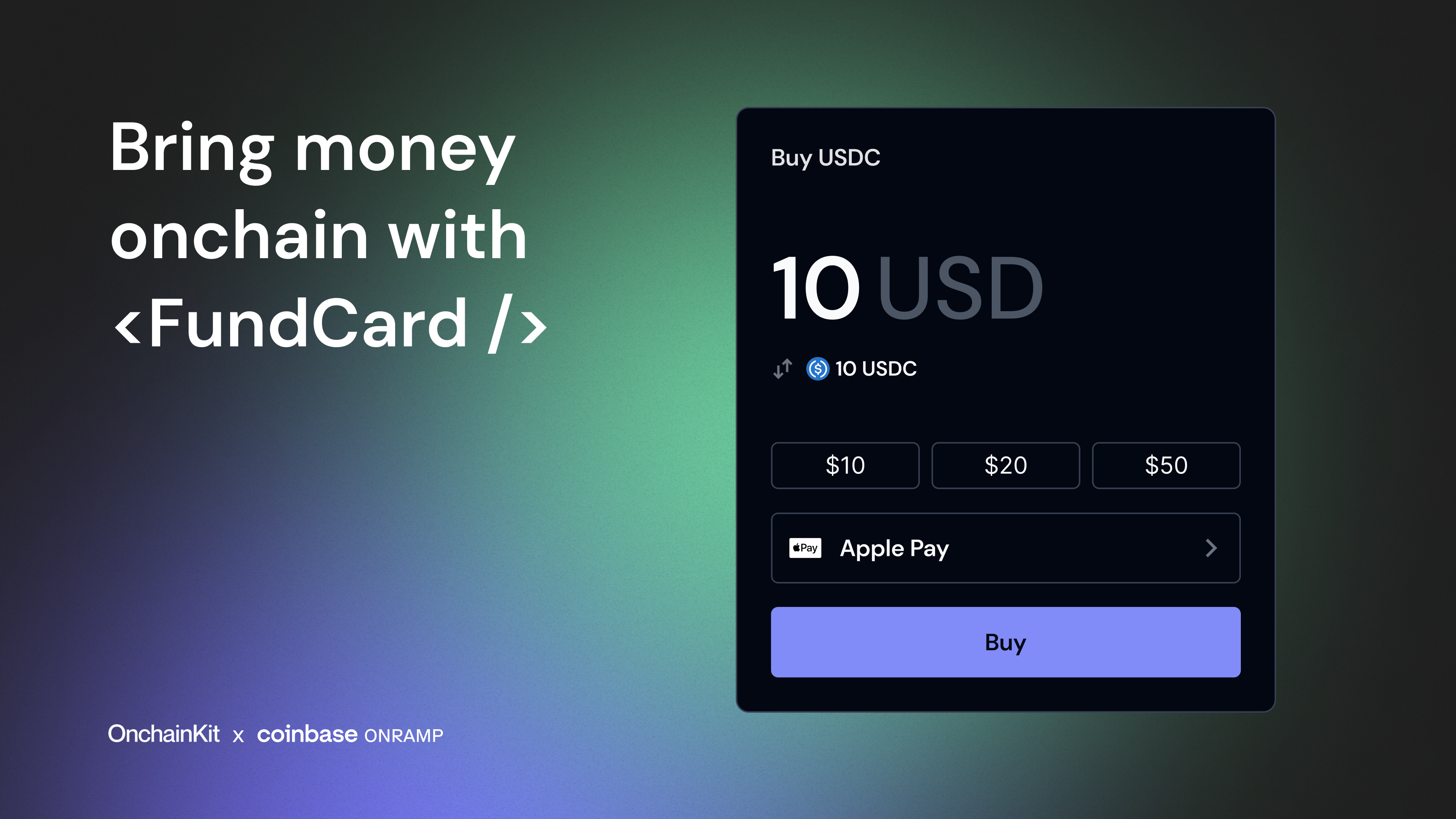

The momentum behind USDC Base real-time payments has been further amplified by strategic partnerships with industry giants like Stripe and Binance U. S. In June 2024, Stripe integrated support for USDC on Base into its crypto payouts product as well as its fiat-to-crypto on-ramp (bloomberg.com). This means users can now instantly purchase USDC using credit cards or Apple Pay – effectively bridging the gap between traditional finance rails and instant blockchain settlements.

The April 2025 integration by Binance U. S. , allowing direct ETH and USDC deposits/withdrawals via Base Layer 2 (cryptonews.net), exemplifies how major exchanges are embracing this low-latency infrastructure to reduce friction for their users while alleviating mainnet congestion.

6-Month Price Comparison: Multichain Bridged USDC (Fantom) vs Major Stablecoins & Bitcoin

Performance of Multichain Bridged USDC (Fantom) compared to leading stablecoins and Bitcoin over the past 6 months (as of 2025-10-02)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Multichain Bridged USDC (Fantom) | $0.0583 | $0.0446 | +30.9% |

| USD Coin (Ethereum) | $0.9997 | $0.9997 | +0.0% |

| Tether (USDT) | $1.00 | $0.9992 | +0.1% |

| Dai (DAI) | $0.9997 | $0.9995 | +0.0% |

| Binance USD (BUSD) | $0.9992 | $0.9995 | -0.0% |

| Pax Dollar (USDP) | $0.9995 | $0.9995 | +0.0% |

| TrueUSD (TUSD) | $1.0000 | $0.9839 | +1.6% |

| Frax (FRAX) | $0.9982 | $0.9977 | +0.1% |

| Bitcoin (BTC) | $119,433.00 | $60,000.00 | +99.1% |

Analysis Summary

Over the past six months, Multichain Bridged USDC (Fantom) significantly outperformed all major stablecoins, rising +30.9%, while most stablecoins maintained their dollar pegs with minimal price changes. Bitcoin nearly doubled in value, reflecting broader market growth. The strong performance of USDC (Fantom) highlights growing demand for cross-chain assets amid the rise of real-time, low-fee USDC payments on Base.

Key Insights

- Multichain Bridged USDC (Fantom) saw a +30.9% increase, far exceeding the stability of other major stablecoins.

- All major stablecoins (USDC, USDT, DAI, BUSD, USDP, FRAX) maintained their pegs to the US Dollar, with negligible price changes over 6 months.

- TrueUSD (TUSD) showed a modest gain of +1.6%, slightly deviating from its peg.

- Bitcoin (BTC) experienced the largest gain among all assets, nearly doubling (+99.1%) in the same period.

- The notable rise of USDC (Fantom) suggests increased interest in cross-chain and Layer 2 solutions, especially as real-time USDC payments become more accessible.

This comparison uses only the exact real-time price data provided for each asset, with current and 6-month historical prices sourced directly from CoinGecko and other referenced sources as of 2025-10-02.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/multichain-bridged-usdc-fantom/historical_data

- USD Coin (Ethereum): https://www.coingecko.com/en/coins/usd-coin/historical_data

- Tether: https://www.coingecko.com/en/coins/tether/historical_data

- Dai: https://www.coingecko.com/en/coins/dai/historical_data

- Binance USD: https://www.coingecko.com/en/coins/binance-usd/historical_data

- Pax Dollar: https://www.coingecko.com/en/coins/pax-dollar/historical_data

- TrueUSD: https://www.coingecko.com/en/coins/trueusd/historical_data

- Frax: https://www.coingecko.com/en/coins/frax/historical_data

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin/historical_data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

The Technical Edge: How Real-Time Streaming Works Under the Hood

This dramatic reduction in transaction latency is powered by deep architectural changes within the Base protocol stack. By leveraging off-chain computation where possible while maintaining robust security guarantees through programmable MPC wallets and smart contract automation, Coinbase engineers have created an environment where settlement finality is measured in seconds instead of blocks.

USD Coin Technical Analysis Chart

Analysis by Mason Callahan | Symbol: BINANCE:USDCUSDT | Interval: 1D | Drawings: 3

Technical Analysis Summary

Given USDCUSDT is a fiat-backed stablecoin pair, the chart reflects its fundamental role as a digital dollar and its tight 1:1 peg with USD. The price action on this daily chart for 2025 displays low volatility and tight consolidation around $0.9994, as would be expected for a well-collateralized stablecoin. Key technical drawing tools here should focus on horizontal lines for pinpointing support/resistance, rectangles for denoting consolidation zones, and text/callouts to annotate macroeconomic or network upgrade events that might cause temporary deviations from the peg.

Risk Assessment: low

Analysis: With USDC’s peg stability reinforced by technological advancements and broad institutional adoption, price risk is minimal for holding or transacting. The main risk remains systemic or regulatory, not technical.

Mason Callahan’s Recommendation: Maintain USDC as a core liquidity and risk management tool within diversified portfolios. Monitor for outlier events, but do not seek speculative gains from price movement.

Key Support & Resistance Levels

📈 Support Levels:

-

$0.998 – Observed as the lower bound of most daily closes, with only brief wick breaks.

strong

📉 Resistance Levels:

-

$1.001 – Ceiling for upside deviations; rarely breached except during high-volume events.

strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$0.998 – Potential opportunity for arbitrage or risk-off entry if price momentarily dips below typical peg range.

low risk

🚪 Exit Zones:

-

$1.001 – Realistic profit-taking zone for arbitrageurs during brief upside deviations.

💰 profit target -

$0.997 – Risk management stop in the unlikely event of a pronounced depeg.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Not shown on chart, but typically spikes during brief peg breaks, indicating arbitrage activity.

Volume would be most relevant during brief excursions outside the peg; annotate these with callouts.

📈 MACD Analysis:

Signal: Not meaningful due to the nature of stablecoin price action.

MACD provides little actionable signal due to tight mean reversion.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Mason Callahan is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

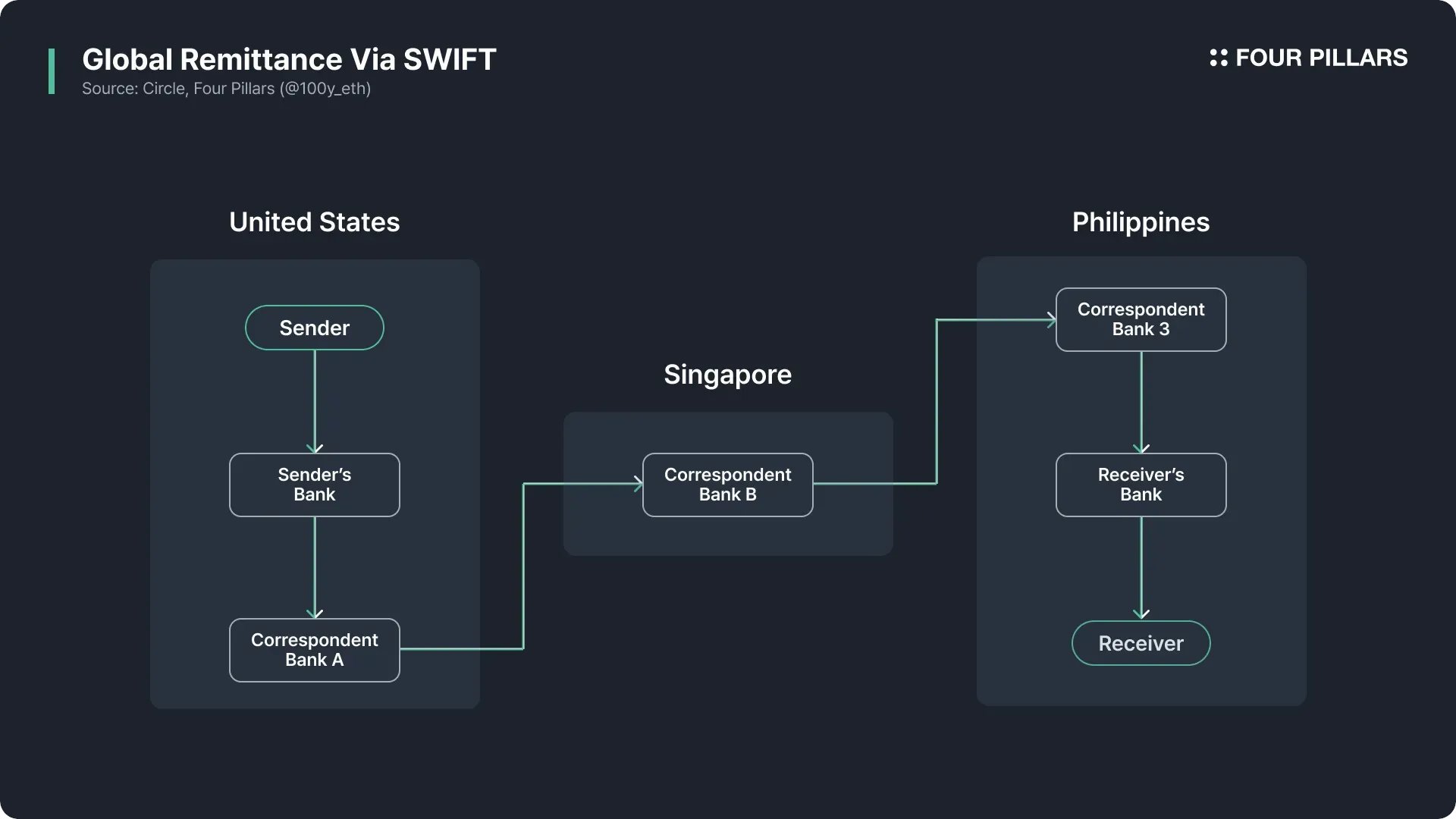

The result? A new paradigm where instant stablecoin transfers are not only possible but expected – setting the stage for broader stablecoin adoption across DeFi protocols, consumer apps, cross-border remittances, and more.

As these technological breakthroughs ripple outward, the broader implications for the digital asset economy are profound. Real-time USDC payments on Base aren’t just a marginal improvement – they’re a categorical leap forward for stablecoin utility, user experience, and the competitive landscape of decentralized finance.

From Niche to Ubiquity: Stablecoin Adoption in Everyday Finance

The rapid acceleration of USDC transaction speed on Base is already shifting how individuals and businesses approach crypto payments. For global payrolls, gig economy payouts, cross-border remittances, and merchant settlements, instant stablecoin transfers eliminate the waiting game and fee drag that once hampered adoption. This is especially salient in frontier markets where access to reliable banking remains limited – now, stablecoins can serve as a de facto payment rail with near-zero latency.

Key Benefits of Real-Time USDC Payments on Base

-

Instant Settlement: Real-time USDC payments on Base reduce transfer latency by up to 90%, enabling near-instant settlement (as fast as ~1 second to receive and ~2 seconds to send). This dramatically improves cash flow for both businesses and individuals.

-

Zero-Fee Transfers: Coinbase’s integration of fee-free USDC transfers on Base eliminates transaction costs, making micropayments and frequent transactions practical for everyone.

-

Scalable Mass Payments: With tools like Paymaker, businesses can send bulk USDC payments to thousands of recipients at once without gas fees, streamlining payroll, rewards, and supplier payments.

-

Enhanced Accessibility: Partnerships with platforms like Stripe allow users to instantly purchase USDC with credit cards and Apple Pay, lowering barriers to entry and enabling seamless onboarding for new users.

-

Lower Cross-Border Friction: Real-time USDC payments on Base offer fast, cost-effective global transfers, reducing the need for intermediaries and minimizing settlement delays for international transactions.

-

Improved User Experience: The Simple Mode in Coinbase Wallet prioritizes essential functions, making USDC transfers on Base more intuitive and accessible for newcomers and everyday users.

-

Broad Platform Support: Integration with major exchanges like Binance U.S. enables users to deposit and withdraw USDC and ETH on Base, ensuring liquidity and flexibility across multiple platforms.

For DeFi projects, reduced network congestion and predictable costs open up new design space for protocols that require microtransactions or frequent value transfers. Instead of architecting around gas spikes or slow confirmations, developers can build experiences that feel as seamless as mainstream fintech apps – but with the added transparency and programmability of blockchain.

Navigating Risks: Security and Market Stability

While the promise is clear, risk management remains paramount. The use of programmable MPC wallets enhances security by distributing key control across multiple parties, reducing single points of failure. However, users should remain vigilant regarding smart contract risks and always verify integrations before moving significant capital.

On the price front, Multichain Bridged USDC (Fantom) holds steady at $0.0583, reflecting both market confidence in stablecoin pegs and growing liquidity across chains. As more capital flows into these faster rails, maintaining robust collateralization and regulatory compliance will be critical for long-term stability.

What’s Next? Scaling Up Instant Stablecoin Transfers

The trajectory is clear: as more platforms integrate USDC Base real-time payments, expect further convergence between traditional financial infrastructure and open blockchain networks. With Stripe’s fiat on-ramps, Binance U. S. ’s direct withdrawals/deposits via Base Layer 2, and Coinbase’s zero-fee wallet experience all converging around this standard, instant settlement is rapidly becoming table stakes for the industry.

The next phase will likely see even tighter integration with e-commerce platforms, payroll services, global B2B payments solutions – all leveraging instant stablecoin transfers to unlock efficiency gains previously unimaginable in legacy systems.

Staying Ahead: Tracking Stablecoin Flows in Real Time

For investors and analysts seeking an edge in this evolving landscape, monitoring Base network stablecoin latency, transaction volumes, and adoption metrics will be crucial. Tools like Stablecoin Flows provide granular data on where liquidity is moving fastest – offering actionable insights into both macro trends and protocol-specific opportunities.

The bottom line? Real-time USDC payments on Base are setting a new benchmark for what’s possible in digital money movement. As friction falls away and instant settlement becomes ubiquitous across DeFi and beyond, expect stablecoins to play an ever-larger role at the heart of modern finance.