Stablecoins have long promised to bridge the gap between legacy finance and on-chain money. But until recently, high latency and unpredictable fees have kept real-time payments out of reach for most users and businesses. Enter USDC on Base: a combination that’s fundamentally altering how digital dollars move across the internet.

Sub-Second Settlement: USDC Base Transaction Latency

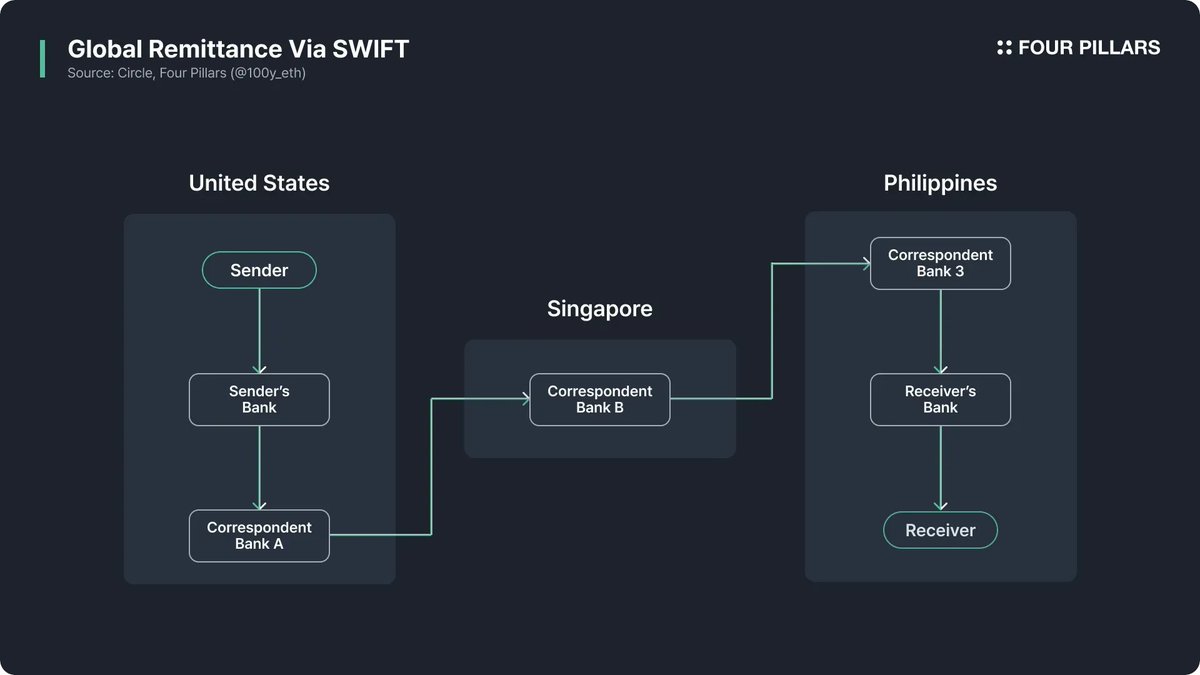

The integration of USD Coin (USDC) with Coinbase’s Base network is setting new standards for transaction speed. Payments now settle in approximately 200 milliseconds – a figure that rivals and often beats traditional card networks. For context, a typical SWIFT wire transfer can take 1, 3 days and cost $30–$50 per transaction, while even credit card payments can take several seconds to clear and hours or days to fully settle (source). With Base, merchants and consumers experience near-instantaneous settlement, making it ideal for e-commerce checkouts, event ticketing, or any scenario where time is money.

Key stat: On-chain USDC payments via Base are now routinely confirmed in under 200ms – faster than most point-of-sale terminals.

Pennies to Fractions: The Fee Revolution

Legacy payment rails are notorious for their hidden costs. International transfers pile on FX spreads, intermediary bank fees, and slow processing. By contrast, Base USDC transfer fees are consistently under $0.01 per transaction, with some cross-border remittances clocking in at just $0.000409. This isn’t just incremental improvement – it’s an order-of-magnitude leap (source).

This dramatic fee compression opens up new business models. Microtransactions become viable; global payroll is democratized; merchant margins improve as payment friction drops below 0.1%. Traditional methods like wires (often 2, 5% per transfer) or cards (1, 3% interchange) simply can’t compete at this scale.

Key Advantages of USDC on Base for Real-Time Payments

-

Ultra-Low Transaction Fees: USDC transfers on the Base network consistently cost under $0.01 per transaction, with some cross-border payments as low as $0.000409. This is a fraction of traditional wire or credit card fees, enabling substantial cost savings for businesses and consumers. Source

-

Near-Instant Settlement: Payments settle on the Base network in approximately 200 milliseconds, providing true real-time processing. This rapid latency is especially advantageous for merchants and platforms requiring immediate confirmation. Source

-

Seamless User Experience: USDC on Base enables one-tap, gasless transactions for end users. Consumers do not need to hold native tokens for fees, and payments are processed with minimal friction—ideal for e-commerce and event ticketing. Source

-

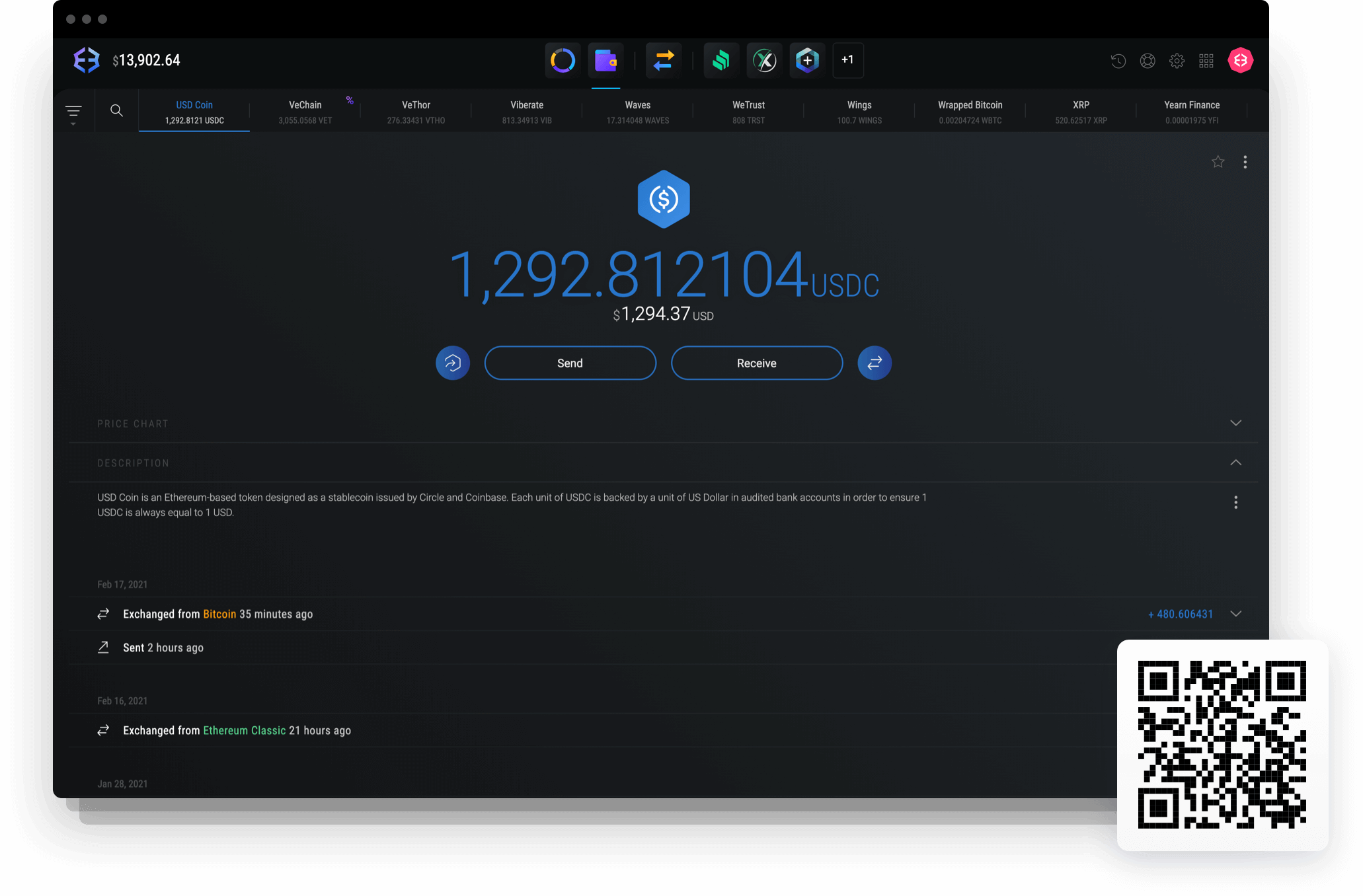

Enhanced Transparency and Traceability: All USDC transactions on Base are publicly verifiable and time-stamped on-chain, supporting auditability and regulatory compliance for institutions and enterprises. Source

User Experience: Seamless Onboarding and Gasless Transactions

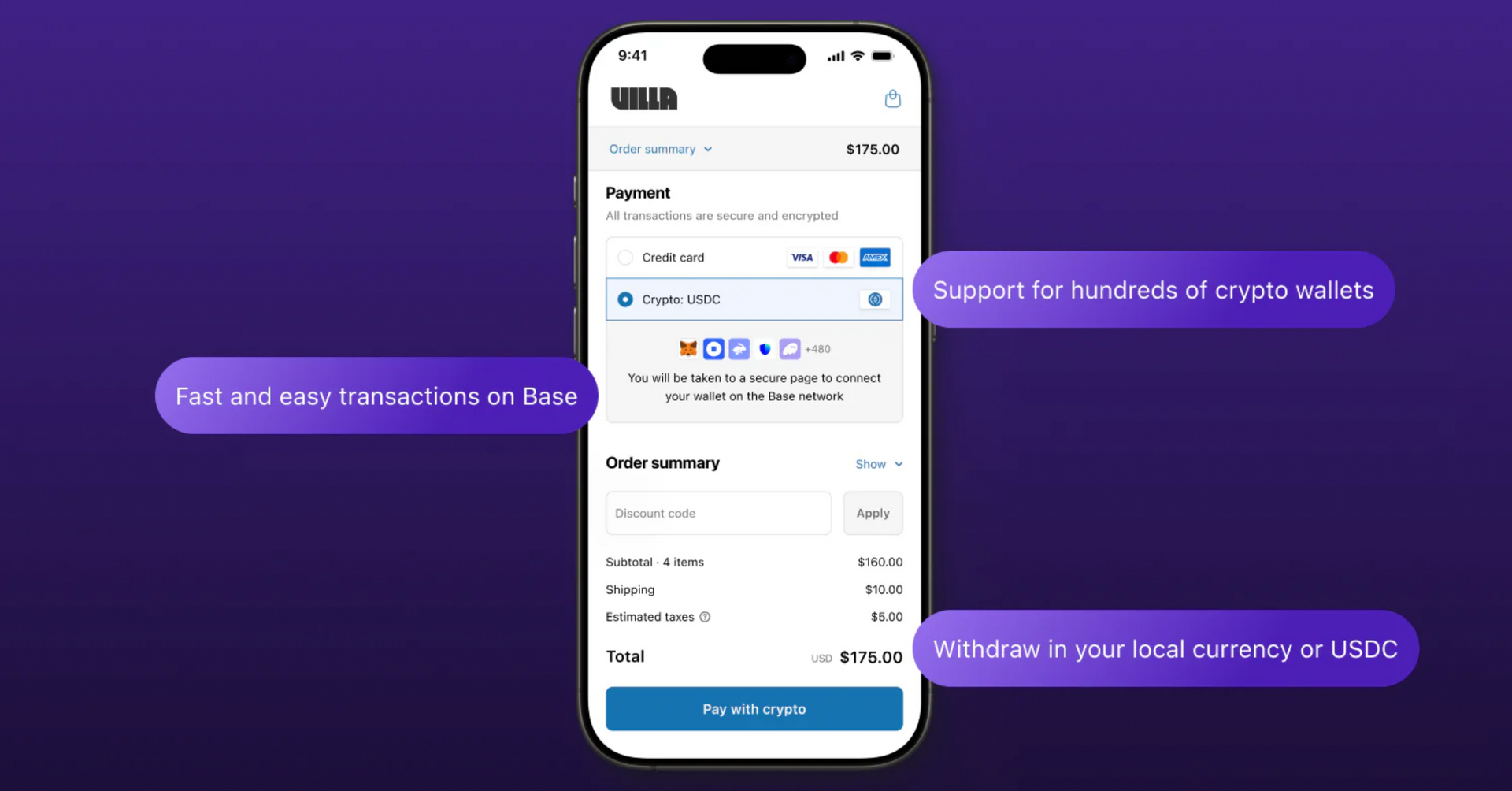

The technical leap is only half the story. For end users, the experience of paying with USDC on Base feels like magic compared to clunky crypto UX of the past. One-tap transactions are now standard for e-commerce platforms and event organizers (source). Merchants can accept stablecoin payments without worrying about volatile assets or complex wallet management.

A standout feature is gasless transactions: users don’t need to hold any native BASE token to cover fees – everything is handled in USDC itself (source). This eliminates a major onboarding barrier and aligns with user expectations from Web2 payments.

For platforms onboarding new users, this shift is seismic. There’s no more educating customers about native gas tokens or forcing them through confusing multi-asset setups. Instead, USDC on Base delivers a streamlined, frictionless payment experience that rivals (and arguably surpasses) traditional fintech apps. The result: higher conversion rates for merchants, broader adoption for stablecoins, and a genuine path to mainstream crypto payments.

Data point: Shopify merchants using Base have reported checkout abandonment rates dropping as seamless USDC payments reduce friction at the point of sale.

From Niche to Norm: Stablecoin Adoption on Base Network

The practical benefits of Base network stablecoin payments are now driving real-world adoption. International freelancers can receive pay in seconds instead of days. Event organizers settle ticket sales instantly with full auditability. Cross-border e-commerce sidesteps both FX risk and bank delays, at costs measured in fractions of a cent.

The transparency of on-chain settlements also appeals to businesses seeking compliance and traceability. Every transaction is timestamped, irreversible, and easily auditable, features that legacy rails struggle to match at scale. This visibility is especially valuable for B2B transactions and marketplaces operating across borders.

What’s Next for USDC Real-Time Payments?

The momentum behind USDC on Base shows no signs of slowing. As more payment service providers integrate stablecoin rails and major merchants adopt one-tap checkout flows, the network effect compounds. The next wave will likely see payroll platforms, gig economy apps, and global supply chains leveraging sub-second settlement and near-zero fees as core infrastructure, not just experimental features.

It’s not just about speed or cost; it’s about programmable money that adapts to modern commerce. With composable smart contracts layered atop instant stablecoin transfers, entirely new financial primitives become possible, from automated revenue sharing to multi-party escrow, all executed at internet speed.

Industries Most Impacted by USDC Real-Time Payments on Base

-

Cross-Border Remittances: USDC on Base enables near-instant, low-cost international money transfers, with fees often under $0.01 per transaction—far lower than traditional SWIFT or wire transfers, which can cost $30–$50 and take days.

-

E-Commerce Marketplaces: Platforms like Shopify now support USDC payments on Base, offering one-tap, gasless checkout and settlement in 200 milliseconds, significantly improving merchant and buyer experiences.

-

Freelance & Gig Economy Platforms: Services such as Upwork and Fiverr benefit from real-time stablecoin payouts, allowing freelancers to receive funds instantly with minimal fees, compared to slower, higher-cost bank transfers.

-

Event Ticketing & Digital Goods: Event organizers and digital content sellers leverage Base’s seamless, gasless USDC transactions for fast, irreversible sales, reducing fraud and chargebacks.

-

Payment Service Providers (PSPs): Major PSPs are integrating USDC on Base to offer faster, lower-fee settlement for merchants, with transaction costs often below 1% versus the typical 2–5% for credit cards.

For investors and analysts tracking stablecoin adoption Base network, the metrics are clear: transaction volumes are up, fee compression is attracting new segments, and user experience improvements are breaking down the last barriers to mass-market use. As digital dollars move faster than ever before, with full transparency, USDC on Base isn’t just catching up with legacy payment systems; it’s setting a new standard for what money can do in the 21st century.