Stablecoin flows are increasingly regarded as a reliable leading indicator for shifts in DeFi Total Value Locked (TVL). In today’s decentralized finance landscape, the movement of stablecoins into or out of protocols often signals coming changes in user engagement, liquidity depth, and overall sector momentum. For investors and analysts, understanding these flows is no longer optional – it’s a core strategy for anticipating market trends and positioning ahead of the crowd.

Why Stablecoin Flows Matter for DeFi TVL

The relationship between stablecoin flows and DeFi TVL is both intuitive and empirically supported. Stablecoins – with their price stability and onchain composability – serve as the primary capital base for most DeFi protocols. When users deposit stablecoins into lending platforms, liquidity pools, or yield farms, these assets are counted directly toward TVL. Conversely, when stablecoins exit protocols en masse, they pull liquidity out of the system, often preceding risk-off periods or sector rotations.

Recent research from Qubit Capital highlights that the influx of stablecoins has dramatically increased DeFi’s economic capacity. More capital onchain means deeper liquidity pools, tighter spreads on DEXs, and more robust lending markets. According to AInvest, stablecoins now underpin roughly 40% of all DeFi TVL – a figure expected to rise as decentralized lending and yield-bearing strategies scale toward a projected $1.2 trillion by 2028.

Current Market Data: The Correlation in Action

The predictive power of stablecoin flows is evident in recent onchain events:

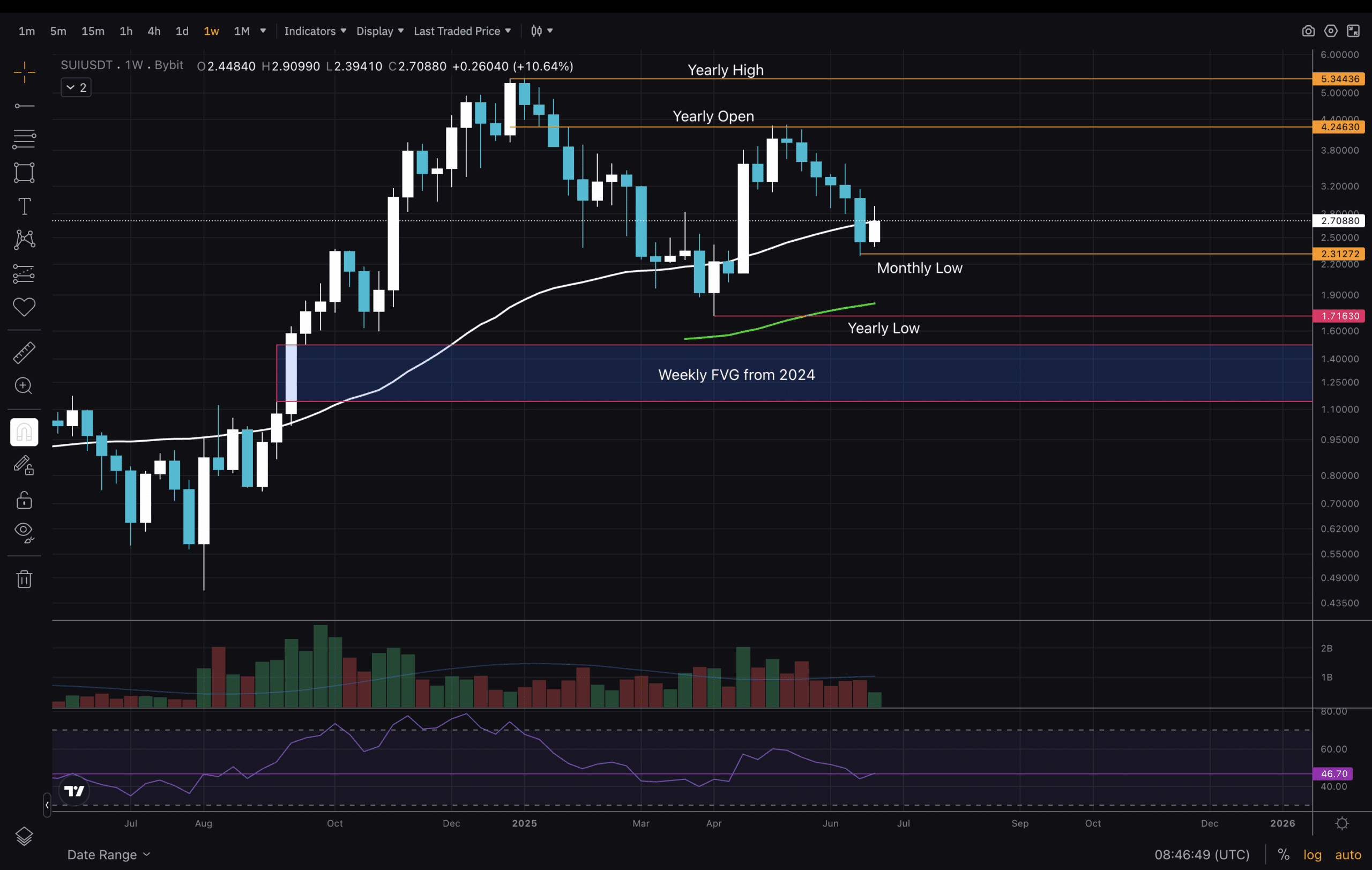

- Sui Network: On April 16,2025, Sui recorded $18.1 million in stablecoin inflows within a single day. This surge was immediately followed by a 2.63% increase in Sui’s DeFi TVL to $1.249 billion – clear evidence that new capital entering via stablecoins can drive protocol growth (source).

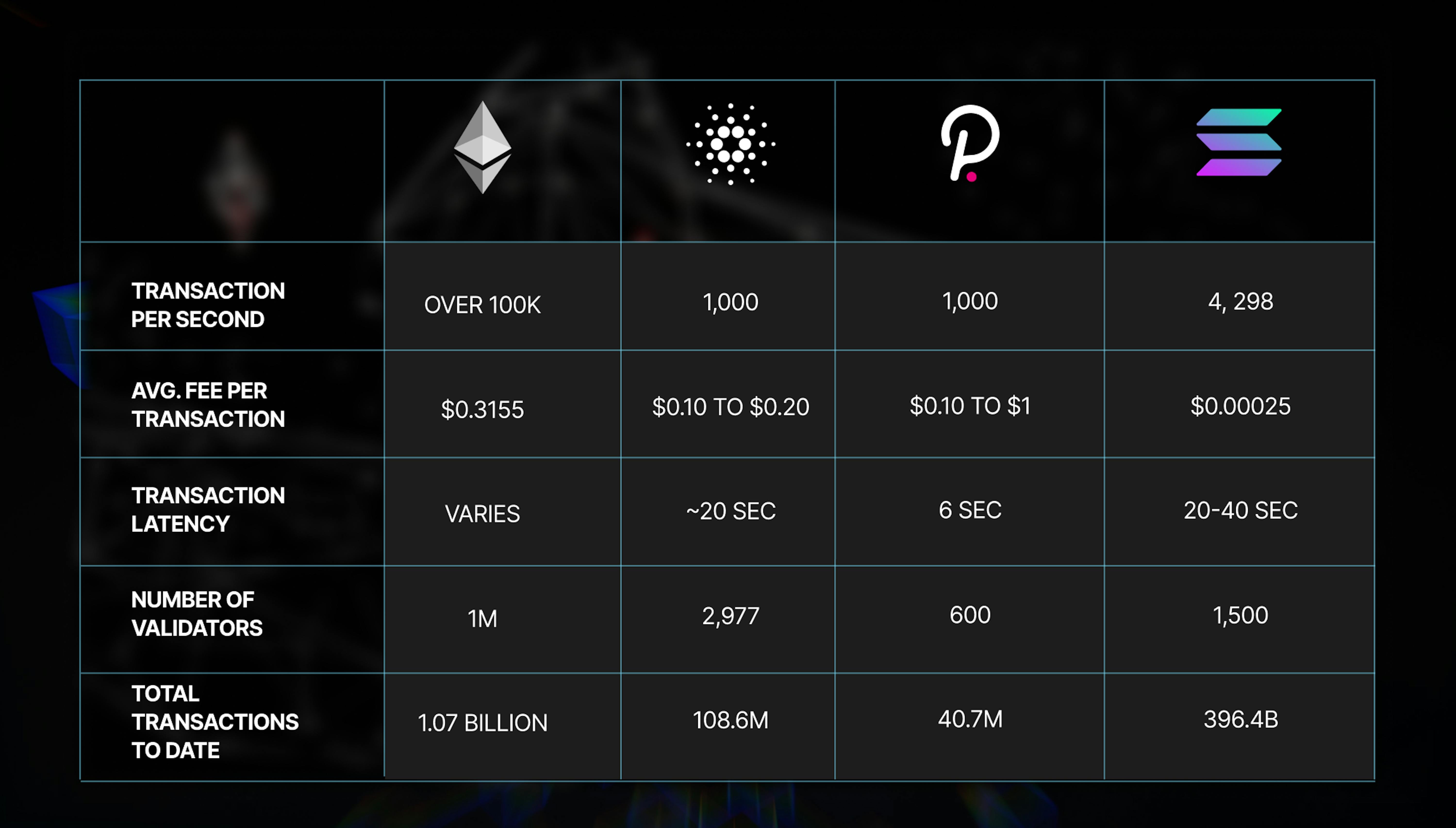

- Solana: In late December 2024, Solana attracted over $454 million in weekly stablecoin inflows. This wave coincided with heightened DEX trading activity and increased usage across its ecosystem (source).

This pattern repeats across chains: capital inflow via stablecoins precedes or accompanies meaningful jumps in TVL and user engagement. As reported by The Defiant and CoinMarketCal, Ethereum and Solana continue to lead as bellwethers for broader DeFi activity – their ability to attract fresh stablecoin liquidity often sets the tone for sector-wide momentum.

The Mechanics: How Stablecoin Movements Predict DeFi Activity

The mechanics linking stablecoin flows to DeFi TVL changes are straightforward yet powerful:

Why Stablecoin Flows Predict DeFi TVL Changes

-

Stablecoin inflows signal new capital entering DeFi. When large amounts of stablecoins are deposited onto DeFi platforms, it often reflects fresh liquidity being deployed, which can directly increase Total Value Locked (TVL). For example, Sui Network saw a $18.1 million stablecoin inflow on April 16, 2025, coinciding with a 2.63% rise in TVL to $1.249 billion.

-

Stablecoins provide immediate liquidity for DeFi protocols. Because stablecoins maintain a stable value and are widely accepted, their movement into DeFi pools rapidly boosts available liquidity. This deeper liquidity enables more lending, trading, and yield-generating activities, which are core drivers of TVL growth.

-

Stablecoin flows reflect user confidence and engagement. Rising stablecoin deposits often indicate increased user trust and participation in DeFi platforms. For instance, Solana’s $454 million stablecoin inflow in late December 2024 was accompanied by a surge in DEX trading and DeFi activity, highlighting the link between stablecoin movement and platform usage.

-

Stablecoin concentration can influence DeFi sector momentum. The aggregation of stablecoins in major protocols or chains often precedes sector-wide TVL expansions, as seen with Ethereum and Solana leading recent DeFi growth. Monitoring these flows helps anticipate which ecosystems may drive the next wave of DeFi activity.

-

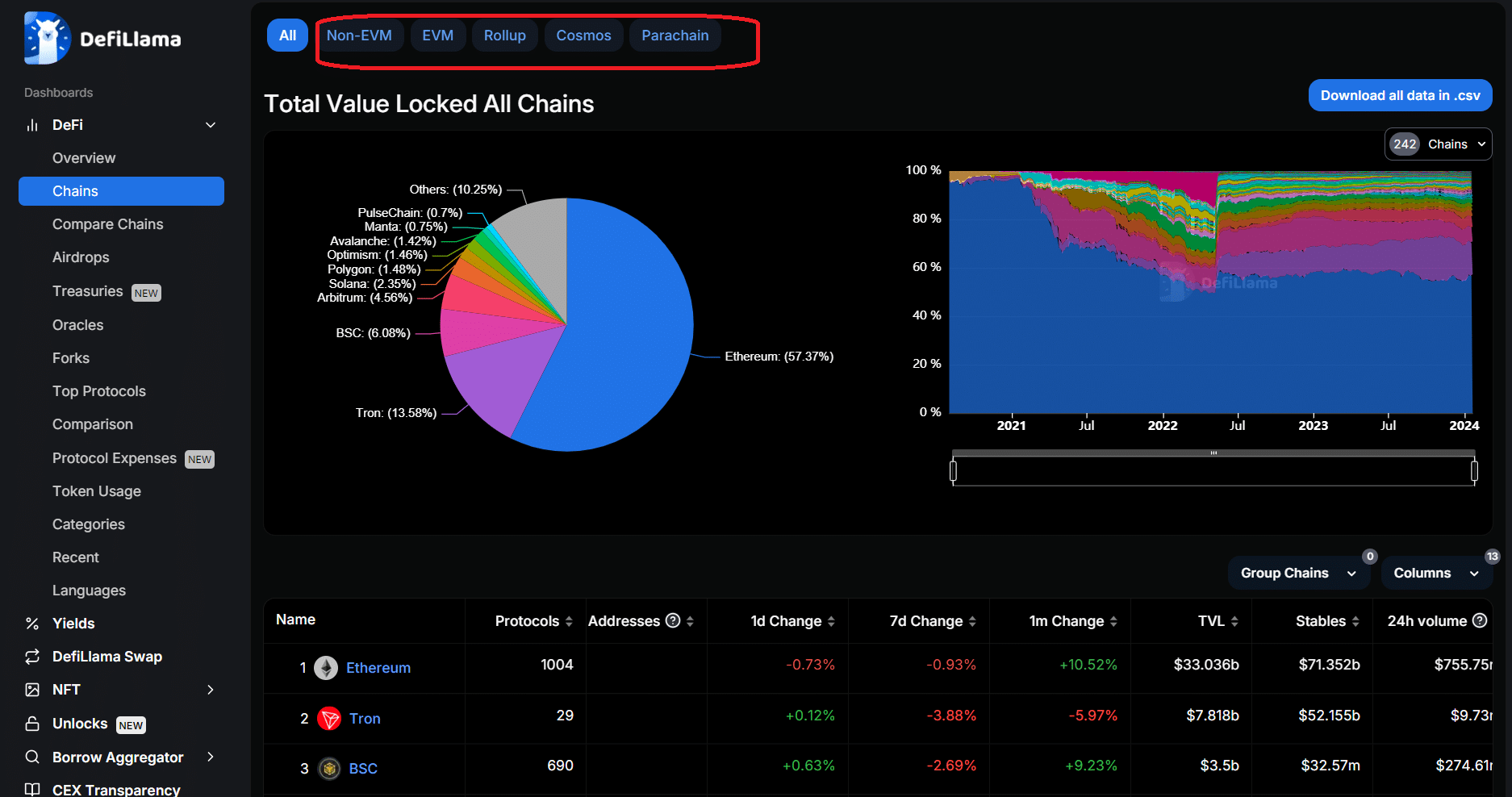

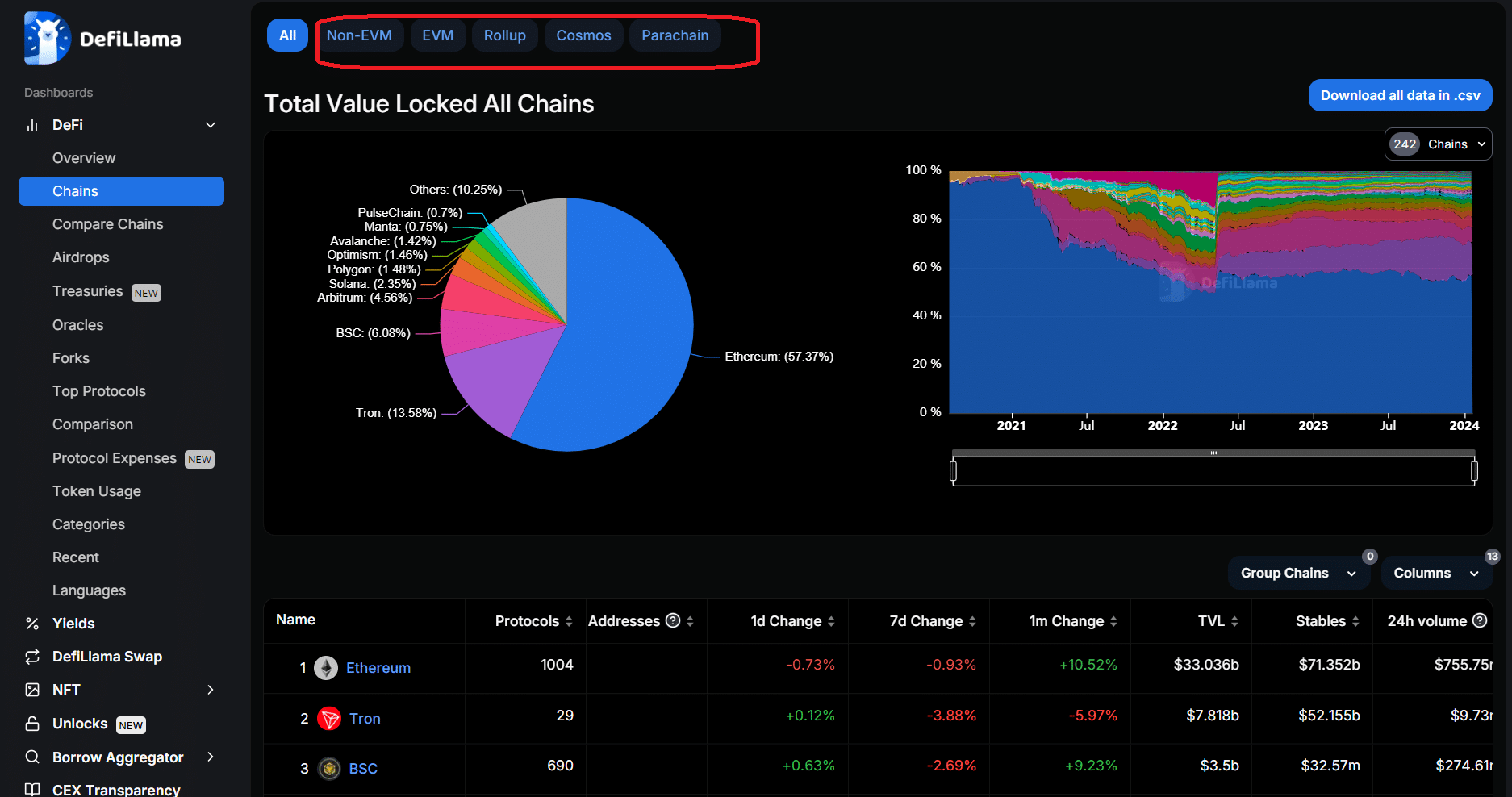

Onchain stablecoin data offers real-time insight into DeFi trends. Platforms like DefiLlama provide up-to-the-minute data on stablecoin supply, inflows, and utilization. Tracking these metrics allows analysts and investors to spot early signals of TVL changes before they are reflected in broader market movements.

A surge of USDC or USDT into a protocol typically reflects new user deposits seeking yield opportunities or positioning ahead of governance proposals or incentive programs. These movements can be tracked in real time via analytics platforms like DefiLlama or Keyrock’s dashboards – offering investors an early warning system before headline-grabbing rallies (or drawdowns) materialize.

Conversely, sharp outflows of stablecoins often foreshadow liquidity crunches, risk aversion, or shifts to other protocols and chains. This is especially apparent during periods of macro uncertainty or when attractive yields rotate elsewhere in the ecosystem. As CoinMarketCal aptly describes, stablecoin issuers have assumed a role analogous to central banks for DeFi: their capital allocation decisions set the pace for liquidity expansion and contraction across the sector.

For context, after stablecoin revenue share in DeFi dipped to just 4.7% in June 2024, it rebounded impressively to a year-to-date high of 30.8%, with Ethereum capturing 25% and Layer 2s rapidly gaining ground. This resurgence underscores how closely DeFi’s fortunes are tied to the underlying flows of base stablecoins.

Strategic Implications for DeFi Investors

Recognizing stablecoin flows as a leading indicator empowers both institutional and retail investors with actionable insights:

- Timing Sector Rotations: Monitoring spikes in stablecoin inflows can help investors anticipate which protocols or chains are about to experience TVL growth and increased user activity.

- Risk Management: Steep outflows may signal an impending correction or flight to safety, allowing investors to de-risk proactively.

- Yield Optimization: By tracking where fresh capital is flowing, yield farmers and liquidity providers can reposition assets toward emerging opportunities before returns compress.

This dynamic is particularly relevant as DeFi TVL recently surged past $126 billion (up over 45% since April), according to The Defiant. Yet despite these headline numbers, capital remains highly concentrated among top protocols and blue-chip chains. For traders and allocators alike, treating TVL expansion as a momentum cue, while watching DEX volumes and stablecoin inflows, remains an effective strategy for navigating sector cycles (source).

Best Practices: Monitoring Stablecoin Flows for Alpha

The most successful DeFi analysts now incorporate multi-layered monitoring tools:

Top Tools for Tracking Real-Time Stablecoin Flows

-

DefiLlama – Renowned for its comprehensive dashboards, DefiLlama offers real-time tracking of stablecoin inflows, outflows, supply, and TVL across major chains like Ethereum, Solana, and Sui. Its stablecoin analytics section provides granular breakdowns by protocol and chain, making it an essential resource for DeFi analysts.

-

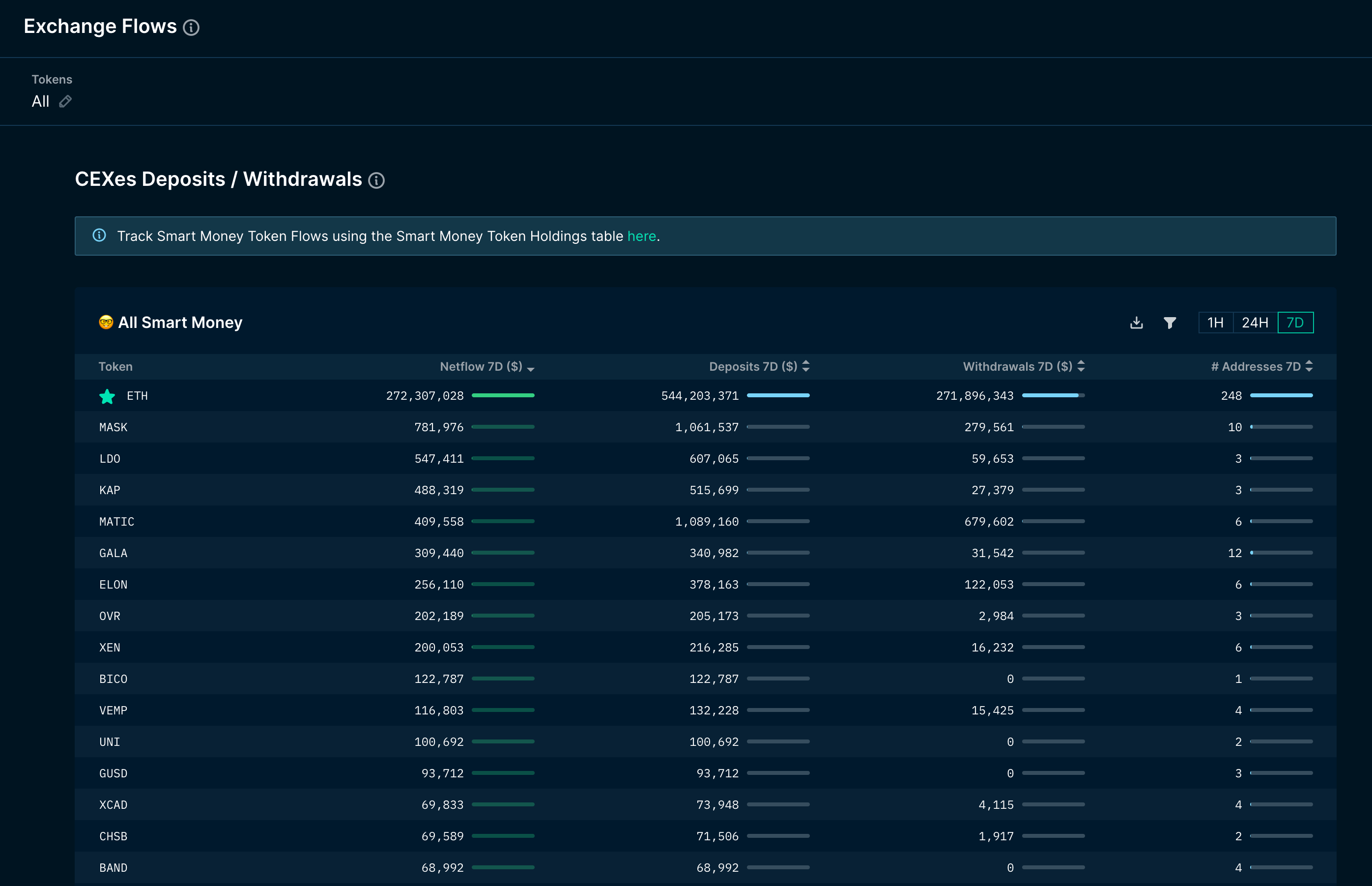

Nansen – Nansen delivers onchain analytics and wallet tracking for stablecoin movements, including large transactions and inflows to DeFi protocols. Its dashboards visualize stablecoin flow trends and link them to changes in DeFi TVL, helping users identify potential sector momentum.

-

Dune Analytics – Dune features a wide range of community-built dashboards that monitor stablecoin flows, liquidity pool changes, and TVL shifts. Users can access or customize queries tracking real-time stablecoin transfers across leading DeFi platforms and chains.

-

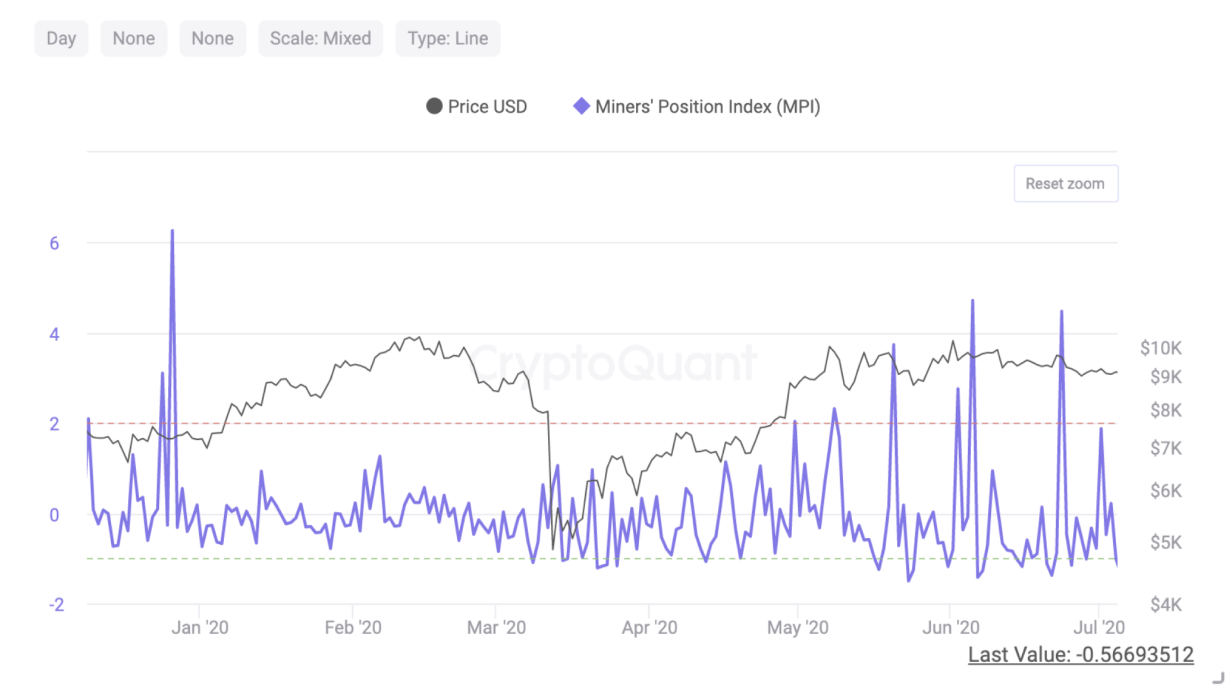

CryptoQuant – CryptoQuant offers onchain data and alerts for stablecoin transactions, exchange flows, and DeFi-related metrics. Its stablecoin flow tracking tools are valuable for anticipating liquidity changes and market sentiment shifts in DeFi.

-

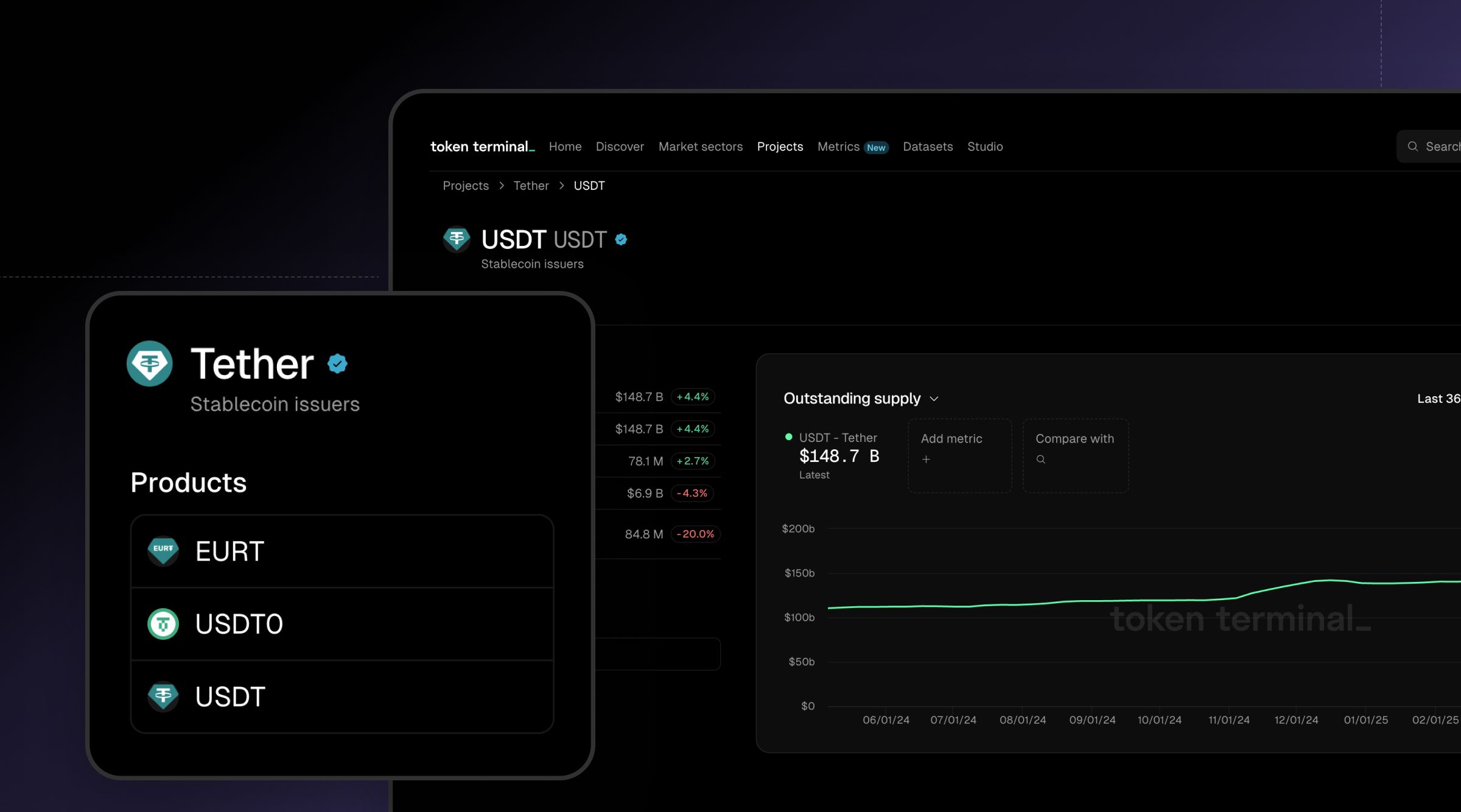

Token Terminal – Token Terminal aggregates protocol financials, including stablecoin supply, inflows, and their impact on DeFi TVL. Its analytics suite helps users correlate stablecoin movement with DeFi sector growth and protocol revenue.

Platforms like DefiLlama provide granular data on total market cap, price stability, supply changes, inflows/outflows, and percent off peg, critical metrics for gauging systemic risk or opportunity. However, as noted by Bank for International Settlements research, not every drop in a protocol’s TVL signals structural weakness; it could reflect temporary rebalancing or strategic asset migration (source).

The key is context: pairing quantitative flow data with qualitative analysis (such as upcoming governance votes or protocol launches) produces a more holistic view. As always in digital asset markets, patience remains essential, short-term volatility often masks longer-term adoption trends that only become clear by watching the movement of base capital.

How often do you track stablecoin inflows when making DeFi investment decisions?

Stablecoin movements are increasingly seen as leading indicators for DeFi TVL changes. Recent surges on Sui and Solana show how inflows can signal rising activity and liquidity. Do you monitor stablecoin flows to guide your DeFi strategies?