As of February 17,2026, Sui’s stablecoin flows have rocketed 2,132% year-over-year to $1.6 trillion year-to-date, a figure that captures the network’s explosive entry into the DeFi spotlight. With SUI trading at $0.9670 after a modest 24-hour gain of and $0.000510 ( and 0.000530%), this surge in Sui stablecoin flows signals more than hype; it reflects tangible infrastructure scaling that could redefine chain competition.

Decoding the Metrics Behind Sui’s Stablecoin Explosion

Stablecoin transfer volume, as tracked by sources like Artemis Terminal, measures raw on-chain activity in USD terms. Sui’s jump from near-zero levels in 2024 to $1.6 trillion YTD dwarfs prior expectations. This isn’t isolated; monthly stablecoin transaction volumes hit over $130 billion by mid-2025, fueled by daily active addresses nearing 1.8 million, outpacing rivals like TON.

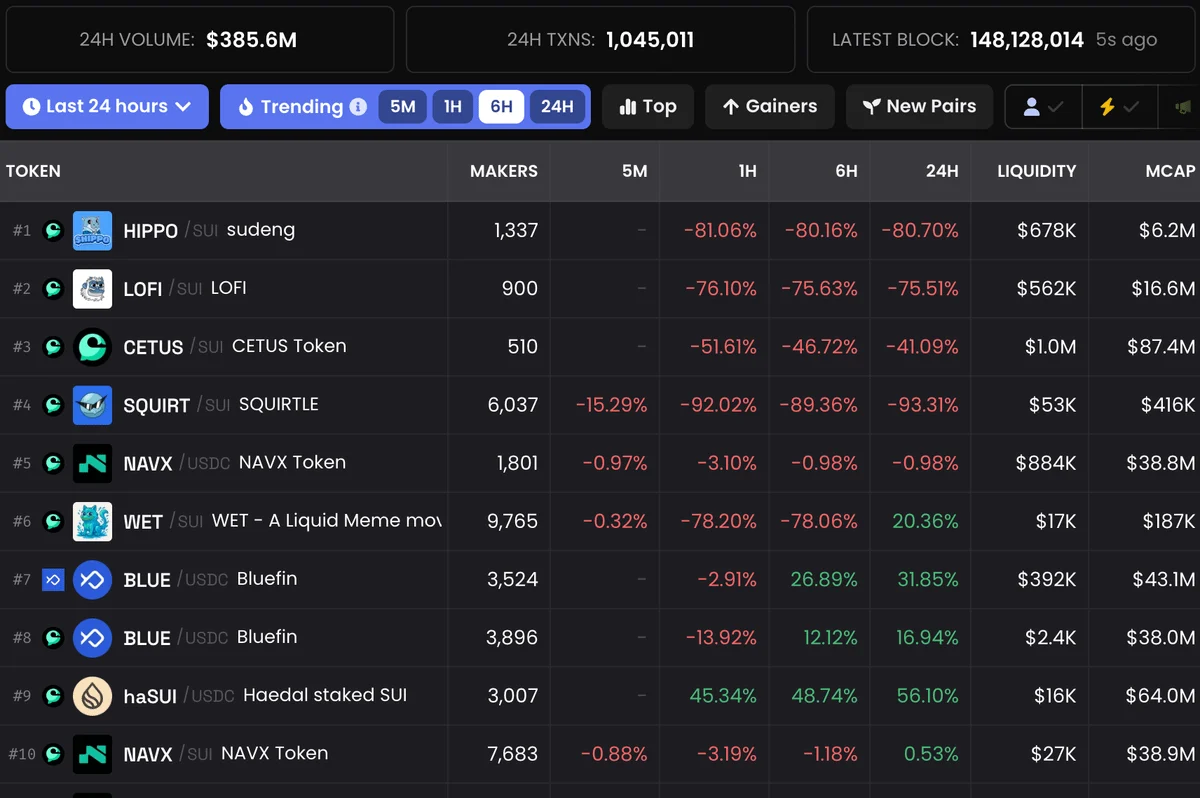

Consider the trajectory: Sui’s stablecoin market capitalization ballooned from $5.42 million in January 2024 to $1.156 billion by May 2025, a staggering 230-fold rise. Platforms like Cetus Protocol and Bluefin have been pivotal, clocking $367.9 million in daily trading volume, mostly stablecoin pairs, which propped up a total value locked (TVL) of $2.065 billion by January 2025.

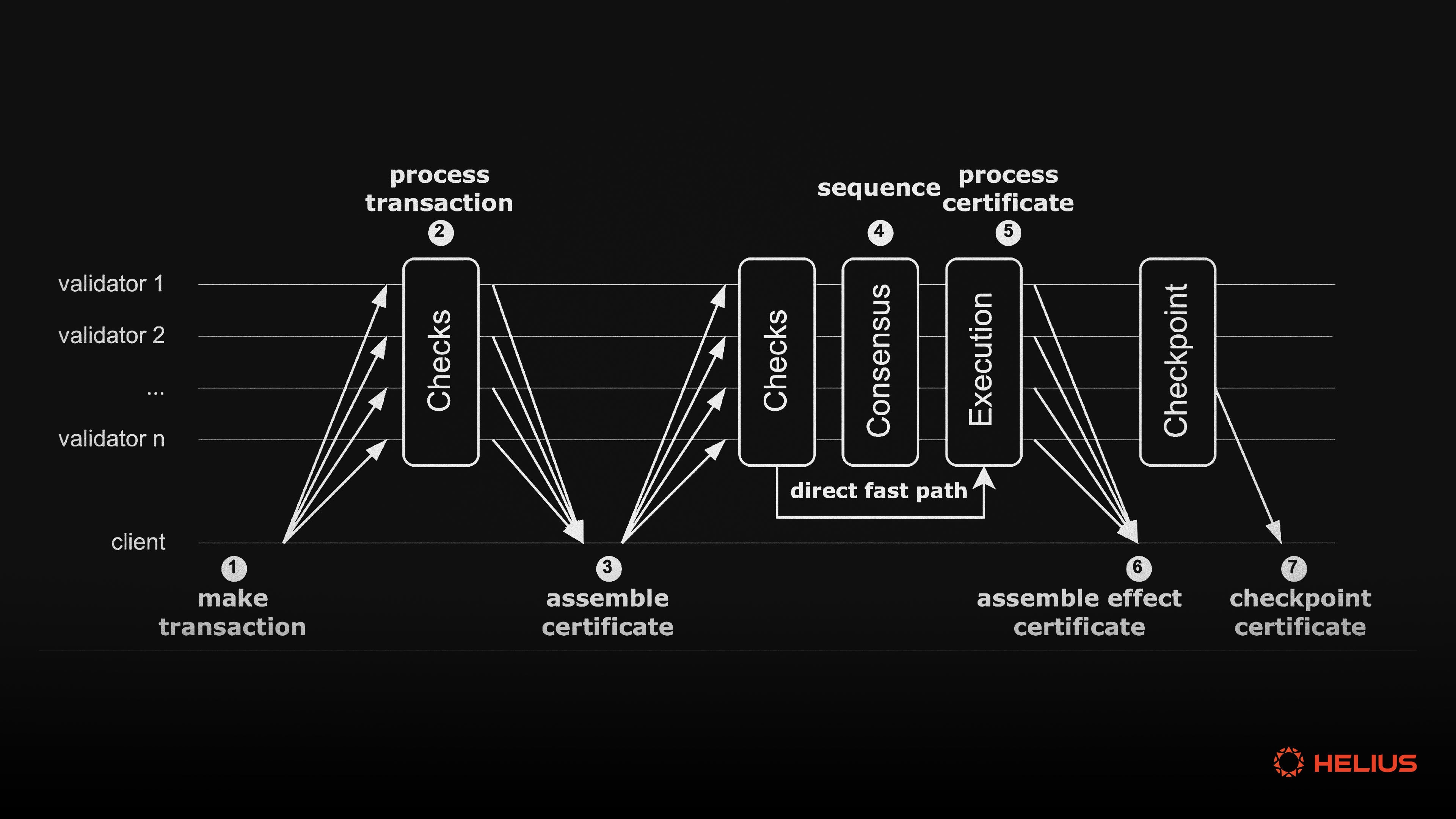

Sui’s growth underscores how object-centric architecture enables parallel execution, handling stablecoin Sui stablecoin transfer volume at scales Ethereum and Solana strain to match.

Sui vs. Base: A Tale of Competing Inflows

While Base leads in net inflows per Artemis data earlier this year, Sui’s stablecoin inflows Sui 2026 momentum challenges that narrative. Base briefly claimed 30% of global stablecoin transfer volume in a single day, eclipsing Ethereum, Tron, and Solana. Yet Sui’s YTD dominance, racing toward $2 trillion, positions it as the underdog turned contender.

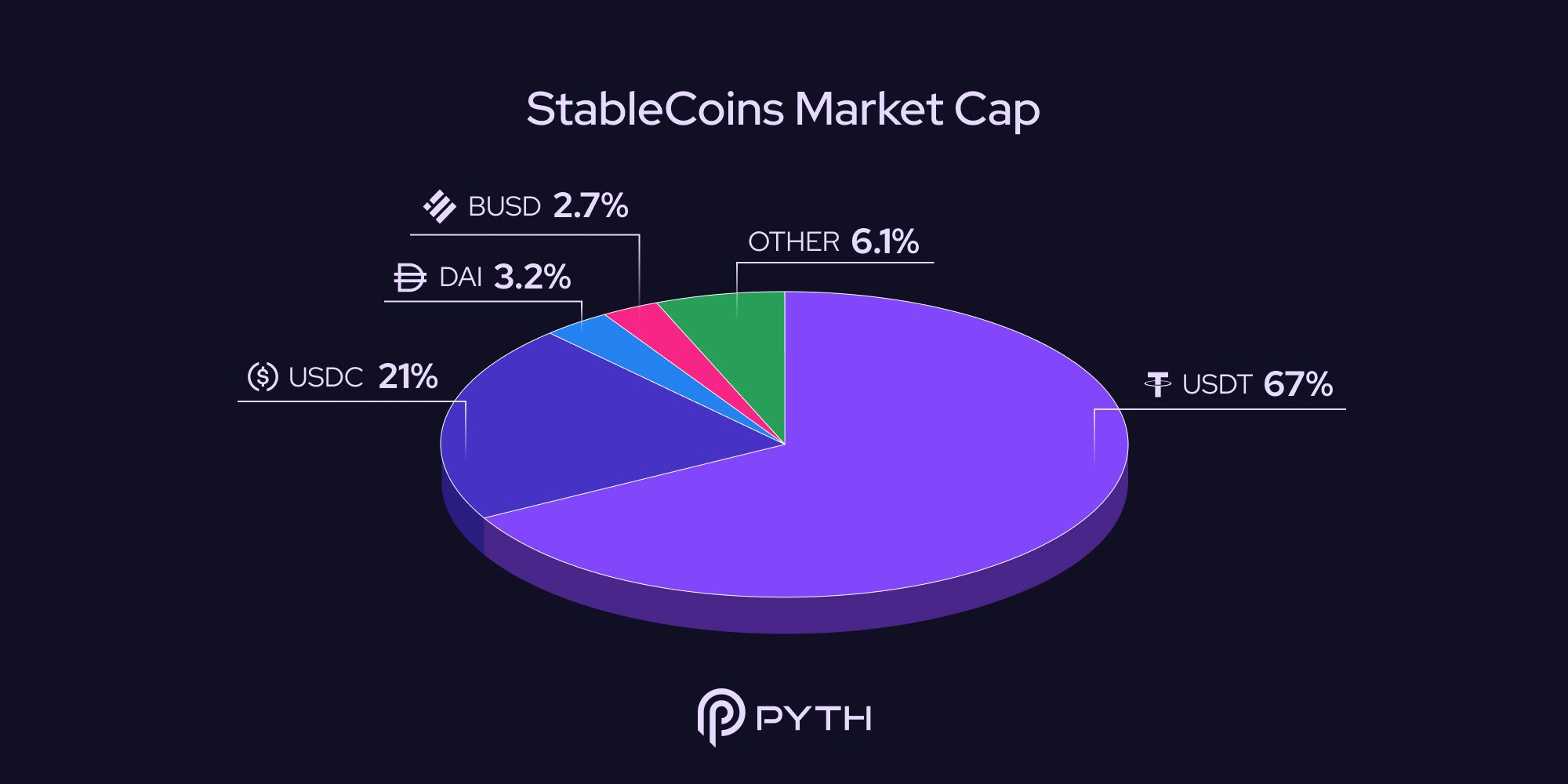

USDC’s edge in DeFi activity, surpassing USDT despite the latter’s $186 billion market cap versus USDC’s $74.9 billion, amplifies this. Globally, stablecoin transactions reached $33 trillion in 2025, with USDC leading volumes. Sui taps this by prioritizing USDC and similar assets, fostering USDC Base vs Sui flows debates among analysts.

Foundational Drivers of Sui DeFi Stablecoin Growth

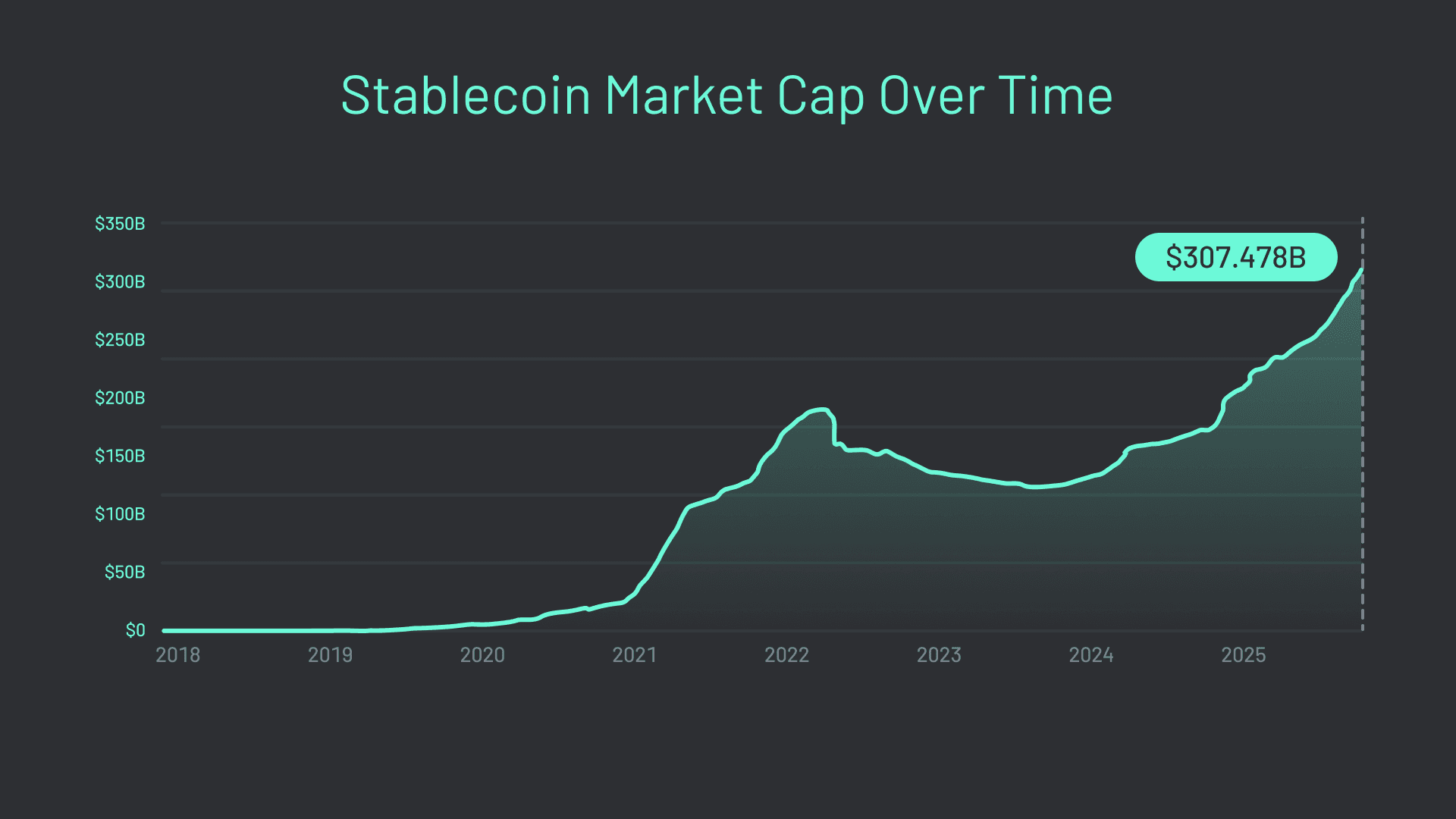

Sui’s edge lies in its scalable infrastructure, designed for high-throughput stablecoin operations. DeFi protocols thrive here, with TVL growth mirroring broader trends: the stablecoin market at $312 billion, eyeing $1.2 trillion by 2028. Daily addresses tripling competitors highlight user migration, drawn by low fees and speed.

This isn’t mere speculation. Empirical analyses, like those on Ethereum hosting 52% of global stablecoin supply, show payment usage patterns Sui now emulates at lower cost. As Q4 2025 saw $11 trillion in volumes alone, up from $8.8 trillion prior, Sui’s share positions it for outsized gains. Read more on recent peaks in Sui chain stablecoin inflows.

Sui (SUI) Price Prediction 2027-2032

Projections Based on 2132% YoY Stablecoin Flow Surge to $1.6T YTD in 2026 and DeFi Growth Trajectory

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $1.10 | $1.80 | $3.00 | +80% |

| 2028 | $1.50 | $2.70 | $5.00 | +50% |

| 2029 | $2.00 | $4.00 | $8.00 | +48% |

| 2030 | $2.50 | $6.00 | $12.00 | +50% |

| 2031 | $3.50 | $9.00 | $18.00 | +50% |

| 2032 | $5.00 | $13.00 | $25.00 | +44% |

Price Prediction Summary

Sui (SUI), currently at $0.97 as of early 2026, is set for robust growth fueled by explosive stablecoin adoption (2132% YoY surge to $1.6T YTD) and DeFi expansion. Projections reflect base-case average growth to $13 by 2032, with bullish maxima up to $25 assuming sustained market share gains, and bearish minima accounting for cycles and competition.

Key Factors Affecting Sui Price

- Explosive stablecoin flows (+2132% YoY to $1.6T YTD, targeting $2T by end-2026)

- Rising TVL ($2B+), daily volumes ($368M), and active users (1.8M DAAs)

- Scalable Move-based architecture outpacing competitors like Solana and TON

- Global stablecoin market expansion to $56T by 2030, Sui capturing larger share

- Potential regulatory tailwinds for DeFi/stablecoins post-2026 clarity

- Market cycles: Bullish adoption phase through 2028, possible correction in 2029

- Competition from ETH, Base, Tron; Sui’s edge in low-cost, high-throughput txns

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Looking ahead, these flows suggest Sui capturing meaningful slices of projected $56.6 trillion global stablecoin payments by 2030. Investors watching Sui DeFi stablecoin growth should note how macro liquidity cycles amplify such chains.

Sui’s ascent isn’t accidental; it’s engineered through innovations like its object-centric model, which sidesteps bottlenecks plaguing account-based chains. This allows seamless handling of Sui stablecoin transfer volume at peaks that would congest alternatives. As institutional interest grows, expect more bridges funneling liquidity from Ethereum and Base.

Protocols Powering the Surge

Cetus Protocol stands out, its concentrated liquidity model mirroring Uniswap V3 but optimized for Sui’s parallelism. Paired with Bluefin’s perpetuals exchange, they’ve captured the bulk of that $367.9 million daily volume. These aren’t fringe players; they’re magnets for stablecoin pairs like USDC-USDT, driving Sui DeFi stablecoin growth amid global volumes cresting $33 trillion last year.

Stablecoin Transfer Volumes YTD 2026: Sui vs. Competitors

| Blockchain | YTD Volume (USD) | YoY Growth % |

|---|---|---|

| Sui | $1.6T | +2,132% 🚀 |

| Ethereum | ~$10T (est.) | N/A |

| Solana | $2.5T | N/A |

| Base | $3T | N/A |

| Tron | $15T | N/A |

Yet challenges loom. Anomalies in Artemis data for Sui highlight the need for robust oracles and liquidity depth. Still, with SUI at $0.9670, holding its 24-hour range between $0.9557 and $0.9971, the network’s resilience shines through volatility.

Risks and Opportunities in 2026

For stablecoin inflows Sui 2026, projections hinge on regulatory clarity and macro tailwinds. If USDC maintains DeFi dominance over USDT’s market cap lead, Sui’s USDC-centric pools could swell. Base’s inflow crown might wane as Sui’s user base triples peers, but competition sharpens efficiency across ecosystems.

Top 5 Drivers for Sui’s $2T Flows

-

Scalable Object Model: Sui’s object-centric data model supports massive parallelism, enabling high throughput for stablecoin transactions and scalability to handle projected growth. Source

-

Cetus & Bluefin Volumes: These protocols drove $367.9M daily trading volume by Jan 2025, primarily via stablecoin pairs, boosting TVL to $2.065B. Source

-

USDC DeFi Preference: USDC dominates DeFi transaction flows, surpassing USDT in activity, aligning with Sui’s growing DeFi ecosystem.

-

Low Fees vs Ethereum: Sui’s sub-cent fees enable efficient stablecoin transfers, contrasting Ethereum’s higher costs and attracting volume.

-

Macro Liquidity Influx: Global stablecoin market projected to $1.2T by 2028, with Sui capturing share amid $56.6T payment flows by 2030. Source

I’ve tracked macro flows for years, and Sui’s trajectory echoes early Solana: undervalued speed meeting demand. Global stablecoin payments eyeing $56.6 trillion by 2030 offer ample room, with Sui’s TVL trajectory suggesting 5-10% capture if momentum holds.

Traders eyeing USDC Base vs Sui flows should weigh Sui’s parallel execution against Base’s Ethereum alignment. At current paces, Sui could redefine mid-cap chain viability, rewarding patient allocators as DeFi matures. With daily addresses surging and TVL firm at $2.065 billion levels, the network’s foundations feel solid for sustained expansion.

Monitoring these flows reveals broader DeFi maturation: stablecoins as the on-ramp for real utility, not just speculation. Sui, at $0.9670, embodies that shift, positioning investors for a multi-chain future where throughput trumps legacy.