Stablecoins have become the lifeblood of decentralized finance, providing a crucial bridge between traditional and onchain markets. Their steady value and deep liquidity are not only fueling trading but also transforming how yield farming opportunities emerge and evolve across DeFi protocols.

Stablecoin Flows: The Engine Behind Yield Farming

Yield farming, at its core, is about putting capital to work in DeFi protocols to earn returns. Stablecoins such as USDT, USDC, and DAI are now the preferred assets for these strategies because they combine price stability with high utility. As of early 2025, the total stablecoin market cap hovers between $250-260 billion, with over $220 billion from U. S. dollar-backed coins alone (source). This immense pool of capital continually flows into lending markets, liquidity pools, and staking contracts, each movement shaping the risk-reward profile for yield farmers.

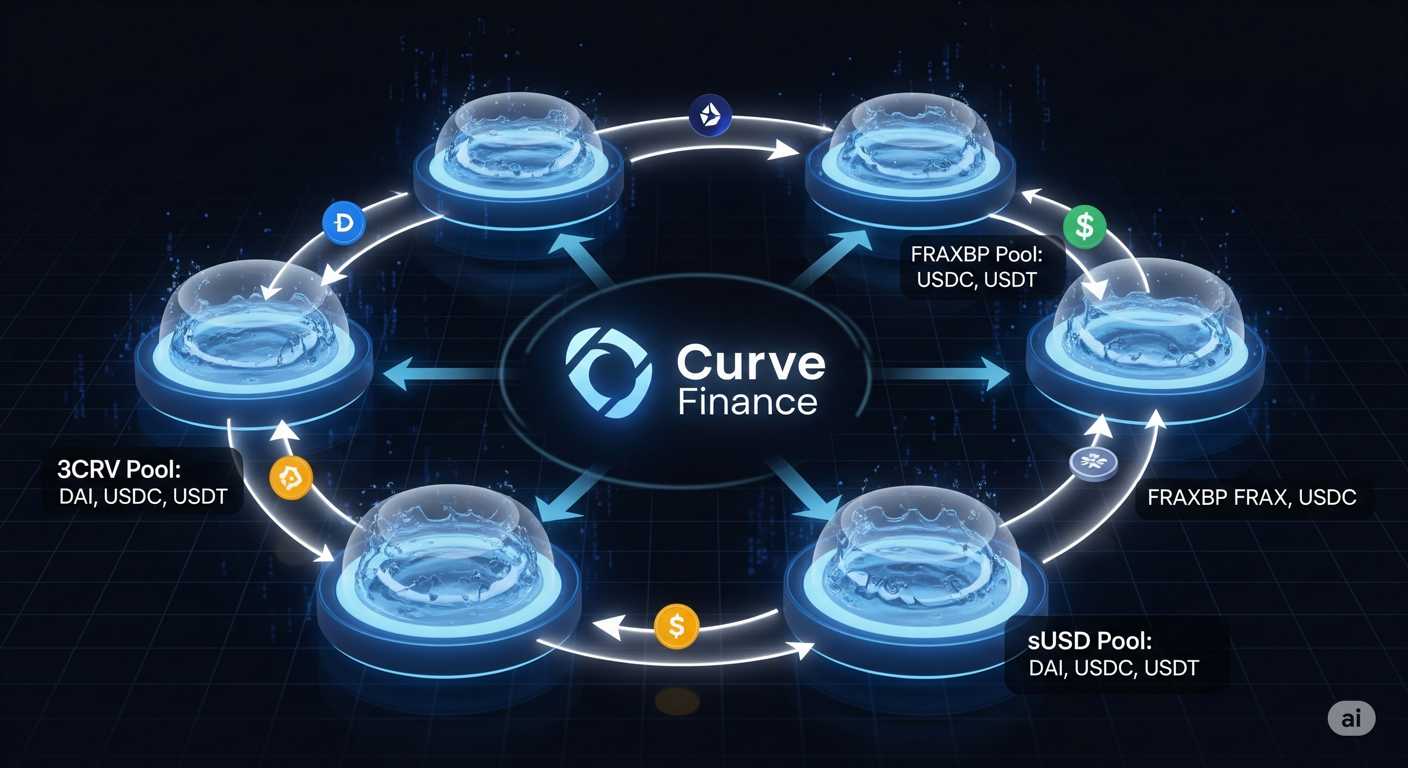

When stablecoins pour into DeFi platforms, they deepen liquidity pools on decentralized exchanges (DEXs) like Uniswap and Curve. This influx reduces slippage for traders and tightens bid-ask spreads, making markets more efficient. However, it also means that rewards, whether from trading fees or token incentives, are distributed among more participants, often driving yields lower as total value locked (TVL) rises.

Liquidity Depth vs. Yield Attractiveness: A Delicate Balance

The relationship between stablecoin flows and yield opportunities is dynamic. As new capital enters a protocol’s pools or lending markets, initial yields may spike due to low competition for rewards. But as more participants chase these returns by depositing their own stablecoins, the available rewards get diluted. This seesaw effect means that savvy yield farmers must monitor both TVL figures and stablecoin inflows to optimize their strategies.

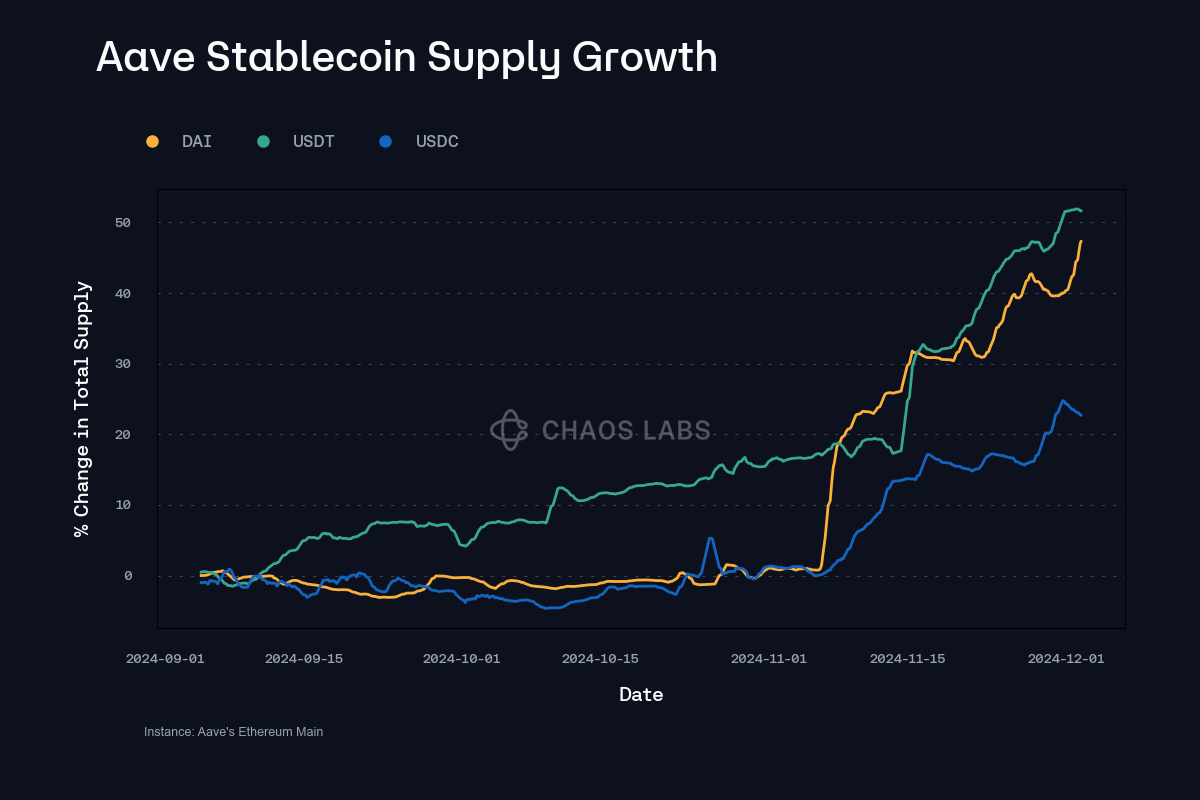

For example, lending platforms like Aave and Compound have reported stablecoin lending rates ranging from 2% to 10%, outpacing most short-term government securities (source). Yet these rates fluctuate based on supply and demand: a surge in deposits can quickly compress returns while an outflow may boost them again.

Key Ways Stablecoin Flows Impact DeFi Yield Farming

-

Enhanced Liquidity in DeFi Protocols: The influx of stablecoins like USDT, USDC, and DAI into DeFi platforms deepens liquidity pools, enabling more efficient trading and lending. As of early 2025, the stablecoin market cap was approximately $250-260 billion, with over $220 billion from U.S. dollar-backed coins, supporting higher protocol valuations. (TransFi)

-

Yield Generation through Lending and Staking: Stablecoins are widely used on lending platforms such as Aave and Compound, where users can earn yields typically ranging from 2% to 10% on their deposits. This offers a predictable income stream compared to more volatile crypto assets. (OpenMarketCap)

-

Participation in Liquidity Pools and Yield Farming: On decentralized exchanges like Uniswap and Curve, stablecoin pairs (e.g., USDC/DAI) are essential for facilitating token swaps. Liquidity providers earn a share of trading fees and may receive additional token incentives, making stablecoin-based yield farming attractive for those seeking stable returns. (DailyDive)

-

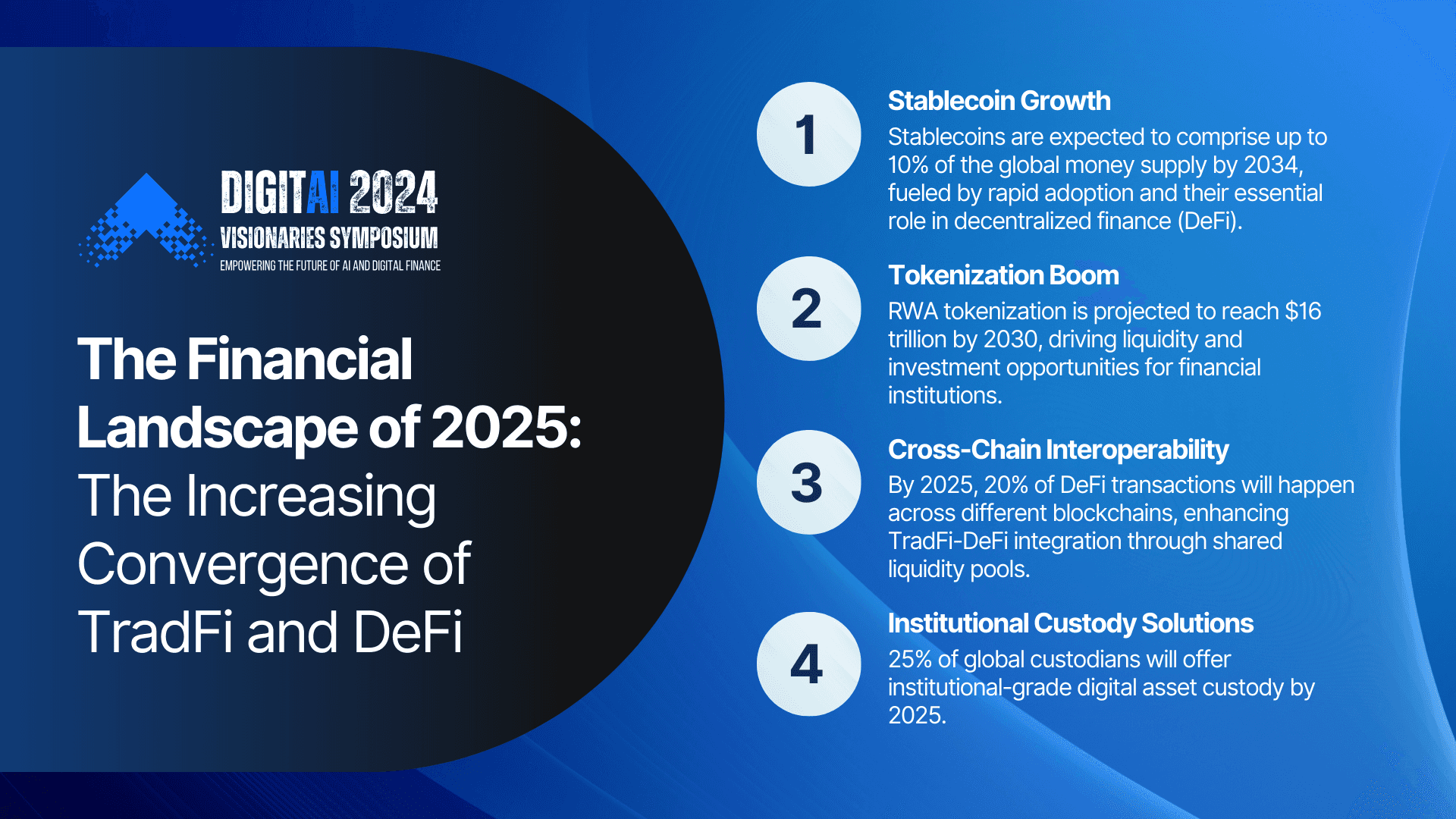

Bridging Traditional Finance (TradFi) and DeFi: Stablecoins act as a bridge between traditional finance and DeFi, allowing users to move capital seamlessly between centralized exchanges, DeFi protocols, and real-world asset platforms. This interoperability expands DeFi’s reach and adoption. (Mitosis University)

-

Risk Considerations: While stablecoin flows boost yield farming opportunities, they also introduce risks such as smart contract vulnerabilities, regulatory scrutiny, and potential depegging events. The TerraUSD collapse in 2022 underscored the systemic risks associated with some stablecoin designs, emphasizing the need for thorough due diligence. (Forbes)

The Rise of Institutional Capital in Stablecoin Yield Strategies

The maturation of DeFi has attracted institutional players who deploy substantial sums into stablecoin-based strategies seeking predictable yields. Their involvement brings both validation and new dynamics to the ecosystem. On one hand, large-scale deposits add stability to liquidity pools; on the other hand, their size can accelerate yield compression when flows surge rapidly.

This trend is underscored by recent data showing that institutions now account for a growing share of TVL in major protocols, a sign that DeFi’s transparent automation is winning over traditional capital allocators (source). As this capital rotates between platforms in search of optimal risk-adjusted returns, it further intensifies competition among retail farmers while raising the bar for protocol security and compliance standards.

At the same time, this influx of institutional capital is fostering a more mature and resilient DeFi landscape. Protocols are responding by enhancing their risk management frameworks, improving smart contract audits, and increasing transparency around reserves and governance. These developments are not only boosting confidence among larger investors but also benefiting retail participants by raising the overall security baseline across the sector.

Yet, as stablecoin flows continue to shape yield farming dynamics, participants must remain vigilant. The very features that make stablecoins desirable, liquidity, stability, and seamless interoperability, also attract sophisticated actors who can move large sums rapidly in and out of protocols. This can lead to sudden shifts in yields or even temporary liquidity crunches if major players exit en masse.

Navigating Risks: Security, Regulation, and Depegging Events

Despite the relative stability of major fiat-backed stablecoins like USDC and USDT, yield farmers must account for several persistent risks:

- Smart contract vulnerabilities: Even audited protocols can harbor bugs or loopholes that may be exploited.

- Regulatory uncertainty: As regulators increase their scrutiny of stablecoin issuers and DeFi platforms, new rules could impact how protocols operate or how yields are distributed.

- Depegging events: Although rare among leading stablecoins, algorithmic designs have shown susceptibility to loss of peg, most notably with TerraUSD in 2022, which can result in catastrophic losses for liquidity providers.

The collapse of TerraUSD continues to serve as a cautionary tale for both protocol designers and investors (source). As such, robust due diligence on both the underlying stablecoin mechanics and protocol security is essential before allocating capital to yield strategies.

Looking Ahead: Stablecoin Flows as a Barometer for DeFi Opportunity

Monitoring real-time stablecoin movement across protocols has become a key metric for assessing current and future DeFi yield opportunities. Platforms that track these flows provide valuable insight into where capital is concentrating, and where outsized returns may be fleeting or sustainable. For example, when USDC deposits spike on a lending platform but yields quickly compress from 10% to 4%, it signals both intense competition for returns and robust market participation.

This dynamic environment rewards those who stay informed about liquidity trends, protocol upgrades, and macroeconomic shifts affecting stablecoin demand. With over $250-260 billion in market cap, and more than $220 billion from U. S. dollar-backed coins, the scale of these flows now rivals some traditional financial markets (source). As adoption deepens, expect further innovation in how yields are generated, from composable vault strategies to cross-chain arbitrage, each influenced by the ebb and flow of stablecoins through DeFi’s digital arteries.

The bottom line: Stablecoin flows remain the engine behind both opportunity and competition in DeFi yield farming. By understanding this interplay, and leveraging up-to-date analytics, investors can position themselves to capture sustainable returns while navigating evolving risks in an increasingly institutionalized sector.