Stablecoins have always promised the best of both worlds: monetary stability and blockchain-native flexibility. But until recently, even the most popular stablecoins like USDT were hamstrung by high transaction fees, fragmented liquidity, and clunky cross-chain transfers. Enter the new breed of Stable Layer 1 blockchains: purpose-built for stablecoins and designed to break these barriers wide open.

Stable Layer 1 Chains: The Next Evolution in DeFi Infrastructure

The launch of Stable, a high-throughput, EVM-compatible Layer 1 blockchain built exclusively for USDT, marks a seismic shift in how stablecoin transactions are executed. Unlike general-purpose chains, Stable is optimized for speed, scalability, and cost-efficiency, enabling gas-free transfers and sub-second settlements. This isn’t just a technical upgrade; it’s a reimagining of what stablecoin rails can be.

What makes Stable truly stand out is its embrace of USDT0, an omnichain version of Tether’s USDT leveraging LayerZero’s OFT (Omnichain Fungible Token) standard. Instead of relying on wrapped tokens or risky bridges, USDT0 locks native USDT on Ethereum and mints an equivalent amount on supported chains like Arbitrum, Optimism, Polygon, Unichain, and Berachain. The result? Seamless cross-chain swaps with zero friction, and no more liquidity silos.

USDT0: The Omnichain Stablecoin Powering Cross-Chain Liquidity

The impact is already tangible. USDT0 has smashed through a $25 billion cross-chain volume milestone as of October 6,2025, proving that unified liquidity isn’t just possible, it’s thriving. By consolidating stablecoin capital into one interoperable asset across multiple blockchains, USDT0 is solving two critical pain points:

- No more fragmented liquidity: Capital moves freely between ecosystems without being trapped or exposed to bridge risk.

- Lower transaction costs: Gas-free transfers enabled by EIP-7702 and Account Abstraction eliminate fee volatility, a game-changer for both retail users and institutional flows.

This new model is particularly attractive to large-volume traders and DeFi protocols that demand instant settlement and deep liquidity pools. Platforms like OKX have already integrated USDT0 across their Ethereum L2 network (X Layer), wallet, and exchange products, making deposits, withdrawals, and transfers seamless across all supported networks.

Key Advantages of Stable Layer 1 Chains for Stablecoin Adoption

-

Omnichain USDT0 Integration: USDT0 enables seamless, native transfers of Tether (USDT) across major blockchains like Ethereum, Arbitrum, Optimism, Polygon, Unichain, and Berachain, eliminating the need for wrapped tokens or complex bridges.

-

Unified Cross-Chain Liquidity: By consolidating liquidity into a single, interoperable asset, Stable Layer 1 chains reduce fragmentation and support efficient, high-volume stablecoin transactions—demonstrated by USDT0’s $25 billion cross-chain volume milestone as of October 2025.

-

Gas-Free and Sub-Second Transfers: Leveraging EIP-7702 and Account Abstraction, Stable Layer 1 chains like Stable offer gas-free USDT0 transfers and sub-second transaction finality, making stablecoin payments fast and cost-effective.

-

Purpose-Built for USDT: Stable is the first blockchain designed exclusively for stablecoins and optimized for USDT, providing tailored features such as free transfers, scalability, and payment-focused infrastructure.

-

Major Exchange and Platform Support: Leading platforms like OKX and Nami Exchange have integrated USDT0, enabling users to deposit, withdraw, and transfer stablecoins seamlessly across supported networks, further boosting adoption and utility.

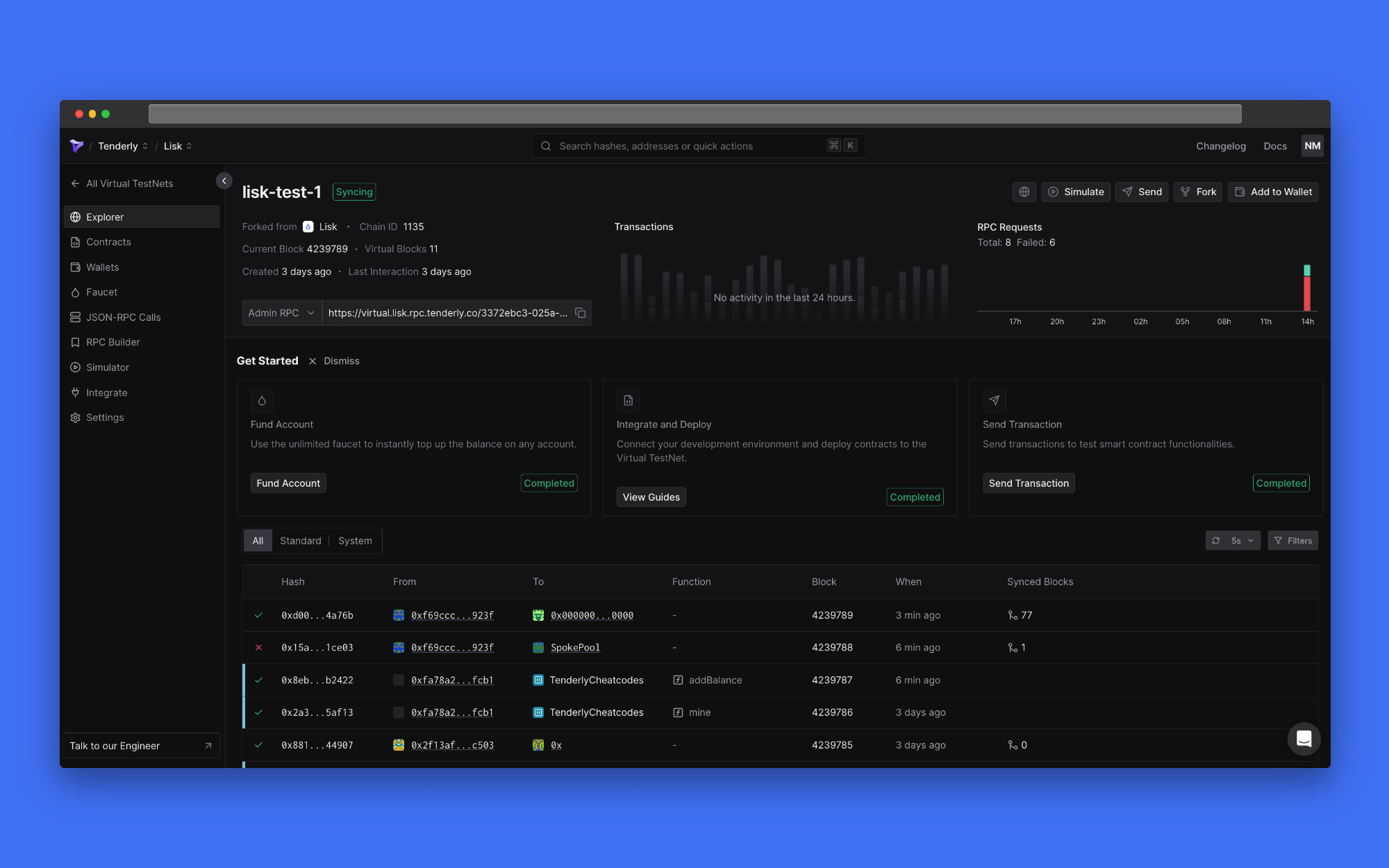

EIP-7702 and Account Abstraction: Unlocking Gas-Free Stablecoin Transfers

A major unlock behind this transformation is the integration of EIP-7702 alongside Account Abstraction. These technologies allow users to pay gas fees directly in stablecoins, removing one of the last frictions in everyday crypto payments. On the Stable chain specifically, all P2P transactions can be conducted gas-free using USDT0 as the primary token. This not only streamlines user experience but also positions stablecoins as true digital cash within DeFi ecosystems.

The implications are massive for institutional use cases where predictability in costs is paramount. With over $3 billion in monthly volume now facilitated by gas-free stablecoin rails on networks like Polygon (see Bitget’s report), we’re witnessing a rapid acceleration in real-world adoption.

“Stable isn’t just another chain, it’s digital nation-building for the world’s most used digital dollar. ”

With these innovations, the stablecoin landscape is no longer just about issuing tokens, it’s about building robust, interoperable DeFi infrastructure that can handle institutional scale and everyday payments alike. As more exchanges and wallets support USDT0, the barriers between blockchains are dissolving, making it easier than ever for users to move capital wherever opportunity knocks.

Security is also getting a major upgrade. By eliminating reliance on wrapped assets and third-party bridges, USDT0 sharply reduces the vectors for exploits and rug pulls that have plagued cross-chain DeFi in the past. Instead, users get native 1: 1-backed stablecoins across every supported chain, no compromises, no hidden risks.

Stablecoin Adoption: From Retail Payments to Institutional Flows

The ripple effects of this new paradigm are already being felt across the crypto economy. Retail users enjoy instant, gas-free payments that feel more like Venmo than traditional blockchain transfers. For institutions, unified liquidity means they can deploy capital efficiently across multiple chains without worrying about fragmented pools or unpredictable fees.

And it’s not just speculation fueling this growth. Payment processors, on/off ramps, and even payroll platforms are starting to leverage omnichain stablecoins like USDT0 for real-world use cases, from paying remote workers to settling global invoices in seconds. The playbook is changing fast: what used to take hours and cost dollars now happens in real time for pennies, or literally nothing in gas fees.

The integration of Stable Layer 1 blockchain technology with EIP-7702 is setting a powerful precedent for future DeFi protocols. Expect copycats and competitors to emerge, but for now, Stable’s head start is undeniable.

What’s Next? The Roadmap for Omnichain Stablecoins

With $25 billion in cross-chain volume already processed by USDT0 as of October 6,2025, the market has validated this model at scale. But we’re only scratching the surface:

- Bigger institutional flows: As regulatory clarity improves and onchain accounting tools mature, expect pension funds and fintech giants to enter the fray.

- Programmable payments: Smart contract automations will enable everything from recurring salaries to streaming payments, all denominated in omnichain stablecoins.

- Global remittances: Frictionless cross-border transfers could finally become a reality for millions who rely on stablecoins as lifelines.

The bottom line? Stable Layer 1 chains like Stable aren’t just an incremental upgrade, they’re rewriting the rules of capital movement in crypto. Whether you’re trading size or just sending your first digital dollar overseas, omnichain stablecoins powered by purpose-built infrastructure are turning friction into flow, and opening up a new era of borderless finance.