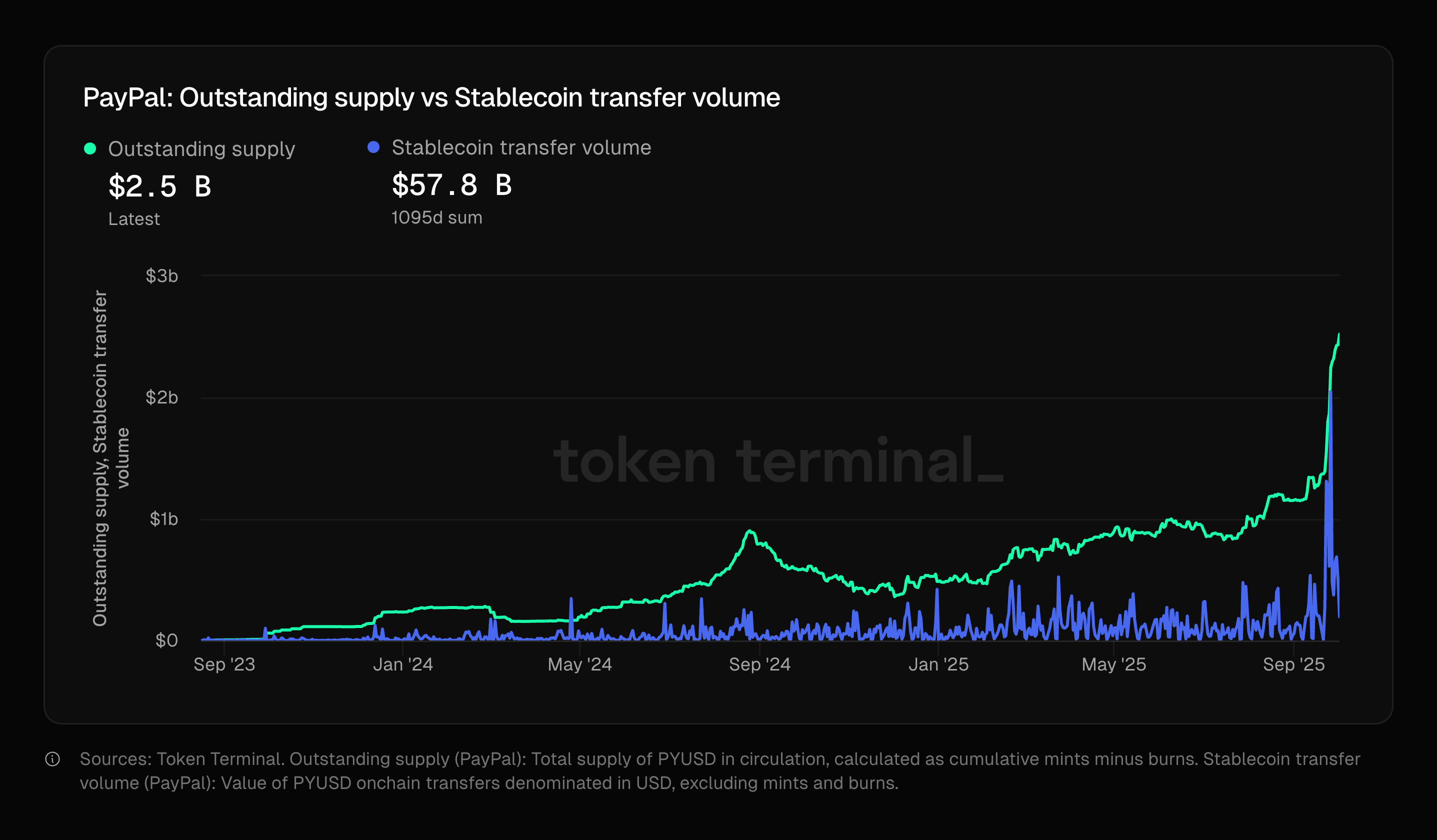

Understanding the flow of stablecoins like USDC on emerging blockchains is crucial for any crypto investor aiming to stay ahead in DeFi. The Base chain, in particular, has rapidly ascended as a dominant venue for USDC transactions, reshaping the landscape of stablecoin analytics and real-time tracking. As of October 2025, Base processed nearly $15 billion in USDC transfers in a single day and over $100 billion throughout October 2024, capturing an impressive 36% share of all USDC transfers during that period. This extraordinary activity highlights the growing importance of monitoring USDC Base flows to identify market trends and capitalize on new opportunities.

Base Chain’s Meteoric Rise: By the Numbers

The explosive growth of USDC on Base is not just anecdotal – it’s backed by robust data. In June 2024, the supply of USDC on Base surged by over 1,000% within just three months. By October 2024, the total value of stablecoins on Base reached $3.771 billion, marking a staggering 1,082.13% increase from March 2024 (source). This rapid inflow signals both heightened user adoption and growing trust among institutional and retail participants.

Key partnerships have further accelerated this momentum. Circle’s native support for USDC on Base since September 2023 eliminated the need for bridging solutions, while Coinbase’s integration with Stripe streamlined global payment rails using USDC (source). These moves have positioned Base as a go-to layer for efficient cross-border transactions and DeFi liquidity.

Why Real-Time Stablecoin Tracking Matters

For crypto investors and analysts, tracking real-time USDC flows provides actionable intelligence:

Why Real-Time Stablecoin Tracking Matters for Investors

-

Detects Large-Scale Fund Movements: Real-time tracking of USDC flows on Base allows investors to spot significant transfers, such as the $15 billion in USDC moved in a single day in October 2024, signaling shifts in market sentiment or institutional activity.

-

Monitors Supply Growth and Market Share: By observing the 1,000%+ increase in USDC supply on Base over 90 days (as of June 2024), investors can identify which platforms are gaining traction and potentially uncover emerging opportunities.

-

Enhances Transparency and Risk Assessment: Tools like Crystal Intelligence and DefiLlama provide real-time data on mint/burn ratios, exchange distribution, and off-peg events, empowering investors to assess liquidity risks and market stability.

-

Tracks Cross-Chain and International Flows: Real-time explorers such as Range’s USDC Explorer and IMF analytics enable investors to follow USDC movements across chains and regions, offering insight into global capital flows and regulatory impacts.

Platforms like Crystal Intelligence allow users to monitor mint/burn ratios, exchange distribution patterns, transfer volumes, user retention metrics, and regulatory shifts across major stablecoins (source). Meanwhile, tools such as DefiLlama offer comprehensive dashboards detailing circulating supply, inflows/outflows by chain, price stability metrics, and more – all vital for evaluating market health and risk.

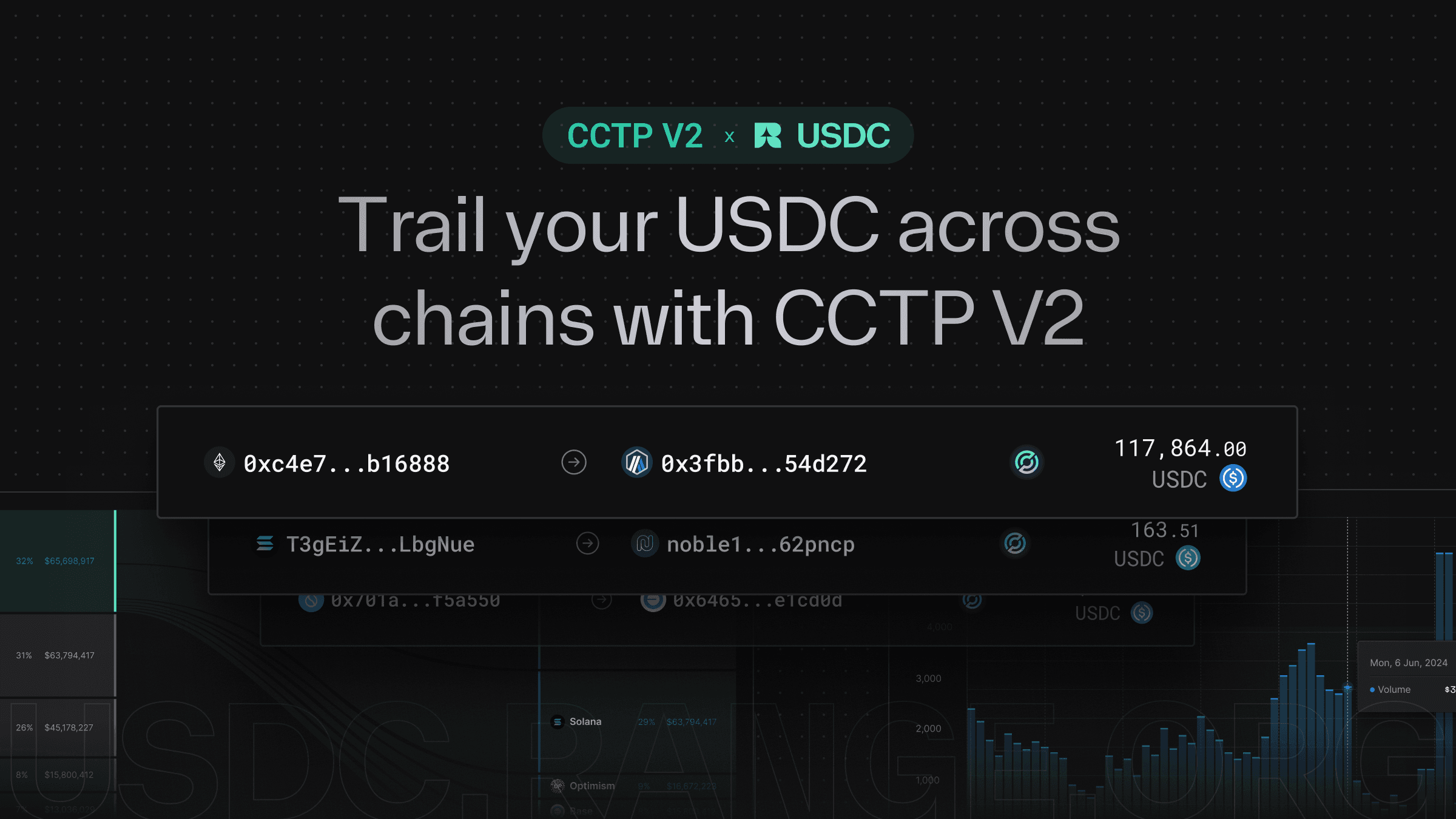

On-chain explorers dedicated to USDC – including those supporting Circle’s CCTP v2 – have made it easier than ever to verify balances or audit transaction histories (source). These resources not only enhance transparency but also empower users to make informed decisions based on up-to-the-minute data.

USDC Flows as a Pulse Check for DeFi Market Trends

The magnitude and direction of net stablecoin flows serve as a barometer for broader DeFi sentiment. When investors move large amounts of USDC onto platforms like Base during periods of high activity (such as October 2024), it often signals growing confidence in that ecosystem or anticipation of new opportunities (e. g. , yield farming launches or protocol upgrades).

Conversely, sustained outflows can be indicative of profit-taking or risk-off behavior triggered by macroeconomic factors or regulatory developments. By leveraging real-time analytics from sources such as MEXC Blog or Visa Onchain Analytics Dashboard – which track settlement volumes around the clock – investors can contextualize these movements within their broader portfolio strategies.

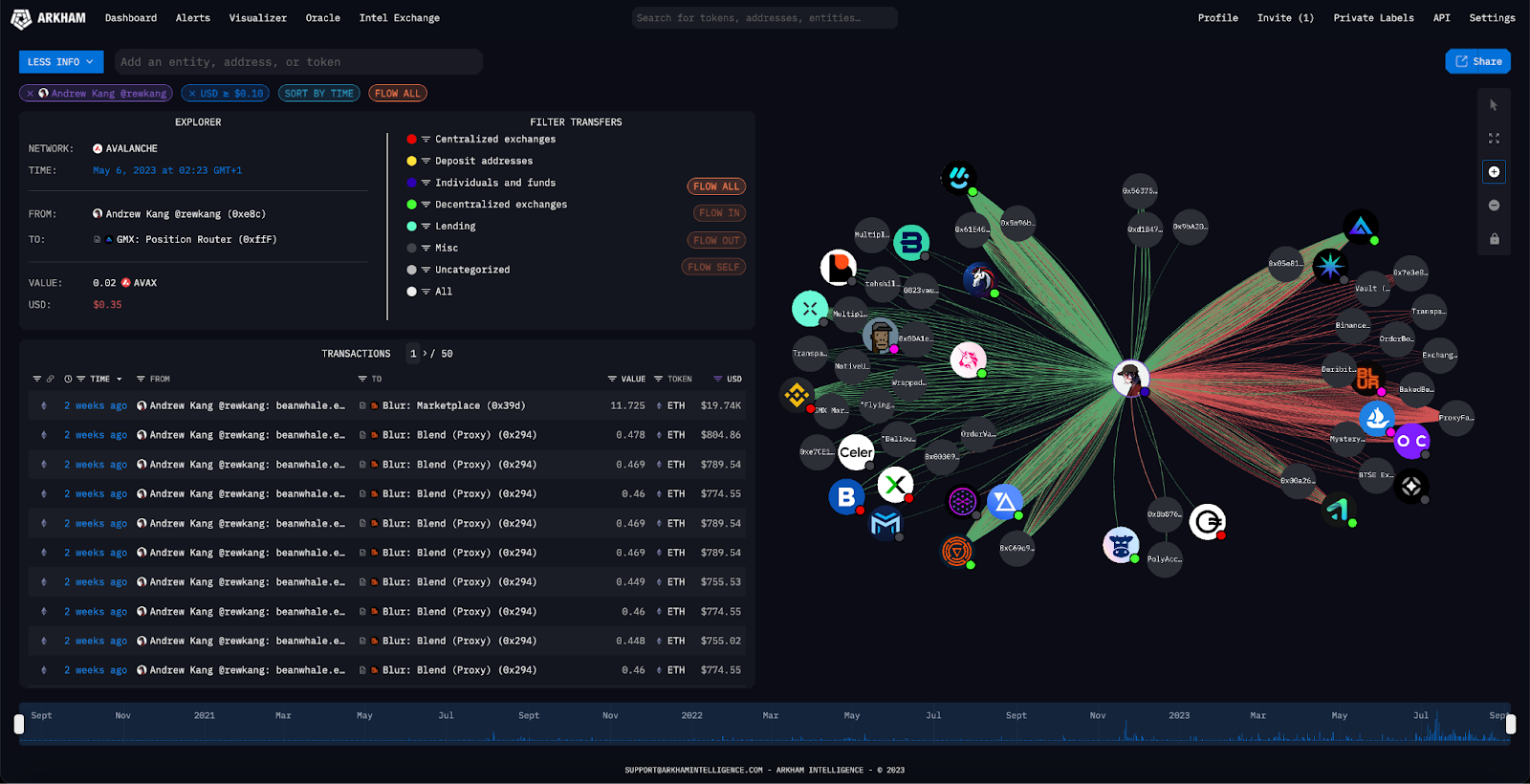

For those seeking a competitive edge, integrating real-time USDC Base flows into your analysis toolkit is no longer optional, it’s essential. The velocity and volume of these flows can reveal liquidity crunches, whale activity, or sudden shifts in user demand before they manifest in price action. For instance, monitoring sharp inflows on Base during a protocol upgrade may signal an imminent surge in DeFi activity, while abrupt outflows could foreshadow market turbulence.

Institutional players are increasingly leveraging these analytics to inform everything from treasury management to algorithmic trading strategies. Retail investors, too, benefit from the transparency and granularity offered by modern stablecoin tracking tools. Whether you’re assessing risk exposure or scouting for arbitrage opportunities between chains, granular flow data provides critical context that simple price charts cannot.

Tools Every Crypto Investor Should Use

The proliferation of USDC across multiple blockchains has spurred innovation among analytics providers. Here are core resources investors should consider:

Top Platforms for Tracking USDC Flows on Base

-

Crystal Intelligence: Offers in-depth analytics on USDC and USDT flows, including mint/burn ratios, exchange distribution, transfer volumes, cross-chain movements, and regulatory trends. Essential for monitoring real-time USDC activity across major blockchains, including Base.

-

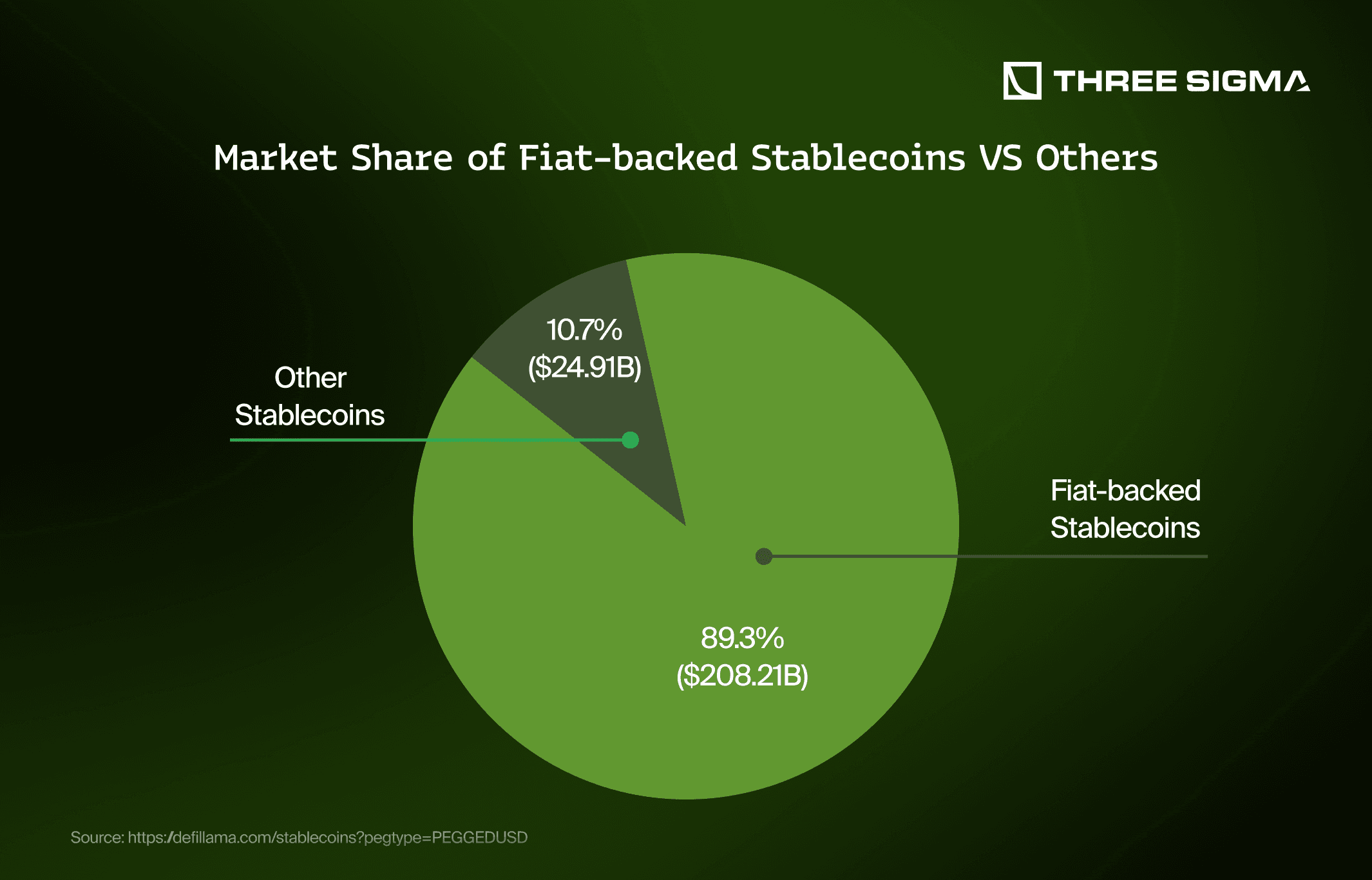

DefiLlama Stablecoins Dashboard: Provides comprehensive data on stablecoin market caps, supply, inflows, and price stability. The platform tracks USDC supply growth on Base, which reached $3.771 billion in October 2024, up 1,082.13% since March 2024.

-

Range.org USDC Explorer: Specializes in tracking cross-chain USDC transfers via Circle’s CCTP, now supporting CCTP v2. Ideal for following USDC movements between Base and other supported chains in real time.

-

Base Explorer: The official blockchain explorer for the Base chain, providing detailed USDC token analytics—including price, total supply, holders, and transaction history—crucial for transparency and on-chain verification.

-

Etherscan (Base Integration): Renowned for its user-friendly interface, Etherscan allows users to track USDC transactions on the Base chain, verify balances, and explore historical transfer data.

-

Visa Onchain Analytics Dashboard: Delivers macro-level insights into stablecoin transaction volumes and settlement flows, helping investors assess USDC’s role in 24/7 global payments, including activity on Base.

-

Coinbase Analytics: As a key partner in the Base ecosystem, Coinbase provides institutional-grade analytics on USDC usage, exchange flows, and transaction patterns, supporting in-depth research for investors.

These platforms allow users to drill down into specific metrics, such as cross-chain transfers via Circle’s CCTP v2 (source), or exchange-level distribution patterns using Crystal Intelligence (source). DefiLlama’s Stablecoin Chains dashboard is particularly valuable for identifying which networks are gaining or losing dominance in real time.

For hands-on analysis, blockchain explorers tailored to USDC on Base offer transaction-level detail. Users can track wallet movements, verify contract interactions, and even monitor the impact of major announcements or macro events on stablecoin flow patterns. This level of transparency is foundational for both compliance and strategic planning.

Looking Ahead: The Future of Stablecoin Analytics

The exponential growth of USDC on Base suggests that the stablecoin’s role as a settlement and liquidity layer will only deepen in coming years. As adoption accelerates, driven by seamless integrations with payment giants like Stripe and robust native support from Circle, the need for sophisticated analytics will become even more pronounced.

Emerging trends such as real-time risk scoring, automated compliance checks, and AI-powered anomaly detection are poised to further enhance investor confidence and market efficiency. For now, diligent monitoring of USDC Base flows remains one of the most reliable ways to gauge DeFi market sentiment, and capitalize on new opportunities as they arise.