The institutional stablecoin landscape has undergone a seismic shift in 2025, catalyzed by the dual engines of regulatory clarity: the U. S. GENIUS Act and the European Union’s MiCA framework. For years, stablecoins hovered at the periphery of mainstream finance, stymied by regulatory ambiguity and fragmented oversight. This year marks a decisive turning point as both the United States and Europe move to legitimize and structure stablecoin adoption, opening the floodgates for institutional participation.

GENIUS Act: The U. S. Blueprint for Institutional Stablecoin Adoption

Passed in July 2025 after years of congressional debate, the GENIUS Act is now the cornerstone of American stablecoin regulation. At its core, the act mandates that all payment stablecoins be backed by 1: 1 reserves of highly liquid assets, prohibits interest payments to holders, and enforces rigorous risk controls for issuers. This clarity has finally given U. S. institutions, from banks to payment processors, a green light to integrate stablecoins into their operations without fear of regulatory whiplash.

The impact is already visible. Visa’s recent pilot program leverages compliant stablecoins for cross-border settlements, dramatically reducing transaction times and eliminating the need for businesses to maintain costly multi-currency reserves (source). Meanwhile, Tether’s announcement of a new U. S. -based stablecoin (USAT), purpose-built to align with GENIUS requirements, signals that even legacy crypto players are pivoting toward regulatory adherence (source).

This isn’t just about compliance; it’s about unlocking scale. By embedding stablecoin issuance within the banking system itself (as highlighted by recent academic analysis), GENIUS effectively transforms stablecoins from fringe fintech tools into core financial infrastructure.

MiCA: Europe’s Unified Approach to Digital Asset Regulation

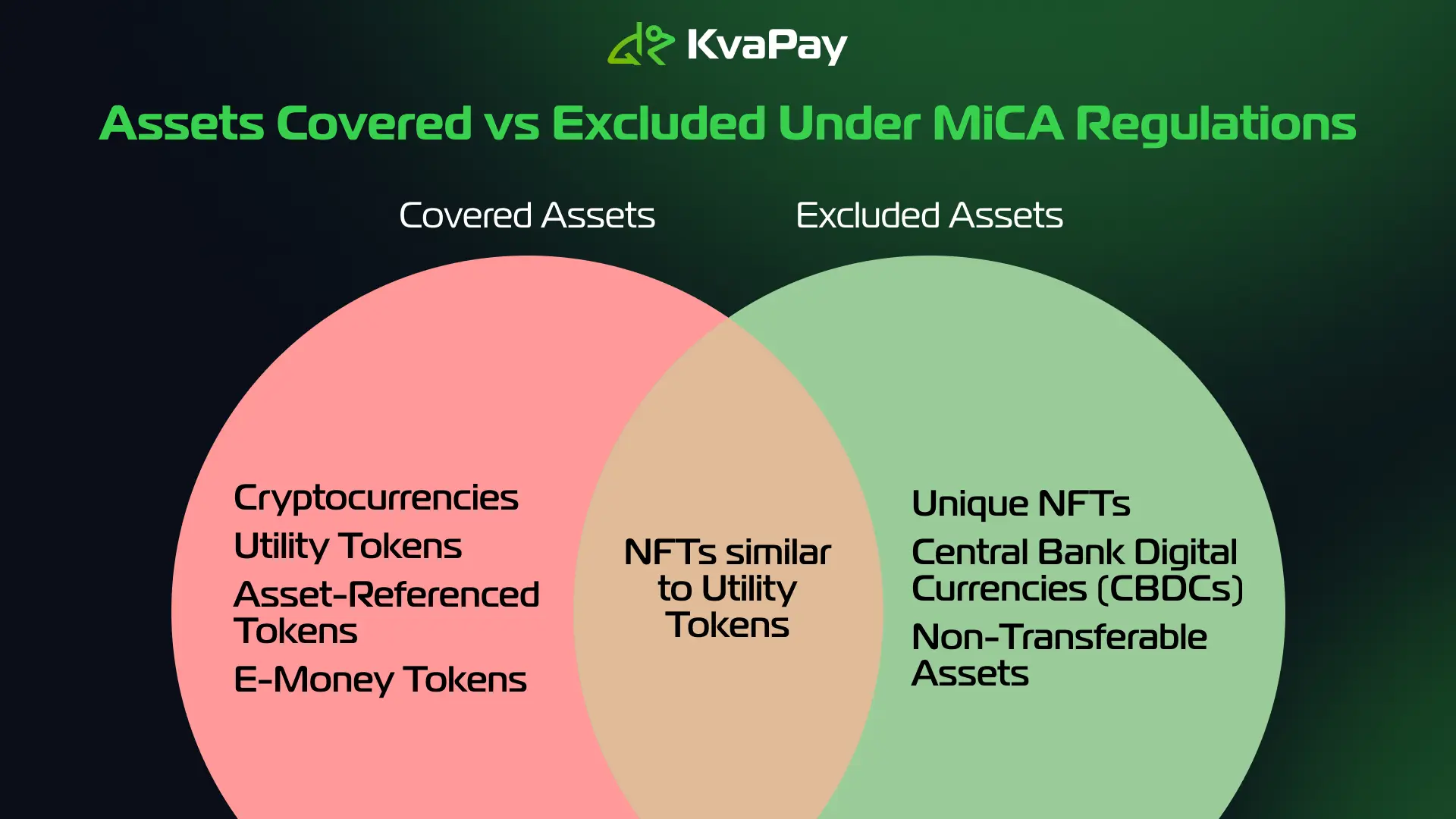

If the U. S. is setting standards for dollar-backed coins, Europe is writing its own playbook with MiCA, implemented across EU member states since December 2024. MiCA distinguishes between E-Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs), providing clear categories for issuers and users alike. This harmonized approach has energized euro-denominated stablecoin development; nine major European banks are collaborating on a MiCA-compliant EMT designed to challenge dollar dominance (source).

The results are striking: European usage now accounts for 34% of global stablecoin activity in 2025, up from just 16% last year (source). For multinational corporations and asset managers operating across borders, this means a single set of rules, not twenty-seven different regimes, enabling seamless integration of euro-based digital assets into treasury operations.

Key Differences: GENIUS Act vs MiCA in Institutional Stablecoin Adoption

-

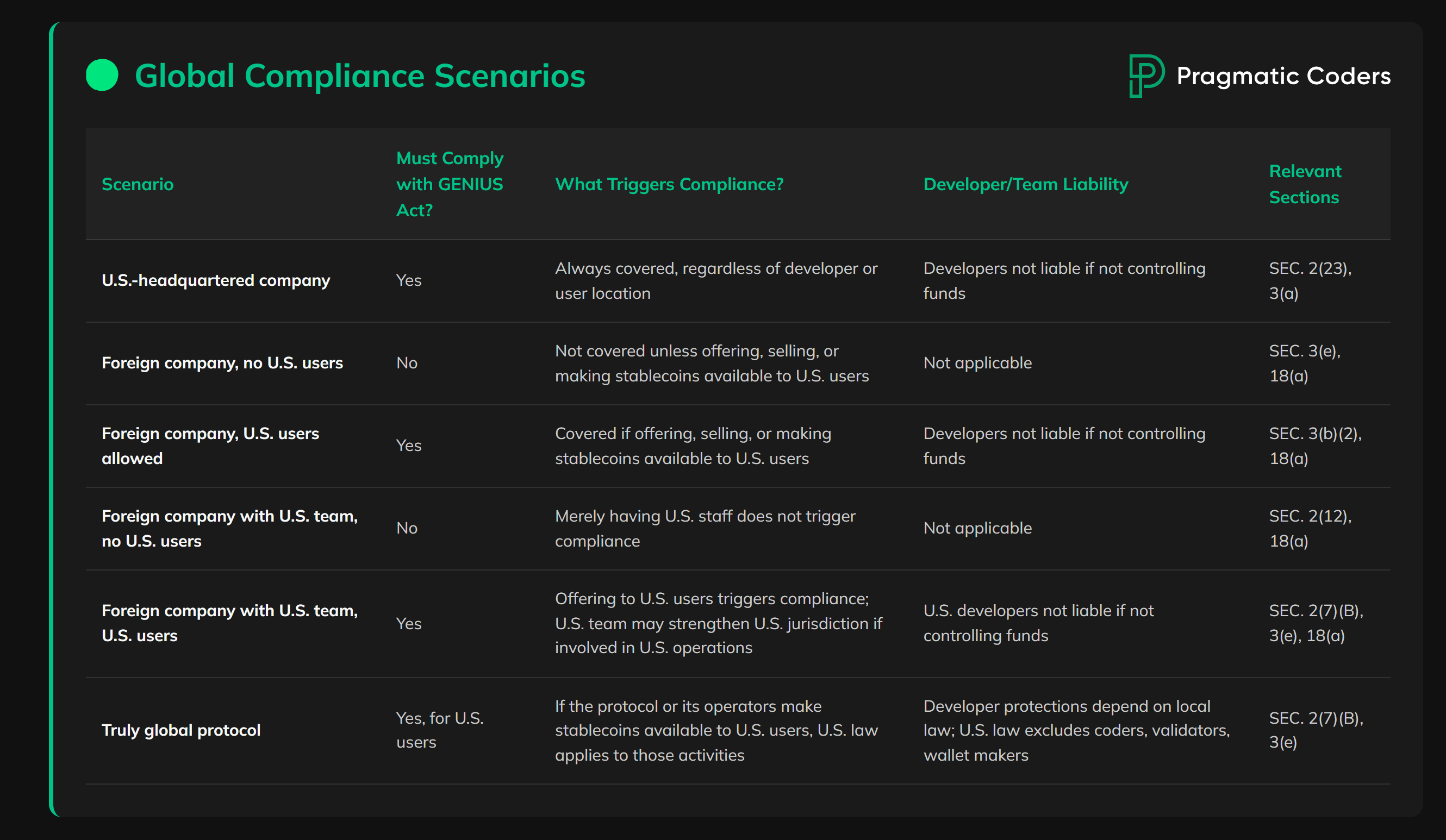

Regulatory Scope and Jurisdiction: The GENIUS Act is a comprehensive federal law governing payment stablecoins across the United States, while MiCA (Markets in Crypto-Assets Regulation) provides a unified framework for all EU member states. This distinction shapes how institutions approach cross-border operations and compliance.

-

Stablecoin Reserve Requirements: The GENIUS Act mandates 1:1 reserves of highly liquid assets for all payment stablecoins, ensuring full backing and prohibiting interest payments to holders. MiCA requires robust reserve standards for E-Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs), but allows some flexibility in asset composition and interest policies.

-

Institutional Integration and Market Impact: The GENIUS Act has led to major U.S. institutions like Visa piloting stablecoin-based cross-border payments, and Tether launching the U.S.-compliant USAT stablecoin. Under MiCA, a consortium of nine European banks is developing a MiCA-compliant euro stablecoin, driving euro-denominated stablecoin growth and increasing the EU’s global stablecoin market share from 16% in 2024 to 34% in 2025.

-

Cross-Border Access and Licensing: Under MiCA, non-EU stablecoin issuers (including those authorized under the GENIUS Act) must establish a separate EU entity to operate within the EU. The GENIUS Act does not grant reciprocal access to U.S. markets for EU issuers, requiring distinct compliance strategies for institutions operating transatlantically.

-

Regulatory Clarity and Institutional Confidence: The GENIUS Act provides explicit definitions, reserve rules, and consumer protections for U.S. payment stablecoins, offering regulatory certainty that has accelerated institutional adoption. MiCA delivers similar clarity for the EU, categorizing stablecoins and setting clear issuer obligations, which has spurred innovation and mainstream adoption among European financial institutions.

The New Era: Stablecoins as Core Corporate Infrastructure

This convergence between regulatory certainty and technical innovation is transforming how institutions perceive, and use, stablecoins:

- Treasury Optimization: Corporates can now deploy dollar or euro-pegged tokens as working capital without legal ambiguity.

- Global Settlement Networks: Payment giants like Visa are building multi-currency rails using regulated coins.

- Banks as Issuers: Traditional banks are no longer sidelined; under GENIUS and MiCA, they’re actively launching their own compliant tokens.

- Risk Management: With enforced reserve requirements and transparent audits, counterparty risk is dramatically reduced versus prior years.

The result? Stablecoins are shifting from speculative crypto assets to foundational instruments underpinning global trade, payrolls, settlements, and liquidity management strategies.

These regulatory shifts have also fueled a wave of new product development and partnerships. Asset managers are rolling out stablecoin-denominated money market funds, while fintechs are embedding stablecoins into B2B payments and supply chain finance platforms. The transformation is not limited to established players: startups are leveraging regulatory clarity to pilot programmable payments, real-time FX hedging, and on-chain cash management, all with compliance built in from day one.

Yet the GENIUS Act and MiCA frameworks aren’t without friction. Cross-border interoperability remains a challenge, particularly as U. S. issuers authorized under GENIUS cannot directly access EU markets without establishing local entities (source). This has led to a bifurcation of the market, with some global institutions opting for dual licensing or strategic alliances to bridge regulatory gaps. For multinational treasurers, the upside is clear: standardized compliance means faster onboarding and lower legal risk, but operational complexity persists until true passporting or mutual recognition emerges.

Looking Ahead: The Strategic Impact for Institutions in 2025 and Beyond

The numbers speak volumes. In 2025, institutional stablecoin flows have reached all-time highs, with U. S. bank-issued coins accounting for nearly half of on-chain settlement volume in North America (source). Meanwhile, euro EMTs are gaining traction as preferred rails for pan-European payroll and trade finance.

What does this mean for corporate strategy? First, CFOs and treasury teams must update risk frameworks to account for new forms of digital liquidity, and the operational nuances between GENIUS Act stablecoins versus MiCA tokens. Second, competitive advantage will accrue to those who can seamlessly switch between dollar- and euro-denominated rails as market conditions dictate. Third, technology partners matter more than ever; integration with compliant issuers and custodians is now table stakes.

Strategic Moves for Institutions Embracing GENIUS Act & MiCA Stablecoins

-

Establish Regulatory-Compliant Stablecoin Operations: Set up dedicated teams to ensure all stablecoin activities adhere to the GENIUS Act in the U.S. and MiCA in the EU. This includes maintaining 1:1 reserves of highly liquid assets and implementing robust consumer protection protocols as required by both regulations.

-

Partner with Established Payment Networks: Collaborate with major networks like Visa, which has launched a pilot program using stablecoins for international payments. Leveraging these partnerships can streamline cross-border transactions and reduce the need to hold multiple currency reserves.

-

Launch or Integrate MiCA-Compliant Euro Stablecoins: Engage with the consortium of nine major European banks developing a MiCA-compliant euro-denominated E-Money Token (EMT). This strategic move enables access to a growing segment, as euro stablecoin usage in Europe has doubled to 34% of global activity in 2025.

-

Develop Multi-Jurisdictional Legal Entities: To access both U.S. and EU stablecoin markets, establish separate legal entities compliant with GENIUS Act and MiCA requirements. This is essential since U.S.-based issuers cannot directly access EU markets without an EU entity.

-

Integrate GENIUS Act-Compliant Stablecoins into Treasury Management: Adopt stablecoins like the upcoming Tether USAT—designed to comply with the GENIUS Act—for efficient internal settlements, liquidity management, and on-chain cash operations.

-

Enhance Risk Management and Audit Capabilities: Implement real-time monitoring and independent audits to meet the strict reserve and transparency requirements of both GENIUS Act and MiCA. This builds institutional trust and satisfies regulatory obligations.

For crypto investors and DeFi builders, these developments mark an inflection point: regulatory clarity is no longer a distant hope but an actionable reality. As more blue-chip corporates embrace stablecoins for everyday operations, not just speculative trading, the asset class is poised to become a backbone of global commerce.

The coming quarters will test just how adaptive legacy systems can be when confronted by programmable money that settles in seconds rather than days. But one thing is clear: in 2025’s regulated landscape, institutional adoption of stablecoins isn’t just accelerating, it’s becoming inevitable.