Yield-bearing stablecoins have rapidly become a cornerstone of the DeFi landscape in 2024, offering a pragmatic solution for investors seeking both capital stability and passive income. As DeFi protocols mature and real-world assets (RWAs) are increasingly integrated on-chain, these stablecoins are embedding yield directly into their design through staking, arbitrage, and protocol-native rewards. In this article, we examine the top five yield-bearing stablecoins by market capitalization and innovation: Ethena sUSDe, FalconStable USDf, Frax Finance sfrxUSD, Ondo Finance USDY, and Curve Finance crvUSD. Each of these tokens demonstrates a unique approach to generating sustainable yield while maintaining a 1: 1 peg to the US dollar.

Why Yield-Bearing Stablecoins Dominate DeFi in 2024

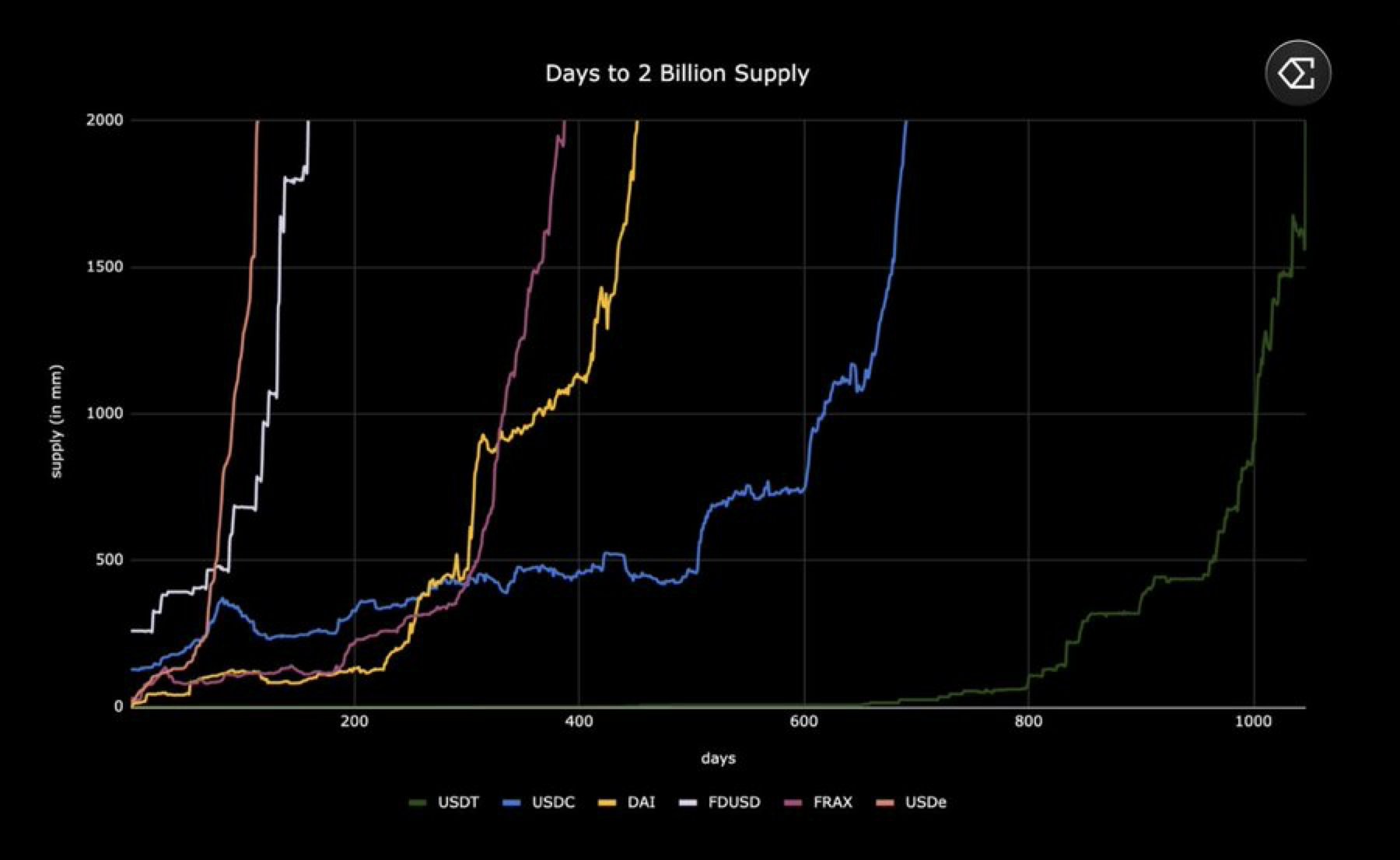

The total addressable market for stablecoins has ballooned past $200 billion in 2024, but the key differentiator now is yield generation. Traditional stablecoins like USDC or USDT offer stability but little to no return. In contrast, yield-bearing variants combine price stability with real returns, often exceeding those available in TradFi money markets. Investors can park capital in these assets to earn APYs ranging from 3% to over 15%, depending on risk exposure and underlying mechanisms. This convergence of TradFi yields and DeFi composability is fueling adoption across both retail and institutional segments.

Top Yield-Bearing Stablecoins: Mechanisms and Market Position

Top 5 Yield-Bearing Stablecoins in DeFi (2024)

-

Ethena sUSDe: sUSDe is a synthetic stablecoin from Ethena, backed by a diversified pool of assets and maintained via delta hedging strategies. It delivered an average APY of 18% in 2024, making it one of the highest-yielding stablecoins in DeFi.

-

FalconStable USDf: USDf (trading at $0.9957 as of September 30, 2025) is issued by Falcon and backed by a portfolio of cryptocurrencies. It generates yield through market-neutral strategies such as funding rate arbitrage, staking, and liquidity provision.

-

Frax Finance sfrxUSD: sfrxUSD is a yield-generating stablecoin on the ERC-4626 standard, redeemable for frxUSD. Its value typically increases over time as it accrues yield from protocol-native rewards and DeFi lending.

-

Ondo Finance USDY: USDY is issued by Ondo Finance and backed by USDC deposits invested in low-risk assets like U.S. Treasury bills. Holders earn an annualized yield of approximately 4.25%, distributed from the underlying interest.

-

Curve Finance crvUSD: crvUSD is Curve Finance’s native stablecoin, designed to generate yield through protocol incentives and lending activities. It integrates seamlessly with Curve’s liquidity pools, offering users both stability and yield.

Let’s break down what sets each of these leading tokens apart:

Ethena sUSDe: Synthetic Yields at Scale

sUSDe, issued by Ethena Labs, is a synthetic dollar-pegged token backed by a diversified pool of collateral. Its peg is maintained through spot collateral delta hedging strategies. What makes sUSDe stand out is its aggressive yield profile, averaging 18% APY throughout much of 2024, driven by funding rate arbitrage across major crypto derivatives platforms. This has positioned sUSDe as one of the most sought-after assets for sophisticated DeFi users seeking high on-chain yields without direct exposure to volatile crypto assets.

FalconStable USDf: Market-Neutral Yield Engine

FalconStable USDf trades at $0.9957 as of September 30,2025 (24h range: $0.9906–$0.9998). This token is collateralized by a portfolio of cryptocurrencies managed via Falcon’s proprietary market-neutral strategies, funding rate arbitrage, cross-exchange trading algorithms, native staking rewards from L1s/L2s, and liquidity provision across major DEXes. The result is a steady stream of protocol-level yield distributed to holders while minimizing directional risk exposure. With robust liquidity on major DeFi platforms and strong transparency around reserve management, USDf has become an anchor asset for many passive income strategies.

Compare APYs and risk models for top yield-bearing stablecoins here

sfrxUSD and USDY: Real-World Assets Meet On-Chain Yields

sfrxUSD, from Frax Finance, leverages the ERC-4626 vault standard to accumulate staking rewards over time, its redemption value grows as underlying frxUSD accrues protocol fees and staking income from various sources (including liquid staking derivatives). This model offers transparent on-chain accounting with predictable growth tied to network activity.

Ondo Finance’s USDY, meanwhile, tokenizes USDC deposits that are used to purchase short-duration U. S. Treasury bills and other low-risk RWAs; most interest generated flows directly back to holders as an annualized yield (~4.25%). By bridging TradFi instruments with DeFi accessibility via smart contracts and KYC-compliant infrastructure layers where required, USDY appeals strongly to institutions seeking regulated exposure without sacrificing composability or interoperability.

The combination of these mechanisms illustrates how yield-bearing stablecoins are evolving beyond simple lending pools or rebasing mechanics, they now tap into global capital markets while maintaining seamless integration with DeFi protocols.

Explore detailed comparisons across all major DeFi yield-bearing stablecoins here

The next section will cover Curve Finance’s crvUSD innovations plus advanced risk considerations for investors navigating this dynamic sector.

USDf Stablecoin (USDf) Price Prediction 2026-2031

Projected price range and average for USDf, factoring in DeFi adoption, stablecoin market competition, and evolving yield strategies.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.9900 | $1.0000 | $1.0100 | +0.4% | Stable peg maintained; yield-bearing trend continues, minor volatility from DeFi market shifts |

| 2027 | $0.9875 | $1.0020 | $1.0150 | +0.2% | Slight increase in volatility as regulatory clarity improves; DeFi adoption grows |

| 2028 | $0.9850 | $1.0035 | $1.0200 | +0.1% | Increased competition among stablecoins, but USDf benefits from yield innovations |

| 2029 | $0.9830 | $1.0040 | $1.0250 | +0.05% | Potential for temporary depegs during market stress; yield strategies support premium scenarios |

| 2030 | $0.9820 | $1.0045 | $1.0300 | +0.05% | Advanced RWA integration bolsters trust and demand for USDf |

| 2031 | $0.9810 | $1.0050 | $1.0350 | +0.05% | Mature DeFi landscape, regulatory harmonization, and robust market-neutral strategies maintain stability |

Price Prediction Summary

USDf is expected to maintain a tight peg to the US dollar, with minor deviations due to market stress or technological changes. The yield-bearing model and innovative DeFi strategies support a slight premium in bullish scenarios, while competition and regulatory events may introduce brief downward volatility. Over the next six years, USDf should remain a leading yield-bearing stablecoin with a strong focus on stability and incremental growth.

Key Factors Affecting USDf Stablecoin Price

- DeFi adoption and yield-bearing stablecoin demand

- Regulatory clarity and global policy on stablecoins

- Technological improvements in market-neutral and staking strategies

- Competition from new and existing stablecoins

- Market liquidity and risk management practices

- Adoption of real-world asset (RWA) integrations and institutional use cases

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Curve Finance crvUSD: Stability With Composable Yield

crvUSD from Curve Finance is engineered for stability and DeFi-native composability. Unlike most yield-bearing stablecoins, crvUSD leverages an innovative soft-liquidation mechanism, dynamically adjusting collateral exposure to minimize the risk of under-collateralization during market volatility. Its yield comes from protocol fees and rewards distributed to liquidity providers in Curve’s pools, with additional incentives for those participating in protocol governance via veCRV. While its base APY is typically lower compared to sUSDe or sfrxUSD, crvUSD stands out for its deep integration across major DeFi protocols and its robust secondary markets, making it a core building block for advanced yield strategies, leveraged stablecoin positions, and automated vaults.

Key Risks and Considerations

Despite their appeal, yield-bearing stablecoins are not risk-free. Investors must weigh smart contract vulnerabilities, potential depegging events during market stress, and the evolving regulatory landscape around RWA-backed tokens. For example:

- sUSDe: High yields depend on derivatives funding rates that can be volatile or even negative during prolonged bear markets.

- USDf: Market-neutral strategies offer downside protection but may underperform if arbitrage opportunities dry up or cross-exchange spreads tighten significantly.

- sfrxUSD and USDY: Exposure to staking derivatives or RWAs introduces risks tied to underlying asset solvency and off-chain enforcement mechanisms.

- crvUSD: While resilient by design, extreme drawdowns could still trigger soft liquidations or temporary illiquidity in Curve pools.

Diversification across multiple protocols and continuous monitoring of APYs versus risk factors is essential for capital preservation in this fast-moving sector. For a deeper dive into these dynamics, including live APY rankings, real-time price feeds (e. g. , USDf at $0.9957), and protocol-specific risk profiles, see our comprehensive resource below.

See the full list of top DeFi yield-bearing stablecoins with live data

Outlook: The Future of Yield-Bearing Stablecoins

The evolution of yield-bearing stablecoins like sUSDe, USDf ($0.9957), sfrxUSD, USDY, and crvUSD signals a maturing DeFi ecosystem where capital efficiency meets programmable money. As more protocols integrate RWAs and optimize on-chain arbitrage engines, expect competition to drive both innovation and higher baseline yields, albeit with new forms of systemic risk emerging as TVLs climb.

The next wave will likely see further convergence between TradFi and DeFi rails: institutional-grade custody solutions for RWA-backed tokens like USDY; new derivatives markets hedging stablecoin depeg events; and automated portfolio managers reallocating between sUSDe’s high-octane yields and crvUSD’s composable stability depending on macro conditions.

Checklist: Evaluating Yield-Bearing Stablecoin Risks

-

Ethena sUSDe: Assess collateral quality (diversified synthetic assets), peg stability (delta hedging), and yield sustainability (historical APY up to 18% in 2024). Review protocol transparency and smart contract audit status.

-

FalconStable USDf: Examine yield sources (market-neutral strategies, arbitrage, staking), portfolio transparency, and peg resilience. Confirm liquidity depth and counterparty risk from underlying crypto assets.

-

Frax Finance sfrxUSD: Check redemption mechanisms (convertibility to frxUSD), yield accrual process (ERC-4626 vault), and historical APY. Evaluate protocol governance and security audits.

-

Ondo Finance USDY: Scrutinize asset backing (tokenized US Treasuries), regulatory compliance, and yield distribution (interest from low-risk assets). Assess redemption policies and issuer transparency.

-

Curve Finance crvUSD: Analyze peg mechanism (soft-pegged via lending/borrowing), protocol incentives (Curve rewards), and liquidation risk. Confirm smart contract security and ecosystem integration.

The bottom line: For investors willing to actively manage their exposure, and keep a close eye on protocol health metrics, yield-bearing stablecoins remain one of the most compelling passive income vehicles in crypto today. Their success will hinge on continued transparency, robust collateral management, and agile adaptation as the regulatory picture evolves.