Stablecoin maximalists, get ready: the landscape just got a jolt. The freshly launched Stable blockchain, a USDT-native Layer 1 chain, is now backed by both Bitfinex and PayPal Ventures. That’s not just headline hype – it’s a seismic move for stablecoin flows and DeFi infrastructure. With PayPal’s $28M bet and the integration of PYUSD directly into Stable’s ecosystem, we’re staring at a new chapter of cross-stablecoin liquidity and real-world payment rails.

![]()

Stablechain: Where USDT Is King

Let’s cut to the chase: Stable is the first Layer 1 blockchain purpose-built for stablecoins, using Tether’s USDT as its native gas token. Forget about volatile tokens for fees – on Stable, every transaction cost is denominated in good old digital dollars. This design isn’t just clever; it eliminates friction for users and protocols who want predictability in fees and settlement, especially for high-frequency or cross-border payments.

The chain is laser-focused on seamless peer-to-peer payments, remittances, and commercial transactions. And yes, this means you can pay gas in USDT to send PYUSD or any other integrated stablecoin, no more swapping or juggling multiple assets just to cover fees.

Why PayPal’s Move Matters (And Why Now)

PayPal Ventures’ strategic investment isn’t just another corporate experiment; it signals a serious push for mainstream adoption of stablecoins as programmable money. By bringing PYUSD onto Stablechain, PayPal unlocks new commerce use cases that go way beyond simple crypto trading. Think instant B2B settlements, global payrolls, or even retail payments, all powered by interoperable stablecoins.

David Weber, head of the PYUSD ecosystem at PayPal, put it bluntly: this partnership is about expanding utility and driving real adoption. For DeFi builders and liquidity providers, that translates into more volume, tighter spreads, and potentially explosive growth in cross-chain stablecoin flows.

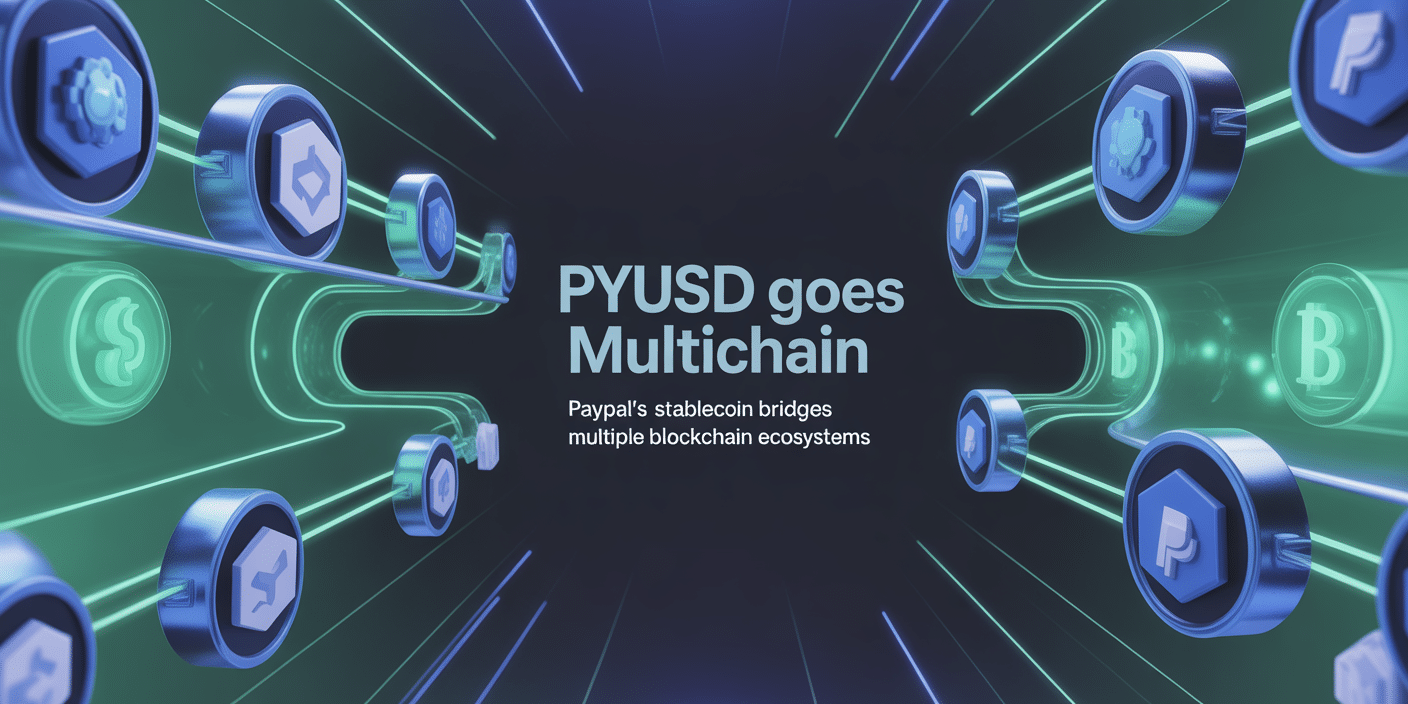

The New Era of Interoperable Stablecoins

This isn’t just about integrating another token. By embedding PYUSD alongside USDT at the protocol level, Stable is setting the stage for true interoperability. Imagine swapping between major stablecoins with near-zero slippage or moving funds across platforms without touching volatile assets, now that’s game-changing for DeFi protocols chasing efficiency and scale.

Key Benefits of Using Stablechain for DeFi Projects

-

USDT as Native Gas Token: Stablechain uses Tether (USDT) for gas and settlement fees, eliminating the need for volatile tokens and simplifying transaction costs for DeFi users.

-

Seamless Integration of Major Stablecoins: With PayPal USD (PYUSD) now integrated, Stablechain enables interoperability between USDT and PYUSD, boosting liquidity and expanding use cases for DeFi protocols.

-

Backed by Industry Leaders: Supported by Bitfinex and PayPal Ventures, Stablechain benefits from robust institutional backing and credibility, which helps attract more developers and users to its DeFi ecosystem.

-

Optimized for Fast, Low-Cost Transactions: Stablechain is purpose-built for peer-to-peer payments, remittances, and cross-border transfers, offering near-instant finality and minimal transaction fees—crucial for DeFi applications.

-

Enhanced Institutional and Retail Utility: The addition of PYUSD and support from traditional finance giants like PayPal expand Stablechain’s reach, making it attractive for both institutional and retail DeFi projects.

This convergence between TradFi giants like PayPal and crypto-native players like Bitfinex means one thing: institutional capital is coming for stablecoin infrastructure. The knock-on effect? Higher liquidity pools on DEXes, faster settlement times across borders, and a real shot at making crypto payments as easy as Venmo, powered entirely by dollar-pegged assets.

But let’s get tactical. For traders, arbitrageurs, and DeFi degens, Stablechain isn’t just another L1 – it’s a new playground for stablecoin flows. The ability to pay gas in USDT removes a major pain point, especially for those running bots or managing large treasuries that can’t tolerate volatility in fee costs. With PYUSD now live on the network, expect a surge in liquidity pools pairing USDT and PYUSD, opening fresh arbitrage routes and tighter spreads for the most liquid dollar assets in crypto.

What This Means for DeFi Liquidity and Infrastructure

The Stable blockchain is purpose-built to address old headaches: slow settlement, fragmented liquidity, and unpredictable fees. By anchoring everything to stablecoins at the protocol layer, Stable makes it dead simple for protocols to build payment rails, lending markets, or on-chain FX desks without worrying about gas volatility. This is massive for institutional adoption, think hedge funds or fintechs looking to plug into DeFi without onboarding into ETH or SOL just to move money around.

And let’s be clear: this isn’t just theoretical. We’re already seeing early integrations with cross-chain bridges and payment APIs designed specifically for USDT-native flows. The presence of both Bitfinex and PayPal Ventures means there’s firepower behind ecosystem grants and incentives, expect a wave of new apps targeting remittances, B2B payments, and real-world commerce over the next six months.

Risks? Sure, But Don’t Blink

No chain launch is risk-free. Centralization questions linger (Bitfinex/Tether ties are strong), and regulatory scrutiny around stablecoins is only heating up. But if you’re tracking capital flows, like I am every tick, the message is clear: TradFi giants want programmable dollars on-chain, and they want them now.

The real test will be volume. Watch for spikes in USDT-PYUSD transfers on-chain as new dApps launch; that’s your signal that institutional money is moving off legacy rails into programmable settlement networks. If volumes explode as expected, we’ll see ripple effects across DEXes everywhere, not just on Stable but across the wider DeFi landscape as liquidity migrates toward chains with predictable costs and deep dollar pools.

5 Ways Stablechain Could Disrupt Cross-Border Payments

-

Seamless USDT-Powered Transactions: Stablechain uses USDT as its native gas token, eliminating the need for volatile cryptocurrencies to pay network fees. This streamlines cross-border payments, making them faster and more predictable for users worldwide.

-

Direct Integration of PayPal USD (PYUSD): With PYUSD now live on Stablechain thanks to PayPal Ventures’ investment, users can send and receive PYUSD globally, tapping into PayPal’s trusted brand and expanding stablecoin utility across borders.

-

Near-Instant Settlement: Stablechain is engineered for near-instant finality in transactions, drastically reducing the waiting times and uncertainty often associated with international wire transfers and legacy payment rails.

-

Enhanced Interoperability Between Major Stablecoins: By supporting both USDT and PYUSD natively, Stablechain boosts liquidity and enables seamless swaps, improving efficiency for remittances and cross-border commerce.

-

Bridging Traditional Finance and DeFi: The collaboration between Bitfinex, Tether, and PayPal on Stablechain signals a major step toward merging traditional payments with decentralized finance, potentially unlocking new markets and reducing costs for global money movement.

The Bottom Line: Every Tick Counts

Stable isn’t just another Layer 1 chasing hype; it’s a purpose-built answer to the biggest bottlenecks in crypto payments today. With USDT as gas and PYUSD joining the party thanks to PayPal Ventures’ $28M bet, we’re watching TradFi meet DeFi at full speed. For anyone serious about stablecoin flows or building next-gen financial rails, keep your eyes glued to transaction volumes on Stablechain, because this is where the future of programmable money gets decided.