Yield-bearing stablecoins have swiftly moved from niche experiments to the beating heart of DeFi in 2025. As investors seek low-volatility assets that don’t sacrifice yield, a new breed of stablecoins has emerged, combining price stability with onchain passive income. The market cap of yield-bearing stables has exploded from $660 million in August 2023 to $11 billion by August 2025, reflecting massive demand for tokenized dollars that work harder for their holders. This shift is being led by three standouts: Ethena’s USDe, BlackRock’s BUIDL, and Ondo Finance’s USDY.

Why Yield-Bearing Stablecoins Are Dominating DeFi in 2025

The appetite for yield is not new – but the ability to earn it natively and securely onchain is. In today’s high-interest-rate environment, investors are demanding more from their stablecoin holdings. According to Stablecoin Insider, analysts at JPMorgan now estimate that yield-bearing stablecoins could capture up to 50% of the total stablecoin market by 2026. This trend is reshaping both DeFi protocols and institutional strategies.

The three leaders, USDe, BUIDL, and USDY, each offer a unique approach:

Top Yield-Bearing Stablecoins in 2025: Features & Differences

-

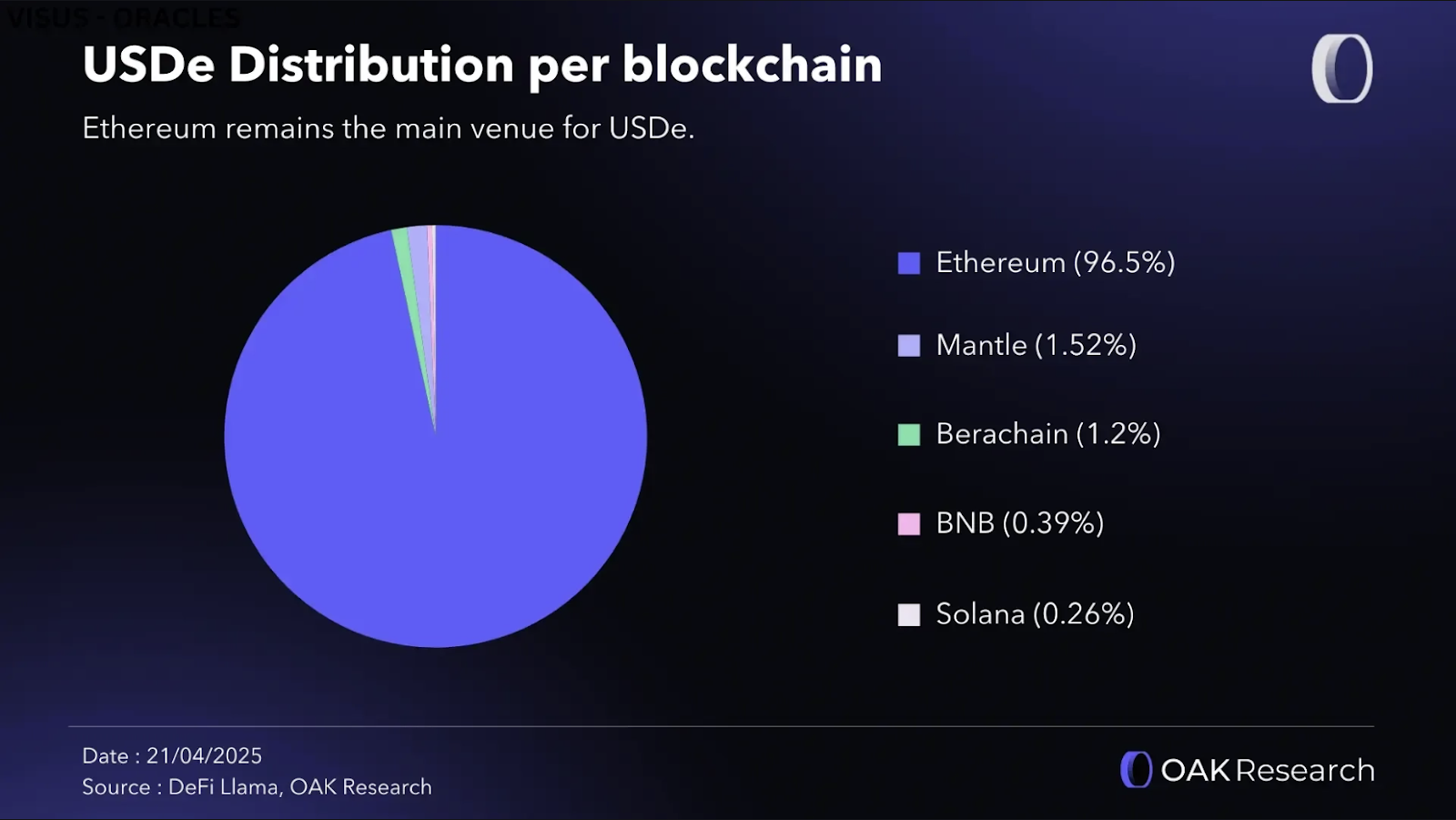

Ethena USDe: USDe stands out as a crypto-native, yield-bearing stablecoin with a total value locked (TVL) of $5.8 billion and over 700,000 users. It maintains its dollar peg via delta-neutral hedging (balancing staked Ethereum and short positions), enabling yields up to 18% annually. USDe is decentralized and offers high returns, making it a leader in DeFi yield innovation.

-

BlackRock BUIDL: BUIDL is a tokenized fund managed by BlackRock, backed by U.S. Treasuries, cash, and repurchase agreements. Launched in 2024, it delivers a stable 4% annual yield and is integrated into DeFi platforms. BUIDL offers institutional-grade security and transparency, bridging traditional finance and onchain yield.

-

Ondo USDY: USDY is a stablecoin backed 1:1 by short-term U.S. Treasury bills and bank deposits. It provides yields between 4% and 5% annually. USDY has expanded across multiple blockchains and payment gateways, improving accessibility for global users and non-U.S. investors seeking stable, onchain passive income.

USDe by Ethena Labs: Crypto-Native Yield at Scale

USDe has become the largest yield-bearing stablecoin by supply, boasting a TVL of $5.8 billion and over 700,000 users as of September 2025 (Stablecoin Insider). Its explosive growth can be traced back to its delta-neutral hedging model: USDe is minted against staked Ethereum (stETH), while short positions on derivatives exchanges offset ETH price risk. This structure allows users to earn yields up to 18% annually, far outpacing traditional savings products or even most DeFi lending pools.

The result? USDe has become the go-to choice for crypto-native users seeking both stability and high returns without leaving the blockchain ecosystem. Its rapid adoption has also spurred integrations across major DeFi protocols, further cementing its dominance.

BUIDL by BlackRock: Institutional-Grade Tokenized Treasuries

BUIDL, launched by BlackRock in early 2024 with an initial $500 million seed, stands out as the first mainstream tokenized fund offering U. S. Treasury-backed yields directly onchain (Amber Group Medium). With annual yields around 4%, BUIDL bridges traditional finance (TradFi) and DeFi by providing a compliant, transparent vehicle for institutions and risk-averse investors alike.

BUIDL’s reserves consist of U. S. Treasuries, cash, and repurchase agreements, assets familiar to any institutional treasurer but now accessible via smart contracts. The integration of BUIDL into decentralized protocols means that blue-chip DeFi projects can tap into real-world yields while maintaining full transparency over collateral.

USDY by Ondo Finance: Global Access Meets Onchain Yield

USDY takes a different tack, offering a stablecoin backed one-to-one by short-term U. S. Treasury bills and bank deposits (CoinMarketCap Ondo USDY updates). Yields range between 4% and 5% annually but with broader accessibility thanks to multi-chain support and payment gateway integrations targeting non-U. S. investors.

This global reach makes USDY especially attractive as capital controls tighten worldwide; users can access dollar yields without needing direct exposure to U. S. -based platforms or accounts. Ondo’s focus on regulatory compliance also reassures institutional allocators who require stringent oversight over underlying assets.

All three of these yield-bearing stablecoins, USDe, BUIDL, and USDY, are fundamentally shifting how capital flows through DeFi. Their strategies differ, but the impact is clear: investors now have diversified ways to earn real returns on stable digital dollars, with risk profiles ranging from crypto-native to TradFi-compliant.

Strategic Implications for Investors and Protocols

For active DeFi users and institutional allocators alike, the rise of yield-bearing stablecoins means rethinking portfolio construction. USDe’s high onchain yields appeal to risk-tolerant traders and protocols seeking leverage or composability. BUIDL’s institutional pedigree and transparent Treasury backing make it a natural fit for DAOs looking for low-risk reserves or treasurers wanting to put idle funds to work onchain. USDY’s regulatory focus and global accessibility offer a middle ground, yield with compliance, especially for non-U. S. participants.

Protocols are racing to integrate these assets as collateral, liquidity pairs, and rewards tokens. The knock-on effect? A more dynamic DeFi landscape where passive income is not just possible but expected from stablecoin holdings.

Risks and Considerations

No yield comes without risk. USDe’s delta-neutral model depends on robust derivatives markets; extreme volatility or liquidity crunches could threaten its peg. BUIDL and USDY rely on the underlying stability of U. S. Treasuries, and while historically safe, macro shocks or regulatory changes could introduce new risks. Smart contract vulnerabilities remain a universal concern across all protocols.

Due diligence is critical: review audits, monitor protocol updates, and understand each asset’s underlying mechanics before allocating significant capital.

Pros and Cons of Holding USDe, BUIDL, or USDY in 2025

-

Ethena USDePros: High yields up to 18% annually, decentralized structure, and robust peg maintenance via delta-neutral hedging. Cons: Exposure to DeFi-specific risks such as smart contract vulnerabilities and reliance on staked Ethereum price stability.

-

BlackRock BUIDLPros: Backed by U.S. Treasuries, cash, and repos, offering institutional-grade security and 4% annual yield. Seamless integration with DeFi platforms.Cons: Centralized issuer, potential regulatory scrutiny, and limited yield compared to crypto-native options.

-

Ondo USDYPros: 4–5% annual yield backed 1:1 by short-term U.S. Treasury bills and bank deposits. Multi-chain support and easy access for non-U.S. investors.Cons: Centralization risk, dependency on U.S. financial system, and possible restrictions for U.S. users.

What Comes Next?

The explosive growth of yield-bearing stablecoins has only just begun. As onchain finance matures and regulators provide clearer frameworks, expect even more sophisticated products that blend yield with programmability, potentially unlocking automated asset management strategies directly within wallets or DAOs.

The convergence of TradFi assets like Treasuries with DeFi-native innovation is breaking down barriers for both retail users and institutions worldwide. Whether you’re chasing double-digit yields with USDe or seeking compliance-first exposure via BUIDL or USDY, 2025 marks a turning point where passive income becomes the new baseline for stablecoin utility.