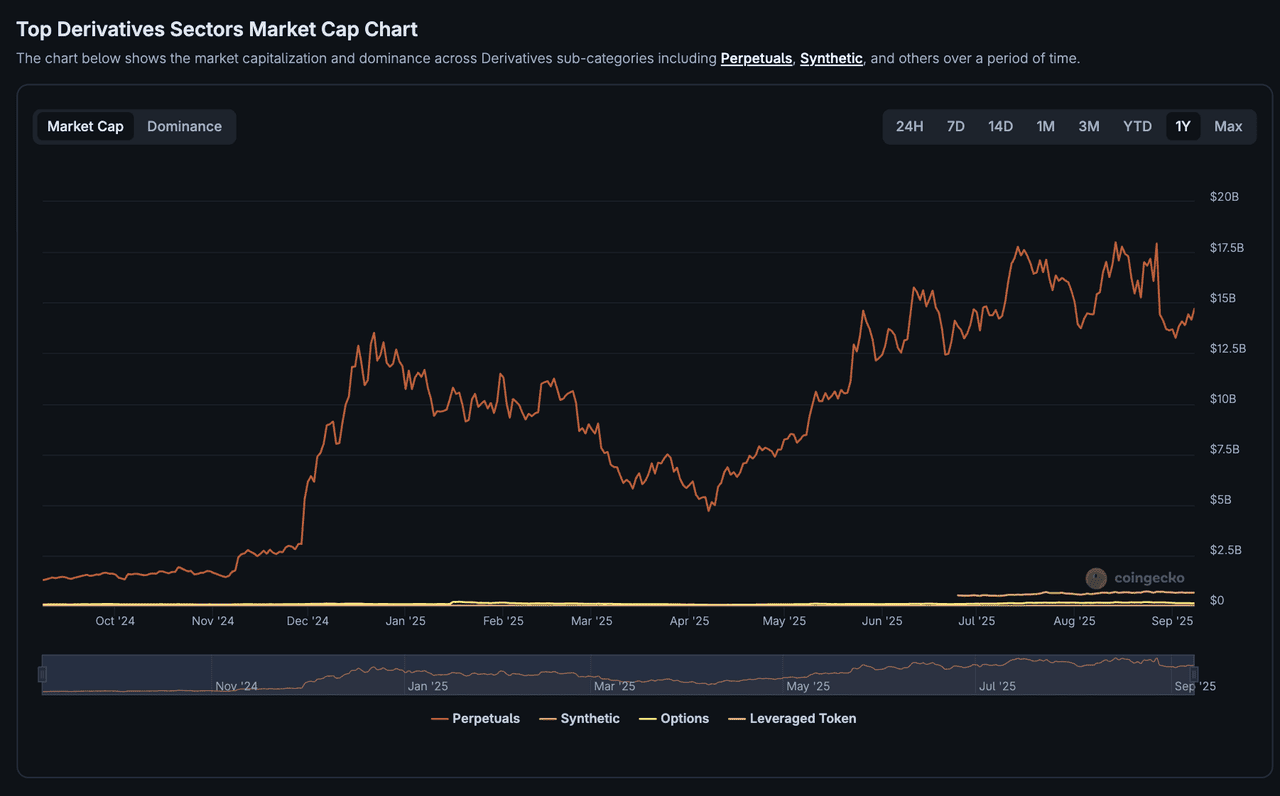

Stablecoin adoption is experiencing a notable resurgence in 2025, with USDC on the Base network emerging as a pivotal force shaping stablecoin flows and DeFi liquidity. After an 18-month period of retracement in the global stablecoin asset base, recent data shows that capital is once again pouring into decentralized finance, and USDC’s expanding footprint on Base is central to this momentum. The Base chain, developed by Coinbase, offers a scalable and cost-effective environment for DeFi applications, making it an attractive platform for both retail users and institutional players seeking efficient stablecoin movement.

USDC Base Adoption Accelerates Amid DeFi Expansion

The integration of USDC into the Base ecosystem has catalyzed a significant shift in how stablecoins are utilized within DeFi. According to StablecoinInsider, USDC accounted for 69% of stablecoin trading volume in DeFi by early 2025, up from 56% at the start of 2024. This surge is not merely quantitative; it reflects a qualitative change in user preference, driven by USDC’s regulatory compliance and transparent reserves.

Coinbase’s August 2025 revitalization of its Stablecoin Bootstrap Fund stands out as a strategic move to deepen USDC liquidity across leading protocols like Aave, Morpho, Kamino, and Jupiter. By targeting these platforms for initial deployments, Coinbase aims to provide users with access to stable yields and robust market depth, further embedding USDC as the preferred base asset for DeFi operations (Coindesk).

Stablecoin Price Comparison: USDC (Base) vs. Peers in DeFi

6-Month Price Performance of Key Stablecoins Illustrating Shifting Flows in DeFi (as of 2025-09-21)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| USDC (Base) | $1.00 | $1.00 | +0.0% |

| Multichain Bridged USDC (Fantom) | $0.0520 | $0.0520 | +0.0% |

| USDT (Ethereum) | $1.00 | $1.00 | +0.0% |

| DAI (Ethereum) | $0.9992 | $0.9992 | +0.0% |

Analysis Summary

Over the past six months, major stablecoins including USDC (Base), USDT (Ethereum), and DAI (Ethereum) have maintained price stability, reflecting their role as stable assets in the DeFi ecosystem. Multichain Bridged USDC (Fantom) also exhibited no price change, though its value remains significantly below $1.00, underscoring persistent depegging issues. This stability among leading stablecoins coincides with USDC’s growing dominance and adoption, particularly on the Base network, which is driving shifts in stablecoin flows within DeFi.

Key Insights

- USDC (Base), USDT (Ethereum), and DAI (Ethereum) all maintained their pegs over the past six months, with no price deviation (+0.0%).

- Multichain Bridged USDC (Fantom) remains severely depegged at $0.0520, showing no recovery over the period.

- USDC (Base) is benefiting from increased adoption and institutional flows, especially within DeFi, as evidenced by its stable price and growing market share.

- The stability of major stablecoins supports their continued use as foundational assets in DeFi, while depegged assets like USDC (Fantom) highlight the risks of certain bridging solutions.

This comparison uses real-time market data as of 2025-09-21, with prices and 6-month historical values sourced directly from CoinGecko. Only assets and data explicitly provided in the prompt were included, ensuring accuracy and transparency in the comparison.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/usd-coin

- Multichain Bridged USDC (Fantom): https://www.coingecko.com/en/coins/multichain-bridged-usdc-fantom

- USDT (Ethereum): https://www.coingecko.com/en/coins/tether

- DAI (Ethereum): https://www.coingecko.com/en/coins/dai

- USDT (Tron): https://www.coingecko.com/en/coins/tether

- Ethereum: https://www.coingecko.com/en/coins/ethereum

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- TrueUSD (Ethereum): https://www.coingecko.com/en/coins/trueusd

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Institutional Influx: Shifting Stablecoin Flows

Institutional adoption is now a primary driver behind the rapid expansion of USDC on Base. As reported by AInvest, Q3 2025 saw institutional allocations to USDC rise sharply: hedge funds now allocate between 5% and 20% of their NAVs to stablecoins, with USDC representing 27% of all stablecoin trading volume. This influx is not only boosting market capitalization, from $32.4 billion to $56 billion by year-end, but also reinforcing the role of USDC as an institutional-grade settlement layer within DeFi.

The result is a pronounced divergence in usage patterns between major stablecoins. While Tether (USDT) continues to dominate centralized exchange flows due to its entrenched status and liquidity pools, data shows that an increasing share of new USDC supply is directed straight into decentralized protocols, fueling lending markets, automated market makers (AMMs), and yield strategies on-chain (Gate.com).

Tracking Stablecoin Movement: Data-Driven Insights

The current market price for Multichain Bridged USDC (Fantom) stands at $0.0520, with minimal volatility over the past 24 hours, a testament to its stability even as volumes surge across networks. This real-time pricing underscores investor confidence in using USDC as collateral and settlement currency within high-frequency DeFi protocols.

USD Coin (USDC) Technical Analysis Chart

Analysis by Elena Rios | Symbol: BINANCE:USDCUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

The USDC/USDT chart for 2025 on Binance exhibits a tight, consistent trading range, characteristic of well-managed stablecoins. The chart shows minor oscillations mostly between $0.9992 and $1.0008, with the current price at $0.9992, sitting at the lower end of this range. Draw clear horizontal support at $0.9992 (current local low) and resistance at $1.0000 (psychological parity), and another at $1.0008 (recent upper wick highs). A subtle downtrend can be traced from early April’s highs to September’s lows. Highlight the consolidation band between $0.9992 and $1.0000 as the dominant range. Use rectangles to emphasize price stability zones and short-term deviations. Mark the most recent support test (September 2025) with a callout, as this could be a temporary liquidity event.

Risk Assessment: low

Analysis: USDC/USDT remains tightly pegged, with robust support at $0.9992 and strong institutional/DeFi backing. The risk of a sustained break below $0.9990 is minimal under current market conditions.

Elena Rios’s Recommendation: Focus on yield, arbitrage, and liquidity strategies over directional trades. Monitor network and regulatory events, but expect price to remain anchored near $1.00 barring systemic shocks.

Key Support & Resistance Levels

📈 Support Levels:

-

$0.999 – Current local low and repeated support area

strong

📉 Resistance Levels:

-

$1 – Psychological and structural resistance at parity

strong -

$1.001 – Upper resistance from April 2025 wicks

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$0.999 – Arbitrage or liquidity provision at support, anticipating mean reversion to $1.0000

low risk

🚪 Exit Zones:

-

$1 – Take profit at the peg, typical for arbitrageurs and market makers

💰 profit target -

$0.999 – Stop loss for risk management in case of rare peg instability

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume is not shown on this chart, but typically increases during brief deviations from the peg.

Monitor volume spikes for signs of liquidity stress or arbitrage activity. Use callouts or arrows at points of sudden price dips.

📈 MACD Analysis:

Signal: Not directly relevant for stablecoin pairs due to minimal price swings.

MACD signals are largely inconsequential for USDC/USDT, but sharp crossovers during rare volatility events could highlight arbitrage windows.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Elena Rios is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

The reacceleration of stablecoin flows can be attributed to several factors:

- Regulatory clarity: Market participants increasingly favor assets like USDC that prioritize transparency and compliance.

- Ecosystem incentives: Initiatives like Coinbase’s Bootstrap Fund directly stimulate protocol-level liquidity.

- User experience improvements: Lower fees and faster settlement times on Base have made DeFi participation more accessible than ever.

This dynamic environment is prompting analysts to closely monitor how incremental inflows into Base translate into broader shifts across other chains, and whether these patterns will persist as new entrants join the ecosystem.

Multichain Bridged USDC (Fantom) (USDC.e) Price Prediction 2026-2031

Comprehensive Outlook Based on USDC Base Adoption, DeFi Trends, and Stablecoin Market Shifts

| Year | Minimum Price | Average Price | Maximum Price | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.0480 | $0.0525 | $0.0570 | +1% | Continued DeFi growth and Base network adoption keep USDC.e near peg; minor volatility from cross-chain liquidity flows. |

| 2027 | $0.0465 | $0.0518 | $0.0585 | -1.3% | Regulatory clarity supports stablecoin trust, but competition from new bridged assets and synthetic stablecoins increases volatility. |

| 2028 | $0.0450 | $0.0510 | $0.0600 | -1.5% | Market matures; increased interoperability and Layer-2 adoption sustain USDC.e usage despite broader stablecoin innovation. |

| 2029 | $0.0440 | $0.0505 | $0.0615 | -1% | DeFi protocols integrate more real-world assets, but USDC.e retains utility; minor depegs possible during high volatility events. |

| 2030 | $0.0430 | $0.0500 | $0.0630 | -1% | Stablecoin market is highly competitive; USDC.e maintains relevance with improved transparency and cross-chain compliance. |

| 2031 | $0.0425 | $0.0498 | $0.0645 | -0.4% | USDC.e remains a key DeFi liquidity tool, but faces margin pressure from next-gen stablecoins and evolving regulation. |

Price Prediction Summary

USDC.e (Fantom) is expected to remain tightly aligned with its USD peg, supported by strong DeFi adoption, regulatory clarity, and ongoing technical improvements. While the average price prediction shows minor downward drift due to competition and market maturation, the maximum price scenario reflects occasional demand surges and volatility. The minimum price projections account for potential depegging events and liquidity stress but remain close to the $0.05 baseline. Overall, USDC.e is likely to continue serving as a core stablecoin within the Fantom and multichain DeFi ecosystem through 2031.

Key Factors Affecting Multichain Bridged USDC (Fantom) Price

- USDC’s dominant position in DeFi and Base network integration

- Coinbase and Circle’s ongoing support for USDC liquidity and compliance

- Increasing competition from new stablecoins and synthetic assets

- Evolving regulatory frameworks and global stablecoin policy

- Cross-chain interoperability and technical upgrades

- Potential for temporary depegging during market shocks or liquidity crunches

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As the DeFi landscape matures, the interplay between USDC Base adoption and stablecoin flows is reshaping liquidity strategies, user behavior, and protocol design. The ability to monitor these movements in real time is crucial for both institutional allocators and retail participants aiming to capture yield and manage risk in a rapidly evolving market.

Key Drivers Behind USDC’s DeFi Dominance

Several factors are converging to underpin USDC’s rising dominance within the DeFi stablecoin ecosystem:

Top 5 Drivers of USDC Base Adoption in DeFi

-

Coinbase’s Stablecoin Bootstrap Fund Revitalization: In August 2025, Coinbase relaunched its Stablecoin Bootstrap Fund, targeting DeFi protocols like Aave, Morpho, Kamino, and Jupiter. This initiative injects liquidity into the ecosystem, making USDC more accessible and deepening its role as a foundational asset for DeFi yields.

-

USDC’s Regulatory Compliance and Transparency: USDC stands out for its adherence to regulatory standards and transparent operations, fostering trust among both retail and institutional users. These qualities have made USDC the stablecoin of choice for DeFi protocols seeking reliability and compliance.

-

Institutional Adoption and Asset Allocation: By Q3 2025, institutional investors drove USDC to represent 27% of all stablecoin trading volume, with 5-20% of hedge fund NAVs allocated to stablecoin strategies. This influx of institutional capital has significantly boosted USDC’s utility and liquidity on Base.

-

Dominance in DeFi Trading Volume: In early 2025, USDC achieved a 69% share of stablecoin trading volume within DeFi, underscoring its dominance. This reflects growing user preference for USDC in decentralized protocols over alternatives like USDT, especially on networks like Base.

-

Cost-Effective and Scalable Base Network Infrastructure: Base, developed by Coinbase, offers a scalable and low-cost environment for DeFi applications. Its technical advantages have made it an attractive platform for deploying USDC, driving adoption among developers and users seeking efficient stablecoin transactions.

Liquidity depth on protocols like Aave and Kamino ensures that large trades can be executed with minimal slippage, attracting sophisticated traders and market makers. At the same time, transparent reserves and regular attestation reports from Circle continue to build trust among risk-conscious users. Regulatory clarity has further distinguished USDC from competitors, especially as global policymakers scrutinize stablecoin issuers for compliance and consumer protection.

The ongoing commitment by Coinbase to bootstrap DeFi liquidity using its fund signals a long-term vision for Base as a foundational layer for permissionless finance. This approach not only drives protocol-level innovation but also incentivizes developers to build new financial primitives anchored by USDC liquidity. As a result, we’re seeing more complex products such as structured vaults, synthetic assets, and cross-chain credit markets emerging on Base, each leveraging USDC as their core settlement asset.

Implications for Stablecoin Movement Tracking

The divergence in usage patterns between USDT (dominant on centralized exchanges) and USDC (increasingly preferred in DeFi) highlights the importance of granular stablecoin movement tracking. Platforms focused on stablecoin flows analysis are now essential tools for investors seeking alpha or managing exposure across multiple ecosystems. Real-time dashboards tracking supply issuance, protocol inflows, and cross-chain transfers provide actionable insights into where capital is accumulating, and where potential risks may emerge.

The stability of Multichain Bridged USDC (Fantom), currently priced at $0.0520, exemplifies how robust infrastructure can maintain peg integrity even during periods of heightened activity or volatility. For users engaging with yield strategies or leveraging collateralized positions, this reliability is paramount.

The Road Ahead for the USDC Base Ecosystem

If current trends persist, driven by institutional allocations, user incentives, and continued protocol expansion, USDC’s share of DeFi activity could further increase through Q4 2025 and beyond. However, this trajectory will depend on several variables: regulatory developments in key jurisdictions, technological upgrades to both Base and bridging solutions, and the ability of competing stablecoins to innovate or differentiate.

“USDC’s momentum on Base is not just about volume; it’s about setting new standards for transparency and composability in DeFi. ”

For investors tracking stablecoin movement, it will be critical to watch how liquidity incentives evolve, and whether other networks replicate Coinbase’s approach to ecosystem funding. At the same time, developers must remain vigilant about security risks associated with bridging assets across chains, especially as volumes scale up.

The next phase of growth will likely see deeper integration between traditional finance rails and decentralized protocols, a trend that could accelerate if regulatory frameworks continue to favor transparent stablecoins like USDC. For now, all signs point toward an enduring role for USDC within both retail-facing dApps and institutional-grade settlement layers across the expanding universe of decentralized finance.