Stablecoins have become the lifeblood of the crypto ecosystem, acting as both a bridge to traditional finance and a vital source of liquidity within decentralized markets. Their rapid ascent is reshaping not only how capital moves across blockchains but also how liquidity crunches unfold during periods of market stress. In this article, we examine how stablecoin flows shape crypto market liquidity, amplify or mitigate crises, and serve as critical signals for investors and regulators alike.

Stablecoins: The Foundation of Crypto Market Liquidity

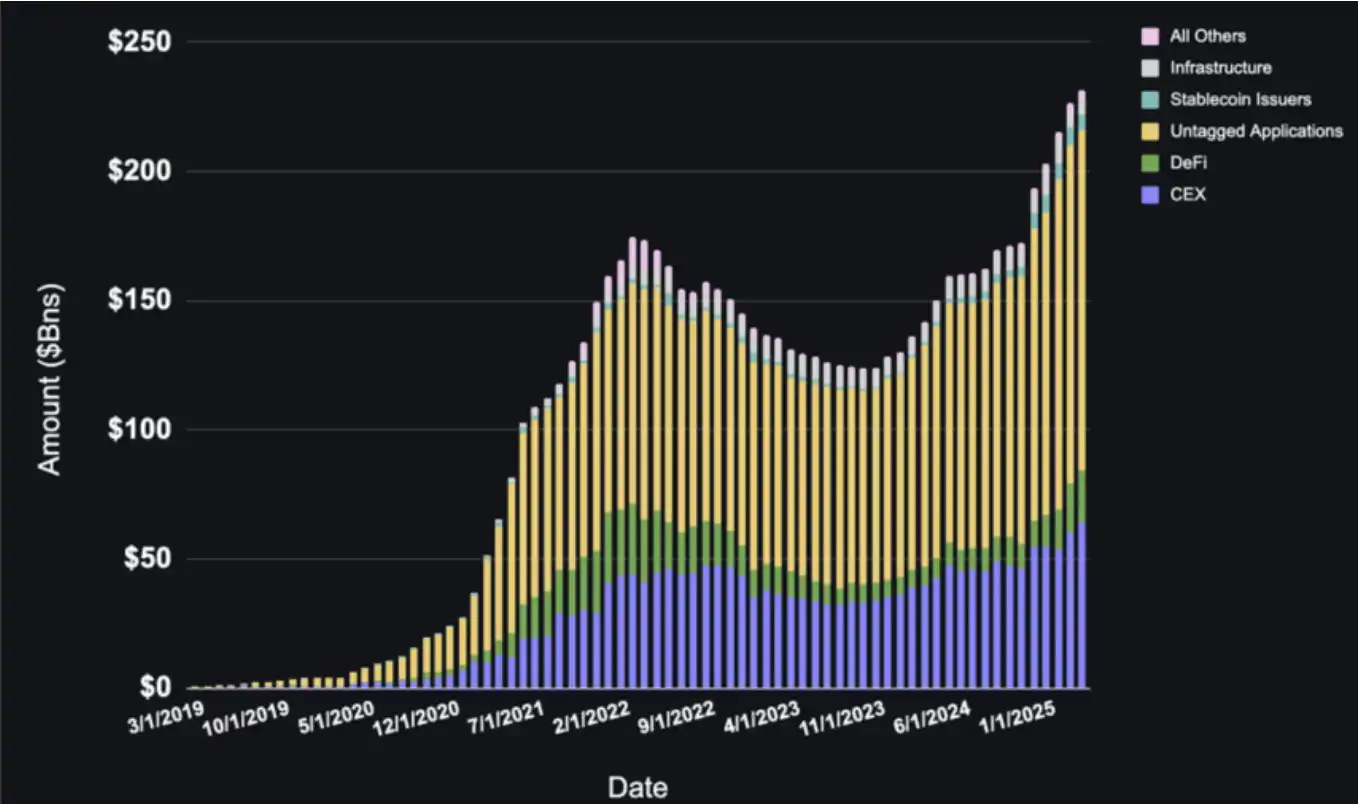

The function of stablecoins goes far beyond providing a digital version of cash. They underpin virtually every DeFi protocol, centralized exchange, and cross-chain bridge. When traders deploy stablecoins like USDC or USDT, they inject fresh capital into the system. This influx is visible in real time: in March 2025, the total stablecoin supply hit a record $217.8 billion, reflecting unprecedented levels of available liquidity for trading and investment (source).

An expanding stablecoin supply almost always coincides with bullish sentiment and rising asset prices. Conversely, shrinking supply often signals risk aversion and capital outflows – classic early warning signs for a potential liquidity crisis. The link between stablecoin movement history and overall crypto market liquidity has never been more direct or consequential.

When Stablecoin Flows Signal Crisis

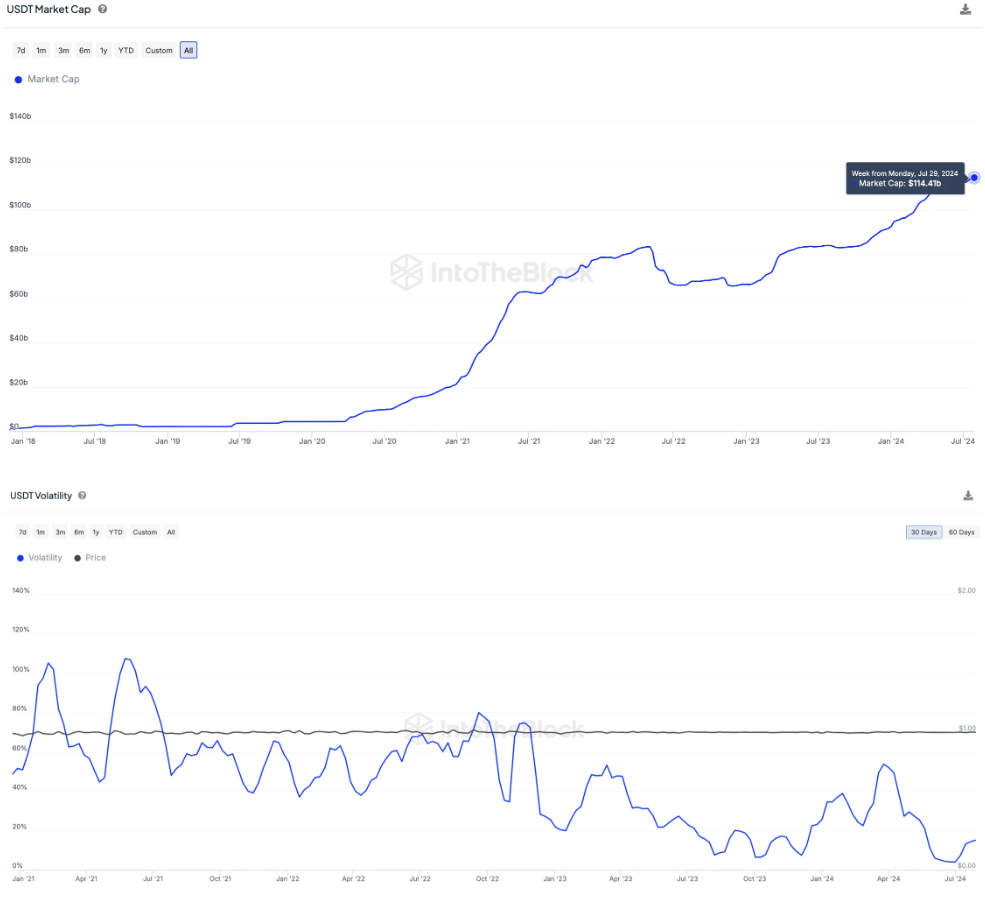

The intuitive view is that stablecoins should act as safe havens during turbulent markets. However, recent research from the Bank for International Settlements shows that their behavior diverges sharply from money market funds during shocks (source). Instead of seeing inflows when volatility spikes, major stablecoins often experience redemptions – their total market capitalization drops as users seek safety in fiat off-ramps or withdraw to traditional banks.

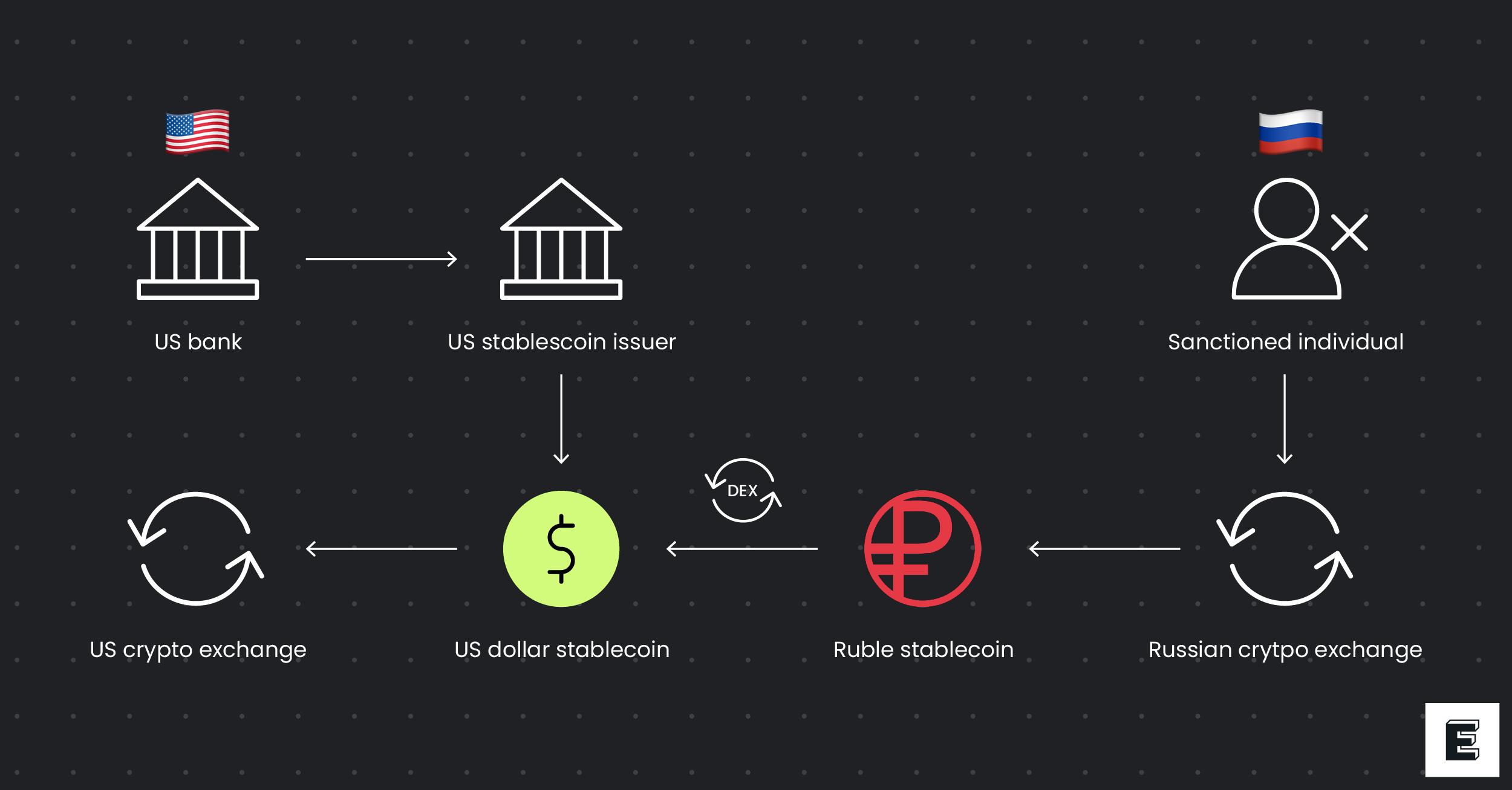

This dynamic can deepen a liquidity crisis rather than cushion it. When large holders redeem en masse or lose confidence in reserve backing, the resulting outflows can drain liquidity from exchanges and DeFi protocols at precisely the worst moment. The dominance of just two issuers – Tether (USDT) and USD Coin (USDC) – means any disruption in these networks can ripple rapidly across all corners of the crypto landscape (source).

The Mechanics Behind Stablecoin Liquidity Crunches

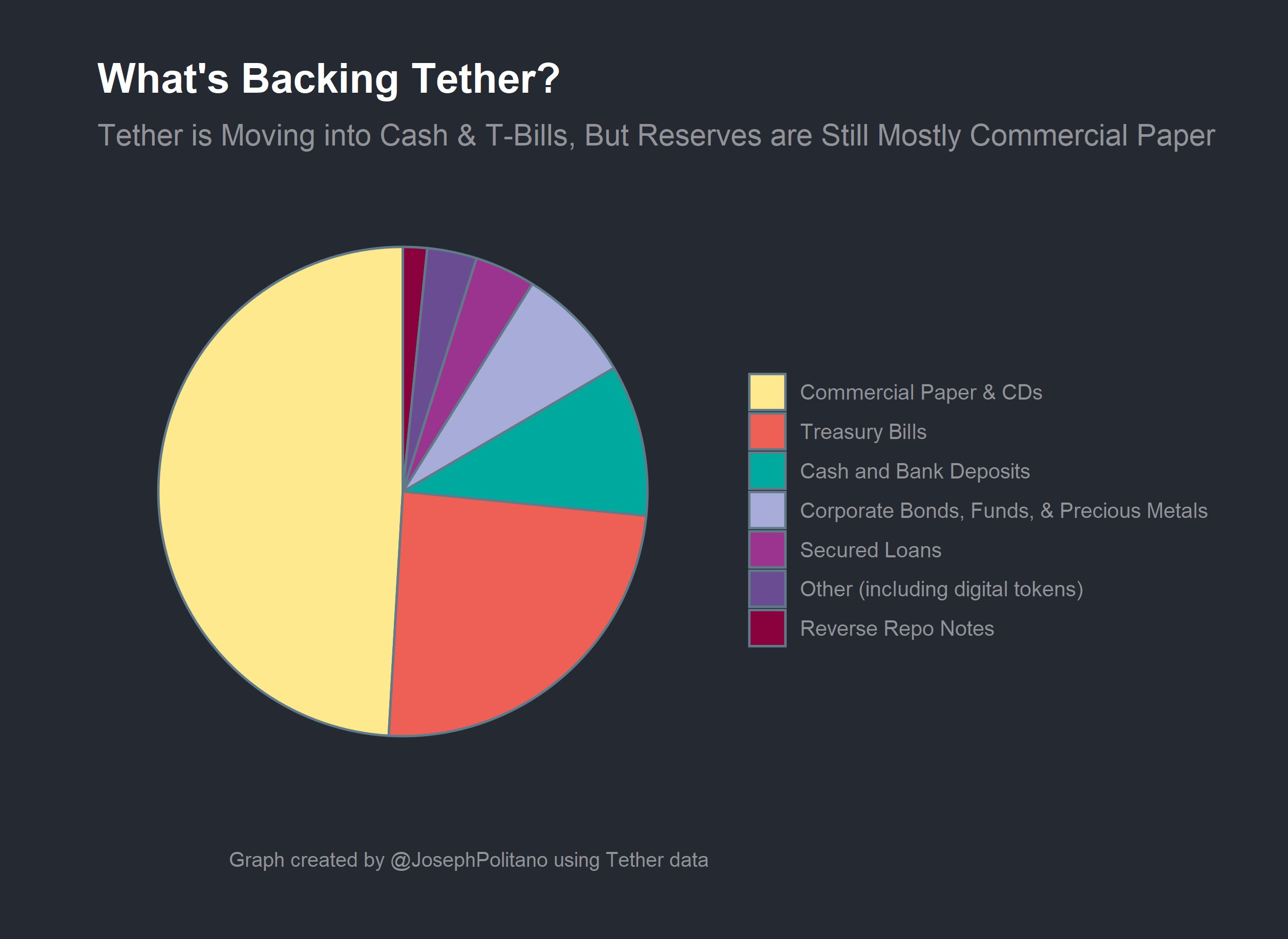

To understand why stablecoin flows can exacerbate stress events, consider how these instruments are structured. Most leading stablecoins are backed by highly liquid assets such as U. S. Treasuries or commercial paper and promise 1: 1 redemption with fiat currency (source). In normal times, this model works efficiently – users trust that their tokens can be redeemed at par on demand.

The challenge emerges when redemption requests surge suddenly. Stablecoin issuers must liquidate reserves quickly to meet redemptions, which can put downward pressure on Treasury prices if done at scale (as warned by U. S. banking authorities). If confidence falters due to questions over reserves or regulatory scrutiny, redemptions accelerate further – draining both on-chain liquidity and potentially impacting traditional financial markets.

Key Risks of Rapid Stablecoin Outflows in Market Stress

-

Liquidity Drain Across Crypto Exchanges: Rapid outflows of major stablecoins like Tether (USDT) and USD Coin (USDC) can sharply reduce available liquidity, making it harder for traders to execute orders and increasing price volatility.

-

Potential for Fire Sales of Reserve Assets: Stablecoin issuers often hold large reserves in assets such as U.S. Treasuries. Sudden redemption waves may force issuers to liquidate these reserves quickly, potentially depressing Treasury prices and affecting traditional financial markets.

-

Systemic Risk from Concentrated Holdings: The dominance of a few stablecoins amplifies systemic risk. If a leading stablecoin like USDT or USDC faces a crisis, it can trigger widespread disruptions across the entire crypto ecosystem.

-

Breakdown of On- and Off-Ramp Infrastructure: Stablecoins serve as key intermediaries for moving funds between crypto and fiat. Rapid outflows can strain or disrupt these payment channels, hindering users’ ability to enter or exit the market efficiently.

-

Loss of Confidence and Panic Selling: Perceived instability in stablecoins can erode market confidence, leading to panic redemptions and a downward spiral in both stablecoin and crypto asset prices.

This feedback loop underscores why monitoring stablecoin flows during a liquidity crisis is crucial for anyone managing risk in digital assets today.

Market participants and regulators are increasingly aware that stablecoin flows are not just passive indicators but active drivers of liquidity conditions. When outflows accelerate, the effects cascade through both centralized exchanges and DeFi protocols. Liquidity pools can dry up, spreads widen, and even blue-chip crypto assets become difficult to trade at expected prices. This has been especially apparent during periods when the stablecoin supply contracts sharply, as witnessed in previous flash crashes.

How Investors Can Use Stablecoin Flow Data as Crisis Signals

For sophisticated investors and funds, monitoring real-time changes in stablecoin balances across major exchanges provides a valuable edge. Sharp drops in aggregate stablecoin holdings often precede market-wide deleveraging or forced selling events. Conversely, a surge in inflows can signal renewed risk appetite and the potential for price recovery.

By tracking metrics such as net inflows/outflows, on-chain transfer volumes, and concentration among whale addresses, analysts can gauge the underlying health of crypto market liquidity. These insights are particularly vital during periods of regulatory uncertainty or macroeconomic stress, when sentiment can turn quickly and liquidity can evaporate almost overnight.

Key Data Points to Monitor for Stablecoin-Driven Liquidity Risks

-

Total Stablecoin Supply: Track the overall supply of major stablecoins like Tether (USDT) and USD Coin (USDC). For example, as of March 2025, the total stablecoin supply hit $217.8 billion, signaling a surge in market liquidity.

-

Stablecoin Net Flows to Exchanges: Monitor inflows and outflows of stablecoins on major crypto exchanges. Rising inflows can indicate increased trading activity and liquidity, while large outflows may signal capital leaving the market.

-

Market Capitalization Changes During Volatility: Observe how stablecoin market caps react during crypto market shocks. Declines in market cap during crises, as noted by the Bank for International Settlements, may reveal a lack of safe-haven behavior.

-

Concentration of Stablecoin Holdings: Assess the distribution of stablecoin reserves. High concentration among a few wallets or entities (“whales”) increases systemic risk if large holders move funds rapidly.

-

Stablecoin Reserve Composition and Liquidity: Examine the assets backing stablecoins—such as U.S. Treasuries—and their liquidity. Regulatory warnings highlight that rapid liquidation of reserves in stress periods could disrupt broader financial markets.

It is also important to recognize that not all stablecoins behave identically under stress. Algorithmic or under-collateralized models have historically proven far more fragile than fully backed fiat-pegged coins. As such, investors should differentiate between types of stablecoins when assessing systemic risk.

Regulatory Scrutiny: A Double-Edged Sword for Market Liquidity

Regulators globally have zeroed in on the risks posed by large-scale stablecoin redemptions. In February 2023, US banking authorities specifically cautioned that mass liquidation of reserve assets could disrupt broader financial markets (source). While enhanced oversight may improve transparency and bolster confidence in the long run, short-term uncertainty around new rules can itself become a trigger for outflows and market instability.

This regulatory push-pull is likely to shape the evolution of both centralized and decentralized finance over the next several years. For now, it reinforces the need for robust monitoring tools and proactive risk management strategies centered on stablecoin flows liquidity crisis signals.

What Comes Next? The Future of Stablecoins Amid Market Volatility

The trajectory of stablecoins will be defined by their ability to balance innovation with safety and transparency. As adoption continues to grow – with supplies reaching records like $217.8 billion in March 2025 – so too will their influence on both crypto-native markets and traditional financial systems (source).

Ultimately, those who understand the mechanics behind stablecoin movement history, monitor real-time flow data, and stay attuned to regulatory developments will be best positioned to navigate future liquidity crises – whether they originate within crypto or spill over from broader economic shocks.