Stablecoin adoption in 2024 has been nothing short of explosive, with DeFi protocols at the epicenter of this transformation. If you’ve watched stablecoins move from a niche payment rail to the backbone of decentralized finance, you know that this year has delivered on every bullish prediction. Let’s break down the most compelling trends shaping stablecoin adoption in 2024 and why DeFi liquidity is looking more robust than ever.

Stablecoins: The New Core of DeFi Liquidity

This year, stablecoins have become the lifeblood of DeFi. According to Stablecoin Insider, they now account for approximately 70% of all liquidity pools. This isn’t just a stat – it’s a seismic shift. Stablecoins like USDC and USDT are providing essential price stability for lending, borrowing, and yield farming, making them indispensable for both risk-averse users and high-frequency traders.

The sheer volume is staggering: in 2024, total stablecoin transfer volume hit $27.6 trillion, surpassing even Visa and Mastercard’s combined transaction volume by nearly 8% (Bastion). This growth speaks to their role not just as a crypto-native asset but as a critical payments infrastructure globally.

The Rise (and Rise) of Algorithmic Stablecoins

If last year was about centralized stablecoins cementing their dominance, 2024 is all about algorithmic stablecoins making waves. Recent data shows that around 33% of crypto users now hold algorithmic stablecoins, up from 28% last year (CoinLaw). Even more telling: nearly 88% of DeFi dApps support these assets, making them far more accessible across ecosystems.

This broad support has fueled rapid experimentation with new models for price stability and collateralization. While risks remain (as always with algo stables), their increased adoption signals growing confidence in decentralized design – and a hunger for innovation beyond fiat-backed tokens.

Key Drivers of Algorithmic Stablecoin Growth in DeFi (2024)

-

Surging Integration Across DeFi Platforms: In 2024, algorithmic stablecoins became deeply embedded in DeFi ecosystems, making up roughly 70% of liquidity pools and providing crucial stability for lending, borrowing, and yield farming.

-

Wider User Adoption: The proportion of crypto users holding algorithmic stablecoins jumped to 33% (up from 28% in 2024), with 88% of DeFi dApps supporting these assets for enhanced cross-platform utility.

-

Expanding Use Cases: Algorithmic stablecoins powered new financial products, from lending and payments to remittances and asset tokenization, often through partnerships between stablecoin issuers and traditional financial institutions.

-

Improved Cross-Chain Interoperability: Protocols like Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enabled seamless movement of stablecoins across multiple blockchains, creating a unified liquidity layer for DeFi.

-

Institutional Adoption Accelerates: Corporations held $11.2 billion in stablecoins in their treasuries, and over 43% of B2B cross-border payments in Southeast Asia used stablecoins for their speed and efficiency.

-

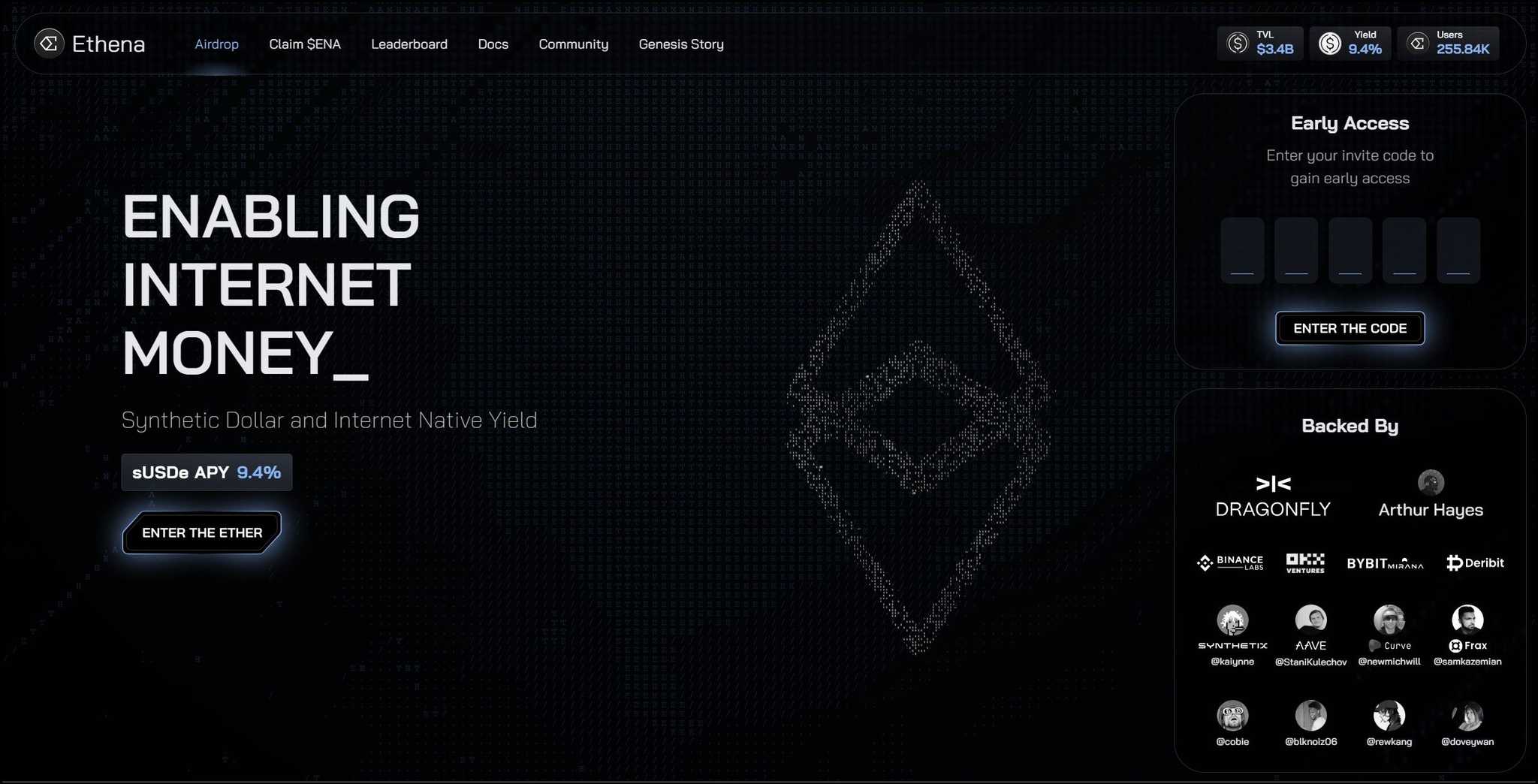

Rise of Yield-Bearing Stablecoins: New algorithmic stablecoins like USDe by Ethena and USD0 by Usual offered holders both price stability and modest yields, attracting more users to DeFi.

-

Layer 2 Scaling Solutions: Adoption of Layer 2 networks improved transaction speed and reduced costs for stablecoin transfers, making algorithmic stablecoins more viable for everyday and high-frequency use.

Beyond Payments: Expanding Use Cases and Institutional Buy-In

The utility of stablecoins is stretching well past simple transfers. In 2024, we saw major collaborations between issuers and traditional financial institutions to create hybrid products that blend the best of both worlds (Medium – Web3Prophet). From seamless cross-border payments to on-chain remittances and even tokenized real-world assets (RWAs), the use cases keep multiplying.

Institutional adoption is also accelerating at breakneck speed. Corporate treasuries now hold over $11.2 billion in stablecoins, while more than 43% of B2B cross-border payments in Southeast Asia leverage these assets. This isn’t just headline fodder – it’s proof that mainstream finance sees real efficiency gains through programmable money.

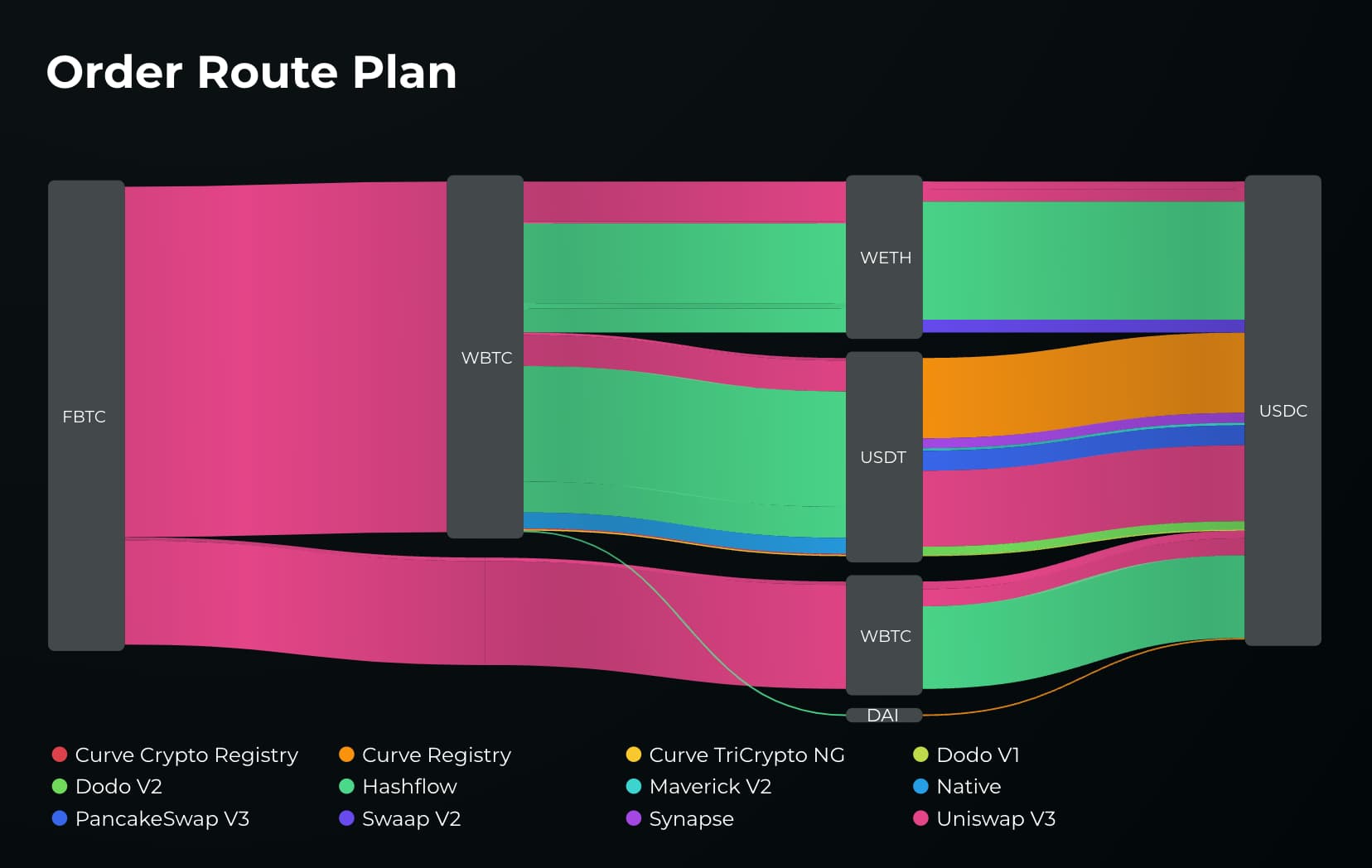

Interoperability has emerged as a game-changer for DeFi protocols and the stablecoin ecosystem. In 2024, we saw a surge in cross-chain activity, with protocols like Chainlink’s CCIP enabling secure, seamless movement of stablecoins across Ethereum, Solana, Arbitrum, Base, and more. This unified liquidity layer means users can now chase yield opportunities or manage risk across multiple blockchains without friction. The days of siloed liquidity are fading fast.

Yield-Bearing Stablecoins and Layer 2: The Next Frontier

If you’re hunting for alpha in DeFi, yield-bearing stablecoins are impossible to ignore. New entrants like USDe by Ethena and USD0 by Usual have introduced mechanisms such as funding rate arbitrage and tokenized RWAs to offer not just stability but also modest yields. This evolution is attracting both retail users seeking passive income and institutions looking for capital-efficient alternatives to legacy finance products.

Layer 2 solutions have also supercharged the stablecoin experience. Lower fees and higher throughput on networks like Base and Arbitrum are making stablecoin transactions viable for everything from micro-payments to high-frequency trading strategies. The result? A more accessible, scalable DeFi landscape that’s ready for mass adoption.

Top Benefits of Yield-Bearing Stablecoins in DeFi

-

Earn Passive Income with Stability: Yield-bearing stablecoins like USDe (Ethena) and USD0 (Usual) let DeFi users earn 3-5% annual returns while keeping their funds pegged to the US dollar, combining the best of both worlds—steady yields and price stability.

-

Seamless Integration Across DeFi Platforms: These stablecoins are widely supported on major protocols such as Aave, Curve, and Uniswap, making it easy for users to deploy capital, farm yields, or provide liquidity without leaving the safety of a stable asset.

-

Lower Volatility, Higher Confidence: Unlike traditional crypto assets, yield-bearing stablecoins shield users from market swings, allowing for predictable returns and safer DeFi participation—even during turbulent market conditions.

-

Enhanced Capital Efficiency: By earning yield on stablecoins, users can maximize returns on idle assets and unlock new strategies, such as using yield-bearing tokens as collateral for borrowing or leveraging in DeFi protocols.

-

Institutional-Grade Security and Transparency: Leading yield-bearing stablecoins are backed by transparent reserves or on-chain mechanisms, and often undergo regular audits, giving both retail and institutional investors greater peace of mind.

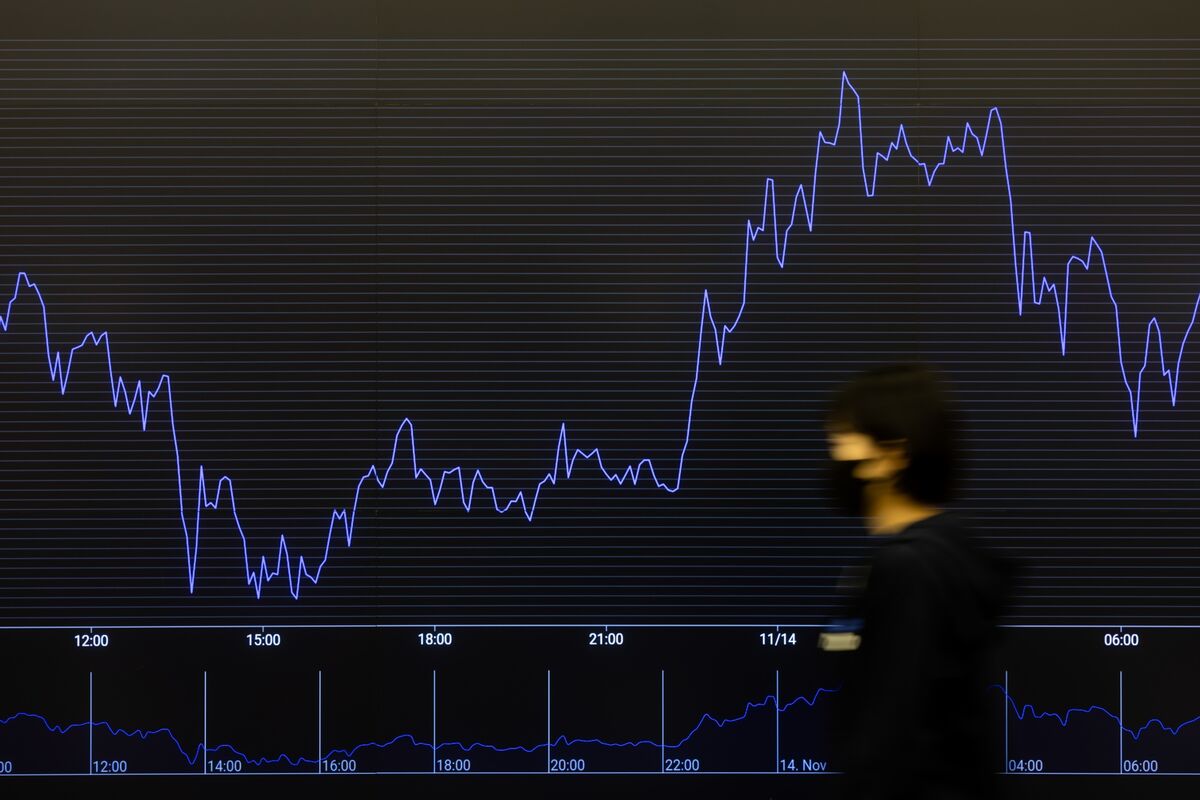

It’s worth noting that this rapid expansion hasn’t come without challenges. Regulatory scrutiny is intensifying as volumes soar, especially with total transfer volume reaching $27.6 trillion in 2024 (Bastion). There’s also the ongoing debate around the long-term sustainability of algorithmic models versus fiat-collateralized options. Still, the overall trajectory points to a maturing market where innovation is balanced by growing demand for transparency and compliance.

Stablecoin Ecosystem Growth: What’s Next?

The data speaks volumes: adjusted monthly transaction volume grew roughly 49%, jumping from ~$472B/month in 2024 to about $702B/month heading into 2025 (CoinLaw). With Ethereum, Tron, Arbitrum, Base, and Solana leading on value settled (Medium – Web3Prophet), the battle for dominance among L1s and L2s has only intensified.

Emerging markets are another hotbed of activity. Stablecoins now power cross-border payments and wealth preservation solutions where local currency volatility remains high, offering a lifeline that traditional banking simply can’t match.

Are stablecoins your top choice for daily payments or mainly for DeFi strategies?

Stablecoins have surged in use across DeFi, powering 70% of liquidity pools and enabling fast, stable transactions. With new yield-bearing options and seamless cross-chain transfers, would you use stablecoins for everyday payments or just for DeFi activities?

If you’re navigating this space as an investor or builder, keep your eyes on these trends:

- Interoperability: Watch how new bridges and protocols expand access across chains.

- Regulatory clarity: Track global policy shifts that could open (or close) doors for certain stablecoin models.

- User experience: UX improvements will be key as competition heats up among DeFi protocols.

- Yield innovation: Expect more hybrid products blending TradFi security with DeFi flexibility.

The bottom line? Stablecoin adoption in 2024 isn’t just about volume, it’s about versatility. As programmable money cements its place at the heart of both decentralized finance and global payments infrastructure, those who stay curious (and nimble) will be best positioned to ride this wave into 2025 and beyond.