In the rapidly evolving world of decentralized finance, real-time stablecoin flow trackers have become indispensable for crypto analysts seeking an edge. Stablecoins are the backbone of on-chain liquidity, and their movements often precede major market shifts. Whether you’re monitoring capital rotation into DeFi protocols or watching for early signs of risk-off sentiment, having access to granular, up-to-the-second data is crucial. But with so many analytics platforms vying for attention, which tools actually deliver actionable insights?

Why Real-Time Stablecoin Flow Analytics Matter

Stablecoins such as USDC, USDT, and DAI now underpin trillions in annual transaction volume. Their flows reflect everything from institutional positioning to retail speculation and even macroeconomic trends leaking on-chain. Analysts who can track these flows in real time gain a unique perspective on liquidity trends, exchange activity, and potential systemic risks.

But not all dashboards are created equal. The best tools combine comprehensive coverage (multiple chains and protocols), customizable metrics, and intuitive interfaces. They empower users to answer questions like:

- Which protocols are attracting the most stablecoin deposits right now?

- How do inflows/outflows correlate with price action or volatility spikes?

- Are large holders accumulating or distributing stablecoins?

The Top 5 Real-Time Stablecoin Flow Trackers for Crypto Analysts

Based on feature depth, reliability, and analyst feedback, these five platforms stand out as essential resources:

Top 5 Real-Time Stablecoin Flow Tracking Tools

-

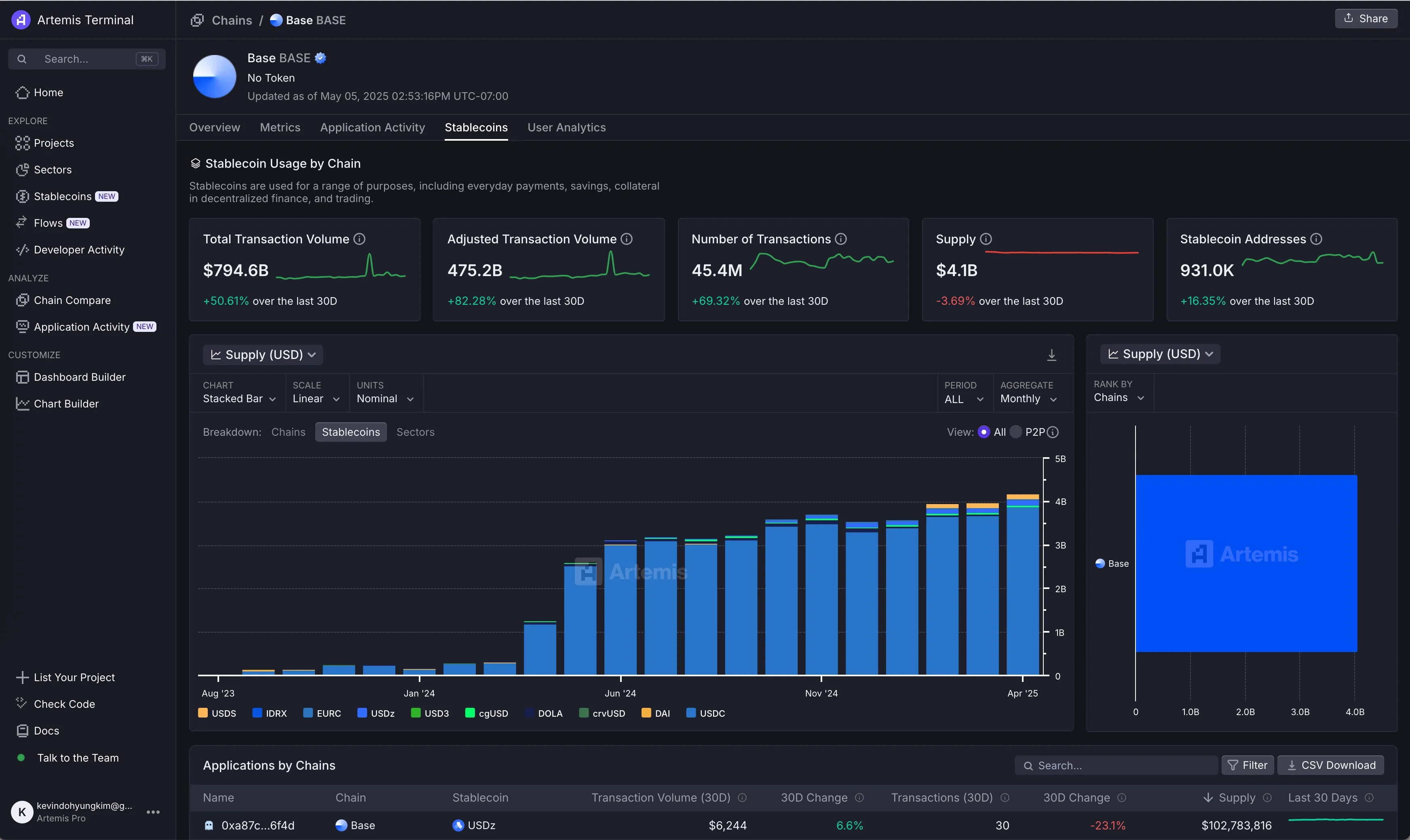

Artemis Analytics: Artemis offers comprehensive on-chain stablecoin analytics, allowing users to compare key metrics across protocols and build custom dashboards. Its Stablecoin Activity Breakdown feature details transfer volumes, supply, and active addresses per chain, making it ideal for in-depth stablecoin flow analysis.

-

Nansen Portfolio & Stablecoin Flows: Nansen provides real-time tracking of stablecoin inflows and outflows across major blockchains and exchanges. Analysts can set custom alerts for significant stablecoin movements, helping them monitor liquidity shifts and market sentiment.

-

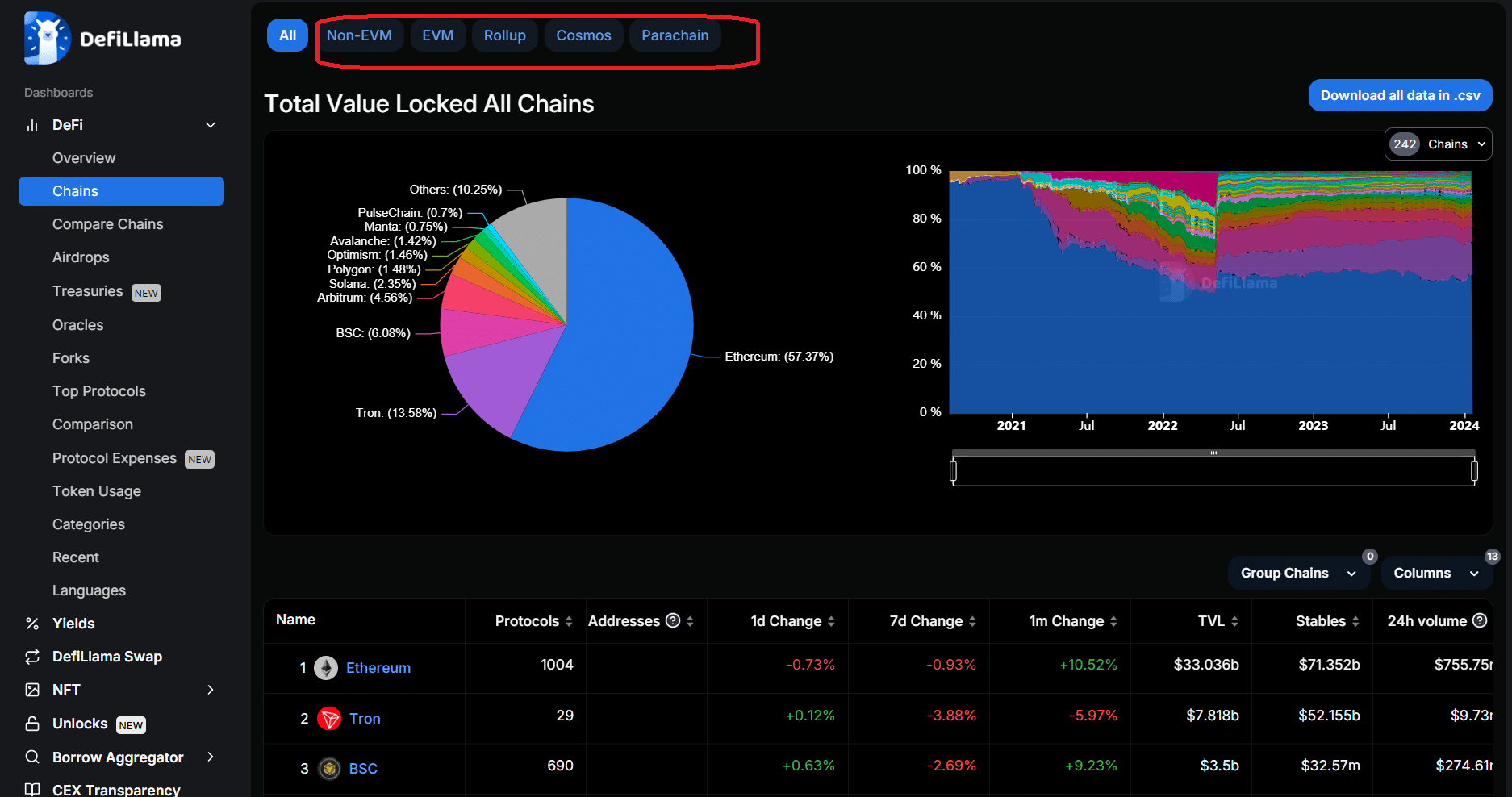

DeFiLlama Stablecoin Analytics: DeFiLlama delivers up-to-date analytics on stablecoin supply, market share, and flows across multiple blockchains. Its easy-to-navigate dashboards help users track stablecoin dominance, growth trends, and protocol-level movements.

-

Dune Analytics (Stablecoin Flow Dashboards): Dune Analytics hosts a range of community-built dashboards that visualize stablecoin transfers, supply changes, and exchange flows in real time. Its customizable queries and visualizations make it a favorite for deep-dive stablecoin research.

-

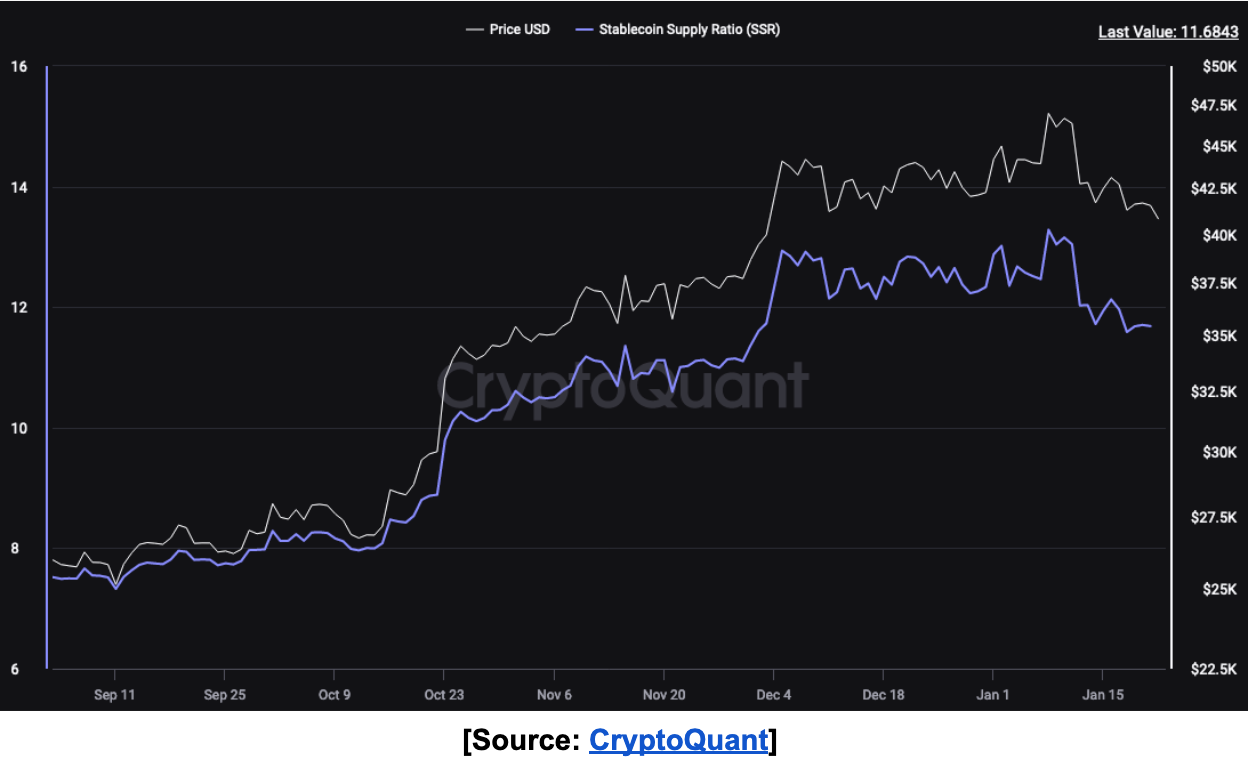

Glassnode Stablecoin Supply & Flow Metrics: Glassnode offers detailed metrics on stablecoin supply, exchange inflows/outflows, and on-chain activity. Its analytics help users identify trends in stablecoin usage and assess the broader crypto market’s liquidity conditions.

Diving Deeper: What Sets These Tools Apart?

Artemis Analytics is a favorite among power users for its ability to pull on-chain data across protocols and chains with ease. Its dashboards make it simple to compare metrics like transfer volume or active addresses side by side – perfect for building custom models in Excel or Google Sheets. Read more about Artemis’ approach at their official resource page.

Nansen Portfolio and Stablecoin Flows brings real-time alerting into the mix. Analysts can set custom thresholds for inflows onto exchanges or specific wallets – an invaluable tool for catching whale movements before they hit the headlines.

DeFiLlama’s Stablecoin Analytics offers a macro lens on stablecoin supply changes across dozens of blockchains and protocols. It’s ideal for spotting ecosystem-wide trends – whether that’s new capital entering Ethereum L2s or sudden outflows from a troubled protocol.

Dune Analytics, meanwhile, stands out for its community-driven approach. Anyone can fork public dashboards or write custom queries using SQL-like syntax – making it one of the most flexible ways to analyze stablecoin transactions at both high and granular levels.

Glassnode’s Stablecoin Supply and Flow Metrics round out our list by offering institutional-grade data feeds on supply changes, exchange balances, and velocity metrics that often serve as leading indicators of market sentiment shifts.