Cross-chain stablecoins are quickly becoming the backbone of interoperable decentralized finance (DeFi), offering seamless movement of value across disparate blockchain networks. Unlike their single-chain counterparts, these stablecoins are engineered to operate across multiple ecosystems, eliminating the long-standing silos that have hindered liquidity and user experience in DeFi. As of September 20,2025, cross-chain assets like Polygon Bridged USDT (USDT) at $1.00, Multichain Bridged USDC (USDC) at $0.052569, and Dai (DAI) at $0.99975 exemplify this trend, each actively facilitating stablecoin movement between blockchains.

The Mechanics of Cross-Chain Stablecoin Flows

The emergence of cross-chain stablecoins has redefined how liquidity is managed and deployed in DeFi protocols. By leveraging bridges and interoperability protocols, users can now transfer value between chains such as Ethereum, Polygon, and others without relying on centralized exchanges or cumbersome manual swaps. This fluidity is crucial for unified liquidity pools, which in turn reduces slippage and increases capital efficiency for traders and investors alike.

For example, a user can move USDT from the Ethereum network to Polygon via a bridge, taking advantage of lower transaction fees while maintaining exposure to a dollar-pegged asset priced at $1.00. This not only optimizes transaction costs but also enables access to diverse DeFi applications that may be exclusive to certain chains.

Liquidity Unification: Breaking Down Fragmentation

One of the most significant implications of cross-chain stablecoin flows is the unification of previously fragmented liquidity pools. In traditional DeFi settings, liquidity often becomes siloed within individual blockchains, limiting trading opportunities and increasing volatility during periods of high demand or network congestion. Cross-chain stablecoins address this by allowing assets to freely traverse multiple ecosystems.

This enhanced liquidity manifests in several ways:

- Efficient Market Making: Traders can arbitrage price discrepancies between chains using the same stablecoin as collateral.

- Lending Protocols: Platforms can offer unified lending markets irrespective of chain boundaries.

- Diversified Yield Strategies: Users can deploy capital on whichever chain offers the best returns without incurring prohibitive bridging costs.

The result is a more robust and interconnected financial infrastructure that supports both retail users and institutional participants.

User Experience: Simplifying Multi-Chain Access

The complexity associated with interacting across multiple blockchain networks has historically been a barrier for mainstream adoption. Cross-chain stablecoins are changing this paradigm by providing a consistent user experience regardless of the underlying chain. Users no longer need to manage multiple wallet addresses or navigate intricate bridging processes; instead, they can rely on familiar assets like USDT or DAI with confidence that their value remains constant provides $1.00 for USDT, $0.99975 for DAI.

This simplification not only attracts new entrants but also empowers existing DeFi participants to optimize their strategies with greater agility.

Polygon Bridged USDT (USDT) Price Prediction 2026-2031

Professional Forecasts for Cross-Chain Stablecoin Performance in an Interoperable DeFi Ecosystem

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | +0.0% | Stablecoin retains peg; minor volatility due to bridge security events |

| 2027 | $0.97 | $1.00 | $1.03 | +0.0% | Increased adoption across chains; minor depegs possible during high volatility |

| 2028 | $0.96 | $1.00 | $1.04 | +0.0% | Regulatory clarity improves trust; competition from new stablecoins |

| 2029 | $0.96 | $1.00 | $1.05 | +0.0% | Enhanced cross-chain tech; arbitrage keeps price tightly pegged |

| 2030 | $0.95 | $1.00 | $1.06 | +0.0% | Large-scale DeFi adoption; rare depegs during systemic crypto events |

| 2031 | $0.94 | $1.00 | $1.08 | +0.0% | Matured interoperability; extreme volatility only during black swan events |

Price Prediction Summary

Polygon Bridged USDT is expected to maintain its peg to the US dollar, with minor deviations reflecting bridge security incidents, regulatory changes, and broader market volatility. Average price is forecasted to remain at $1.00 throughout 2026-2031, with minimum and maximum price bands widening slightly to account for rare but possible depegging events. Overall, the outlook remains stable and reliable for investors seeking dollar-pegged exposure within interoperable DeFi.

Key Factors Affecting Tether Price

- Cross-chain bridge security and audit improvements

- Growth of interoperable DeFi protocols and liquidity pools

- Regulatory developments impacting stablecoin issuance and operations

- Emergence of competing cross-chain stablecoins

- Market sentiment during systemic crypto events (e.g., hacks, regulatory crackdowns)

- Centralization versus decentralization trade-offs in bridge design

- Arbitrage efficiency across multiple blockchains

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Role of Arbitrage in Interoperable DeFi Analytics

An additional layer unlocked by cross-chain stablecoin flows is dynamic arbitrage between networks, a practice that maximizes capital efficiency while ensuring price stability across chains. With real-time analytics platforms tracking these flows, market participants gain critical insights into where liquidity is moving fastest and where inefficiencies may arise.

The ability to track cross-chain stablecoins in real time is vital for sophisticated trading desks as well as everyday users seeking yield optimization or risk mitigation strategies within interoperable DeFi environments (source). As bridges mature and analytics become more granular, expect arbitrage opportunities to become both more frequent and competitive, further reinforcing price parity among leading assets like Polygon Bridged USDT at $1.00.

Yet, while the promise of cross-chain stablecoin flows is transformative, the path to seamless interoperability is not without its challenges. Security remains a top concern, particularly as high-profile exploits on cross-chain bridges have underscored the need for rigorous auditing and robust protocol design. Even as protocols evolve, vulnerabilities in bridge mechanisms or validator sets can expose users to risk, highlighting the ongoing tension between innovation and risk management in decentralized finance.

Security and Standardization: The Next Frontier

As adoption accelerates, industry leaders and policymakers are increasingly focused on standardization. The Bank for International Settlements notes that while cross-chain interoperability solutions exist, they are only as resilient as their weakest link (source). Calls for unified security frameworks and interoperable standards are growing louder. Without these safeguards, the risk of systemic shocks, such as cascading failures across interconnected chains, remains elevated.

Meanwhile, concerns around centralization persist. Some bridging solutions rely on trusted custodians or multisig setups that could undermine DeFi’s core principles if not managed transparently. As developers race to create trust-minimized bridges and decentralized validators, users must weigh convenience against sovereignty when choosing where to deploy capital.

Tracking Cross-Chain Stablecoins: Analytics in Action

The analytics landscape is evolving just as rapidly as the technology itself. New platforms are emerging to help investors and institutions monitor stablecoin movement across blockchains, offering granular data on transaction volumes, bridge usage rates, and liquidity migration patterns. These tools enable users to identify trends, such as surges in Dai ($0.99975) moving from Ethereum to Polygon during periods of lower fees, or spot anomalies that may signal arbitrage opportunities or security risks.

Top Analytics Tools for Cross-Chain Stablecoin Flows

-

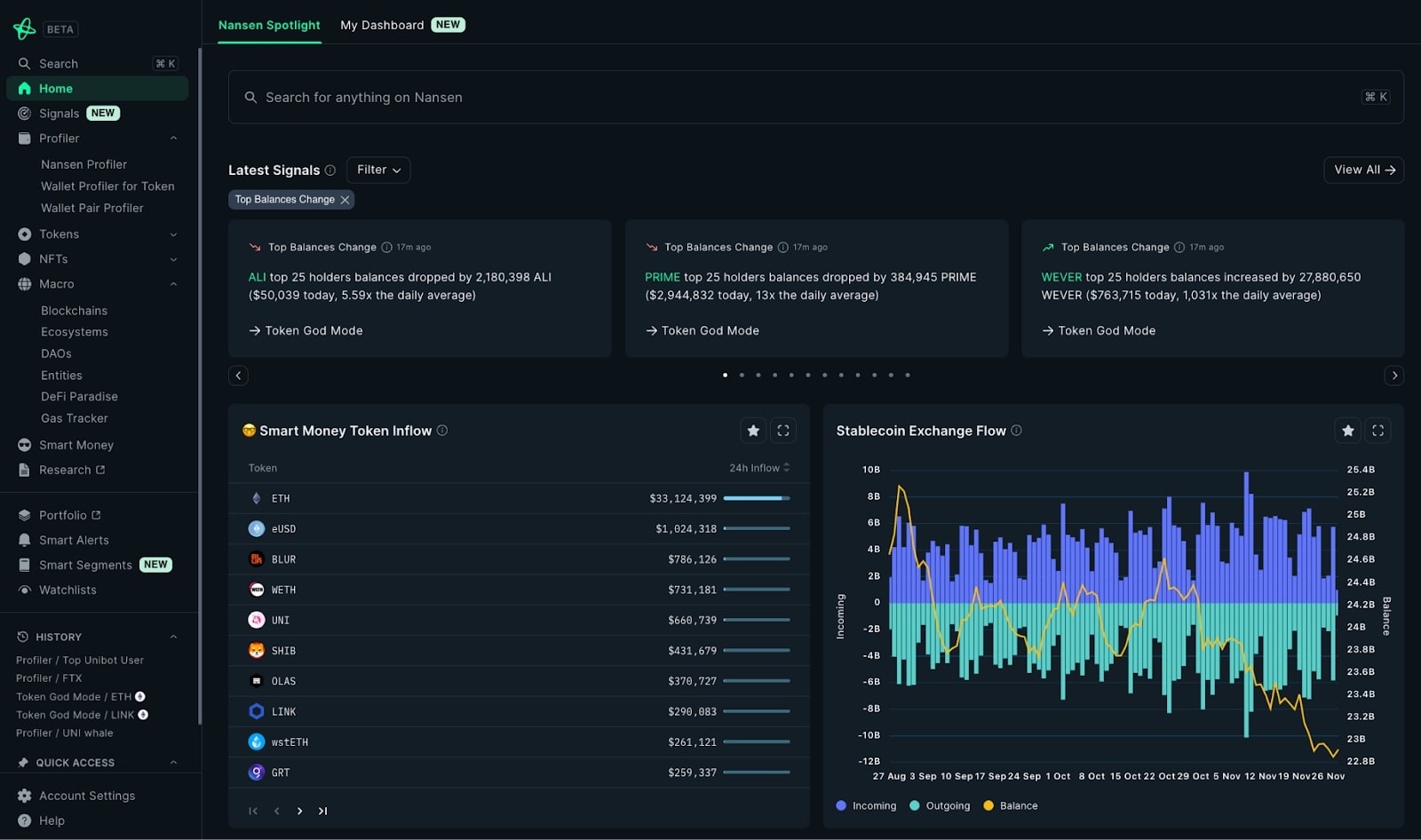

Nansen: A leading blockchain analytics platform, Nansen offers comprehensive tracking of stablecoin movements across multiple chains, including Ethereum, BNB Chain, Polygon, and more. Its dashboards provide real-time insights into cross-chain flows, wallet activity, and liquidity trends.

-

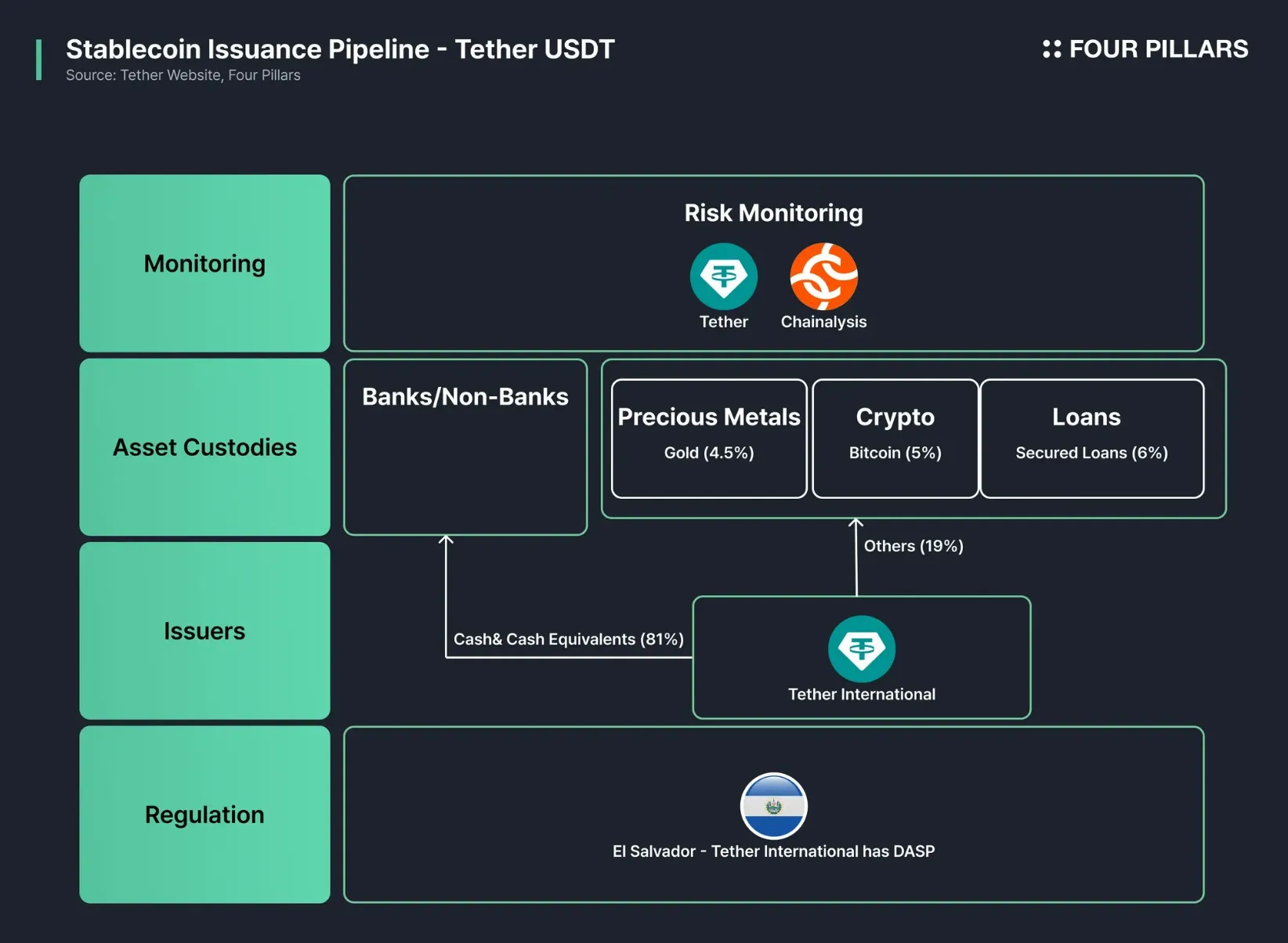

Chainalysis: Renowned for its institutional-grade analytics, Chainalysis delivers cross-chain asset tracking and compliance tools. Its platform enables users to monitor stablecoin transfers across various blockchains, detect illicit activity, and analyze market flows.

-

DeBank: DeBank is a popular DeFi portfolio tracker that supports multi-chain stablecoin monitoring. Users can view stablecoin holdings and transfers across networks like Ethereum, BNB Chain, Arbitrum, and Polygon, making it a go-to tool for cross-chain asset management.

-

Dune Analytics: Dune empowers users to create custom dashboards and queries for tracking stablecoin flows across different chains. Its open data model allows the DeFi community to analyze cross-chain bridge activity, stablecoin supply, and liquidity movements with SQL-based tools.

-

Flipside Crypto: Flipside Crypto provides on-chain analytics and data visualization for major blockchains. Its platform features community-built dashboards that track stablecoin flows between chains, helping users understand liquidity shifts and DeFi interoperability.

This transparency supports better decision-making at every level of participation, from retail yield farmers seeking optimal returns to institutional desks managing liquidity at scale. As a result, real-time interoperable DeFi analytics are quickly becoming a competitive edge in a crowded market.

Looking Ahead: A Unified DeFi Ecosystem

The trajectory of cross-chain stablecoin flows points toward an increasingly unified DeFi landscape, one where value moves frictionlessly between networks and users enjoy consistent experiences regardless of their preferred chain. As assets like Polygon Bridged USDT ($1.00), Multichain Bridged USDC ($0.052569), and Dai ($0.99975) continue to anchor liquidity across ecosystems, we can expect further integration between protocols, more sophisticated risk management frameworks, and enhanced composability for developers building the next generation of financial applications.

Ultimately, the success of interoperable DeFi hinges on our ability to balance innovation with vigilance, embracing new paradigms without sacrificing security or decentralization. As always, staying informed through reliable analytics platforms and understanding both the opportunities and limitations of cross-chain technology will be crucial for anyone navigating this evolving terrain.